With additional tariffs in the pipeline, should the Fed take notice?US President Trump pre-announced a further expansion of the US tariffs on imports from China: the remaining half of imports not yet taxed will be at a rate of 10%. It was our central scenario that the tariff net would be increased before the 2020 elections, but we are surprised by the timing, so close on the heels of the G20 meeting in Osaka.Such tariffs further reduce the possibility of an encompassing trade deal with China...

Read More »FX Daily, August 1: Mid-Course Correction Sends Greenback Higher

Swiss Franc The Euro has fallen by 0.15% to 1.0989 EUR/CHF and USD/CHF, August 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Federal Reserve delivered the first rate cut since the Great Financial Crisis but couched it in terms of a mid-course correction rather than the start of a larger easing cycle. By doing so, Fed chief Powell cast the cut in less...

Read More »FX Weekly Preview: The FOMC and US Jobs Headline the Week Ahead

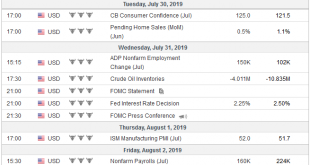

There is little doubt that the Federal Reserve will ease monetary policy at the conclusion of the FOMC meeting on July 31. We never thought the chances of a 50 bp move were anything but negligible, though even at this late stage, the market appears to be pricing in about a one-in-five chance. Although a minority, and maybe worth a dissent or two (Rosengren? George?), we are sympathetic to those Fed officials that do not...

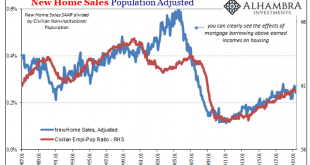

Read More »What Does It Mean That Real Estate, Not Equities, Is Driving Monetary Policy?

In the world of assets classes, I don’t believe it is equities which hold the Federal Reserve’s attention. After the 2006-11 debacle, the big bust, you can at least understand why policymakers might be more attuned to real estate no matter how the NYSE trades. It may be a decade ago, but that’s the one thing out of the Global Financial Crisis which was seared into the consciousness of everyone who lived through it....

Read More »HAS Modern Monetary Theory ALREADY TAKEN HOLD IN WASHINGTON?

The interest in Modern Monetary Theory has grown as the limitations of ‘mainstream’ economic theories have become ever plainer to see since the financial crisis.Modern Monetary Theory (MMT) is a theory, initially emanating from left-wing US economists, that argues that since governments, and in particular the US government, issues its own currency, it can never run out of funding.The corollary is that it is possible for the government to spend more to push the economy towards its full growth...

Read More »FX Weekly Preview: Highlights in the Week Ahead

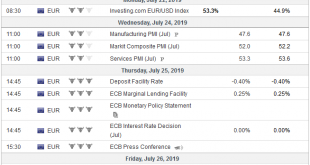

Three events that will capture the market’s attention next week: The consequences of the Japanese election, the first look at US Q1 GDP, and the ECB meeting. The central banks of Turkey and Russia also meet. Both are expected to cut interest rates, following rate cuts in the middle of last week by South Korea, Indonesia, and South Africa. Japan goes to the polls on July 21 to elect the upper chamber of the Diet. There...

Read More »FX Daily, July 19: Dollar Pares Losses as Market Partly Corrects Confusion of Magntiude and Timing of Fed

Swiss Franc The Euro has fallen by 0.35% at 1.1024 EUR/CHF and USD/CHF, July 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Comments underscoring the importance of acting preemptively by two Fed officials sent the dollar reeling and helped lift equities after the S&P fell to a two and a half week low. The decline in rates and the US shooting down of an...

Read More »FX Daily, July 17: Back to the Well Again

Swiss Franc The Euro has risen by 0.22% at 1.1095 EUR/CHF and USD/CHF, July 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After slapping punitive tariffs on structural from China and Mexico last week, US President Trump threatened to end the tariff truce with China because it is not stepped up its purchases of US agriculture products. Trump said the tariff...

Read More »FX Weekly Preview: What to Watch if Fed and ECB are Committed to Easing

There is little doubt after the Federal Reserve Chairman Powell’s testimony last week and the FOMC minutes that a rate cut will be delivered at the end of the month. Similarly, after comments by several ECB officials and the record of their recent meetin.g confirms it too is prepared to adjust policy. The timing of the ECB’s move is more debatable, an adjustment at the July 25 meeting appears to have increased. While a...

Read More »FX Daily, July 10: North American Focus: Poloz and Powell

Swiss Franc The Euro has risen by 0.03% at 1.1135 EUR/CHF and USD/CHF, July 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US Treasury market is retreating for the fourth consecutive session ahead of Fed Chairman Powell’s testimony before Congress. It is the longest losing streak in six months, and the 10-year yield has risen 15 bp over the run. This is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org