Dear Mr. Taft: I eagerly read your piece Warriors for Opportunity on Wednesday, as I often do about pieces that argue that capitalism is not working today. You begin by saying: “Financial capitalism – free markets powered by a robust financial system – is the dominant economic model in the world today. Yet many who have benefited from the system agree it’s not working the way it ought to.” Leaving aside that our financial system is not robust—the interest rate is...

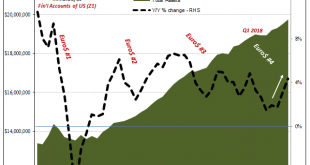

Read More »A Repo Deluge…of Necessary Data

Just in time for more discussions about repo, the Federal Reserve delivers. Not in terms of the repo market, mind you, despite what you hear bandied about in the financial media the Fed doesn’t actually go there. Its repo operations are more RINO’s – repo in name only. No, what the US central bank actually contributes is more helpful data. Since our goal is to use that data to produce the best possible, most accurate interpretation of the facts, the depth and...

Read More »FX Weekly Preview: Central Bank Meetings and Flash PMI Reports, but its Over except for the Shouting

After last week’s flurry of events, market activity is set to slow over the next three weeks. But what a flurry of events it was. A new NAFTA apparently has been agreed, and it is set to be approved by the US House of Representatives next week and the Senate early next year. The US and China struck an agreement that will get rid of the immediate tariff threat and unwind half of the punitive tariffs in exchange for a commitment to buy twice the amount of agriculture...

Read More »FX Daily, December 13: Stunning Tory Victory and US-China Trade Boosts Risk Assets

Swiss Franc The Euro has risen by 0.21% to 1.0964 EUR/CHF and USD/CHF, December 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The combination of a US-China trade deal and exit polls showing the Tories securing a majority in the House of Commons boosted risk assets, sent sterling flying, and the euro sharply higher. Separately, the Fed stepped up its efforts to make as smooth as possible funding over the...

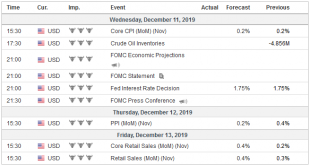

Read More »FX Daily, December 12: Enguard Lagarde

Swiss Franc The Euro has risen by 0.08% to 1.0946 EUR/CHF and USD/CHF, December 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.comeur - Click to enlarge FX Rates Overview: With the FOMC meeting delivered no surprises, attention turns to the ECB meeting as the UK go to the polls. Lagarde will hold her first press conference as ECB president today, and it will naturally command attention. Equities are advancing today, and tech appears to be leading...

Read More »FX Weekly Preview: An Eventful Week Ahead

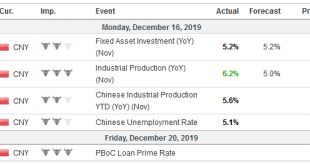

The US employment report on the first Friday of December usually marks the unofficial end of the year. The desks are often lighter and dealers are loath to jeopardize the year’s bonuses in thin and often erratic markets. This year is an exception. Next week features the first ECB meeting with Lagarde at the helm and the final FOMC meeting of the year. The UK and China have their monthly data dumps—a concentration of high-frequency data. The US reports both CPI...

Read More »FX Daily, November 26: Some Are More Equal Than Others

Swiss Franc The Euro has risen by 0.08% to 1.0982 EUR/CHF and USD/CHF, November 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Neither optimistic comments from Federal Reserve Chairman, that the economic glass is more than half full, nor a seemingly positive spin on the weekend fall calendar between Chinese and US officials have succeeded in deterring some profit-taking today. Most of the large markets in...

Read More »FX Weekly Preview: Is Conventional Wisdom Too Optimistic?

There have been three general issues that the macro-fundamental picture has revolved around this year: trade, growth, and Brexit. On all three counts, conventional wisdom seems unduly optimistic, and this may have helped dampen volatility. A series of signals suggest that the US and China remain far apart in trade negotiations. The US wants China to promise to increase agriculture imports from American farms to more than twice the 2017 peak. Not only is China...

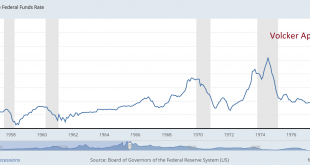

Read More »US Money Markets

For over a year the federal funds rate has increased relative to the rate the Fed pays on excess reserves. In mid September 2019, the federal funds rate increased abruptly, triggering the Fed to inject fresh funds. In parallel, the repo market rates spiked dramatically. On the Cato Institute’s blog, George Selgin argues that structurally elevated demand collided with reduced supply. He mentions explicit and implicit regulation; Treasury General Account (TGA) balances; the NY Fed’s foreign...

Read More »FX Daily, November 19: Hong Kong Stocks Rally as Stand-Off Continues

Swiss Franc The Euro has risen by 0.25% to 1.0981 EUR/CHF and USD/CHF, November 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The run-up in equities continues to be the dominant development in the capital markets. Although the Japanese and South Korean bourses fell, the rise in Australia, China, Hong Kong, and Taiwan underpin the MSCI Asia Pacific Index. The Hang Seng’s gains (1.5% on top of yesterday’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org