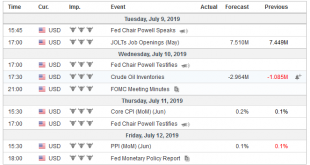

Our hypothesis that the market had reached peak dovishness toward the Fed remains intact after the employment data. Job growth was the strongest since January. The participation rate and the unemployment rate ticked up. Average hourly earnings edged 0.2% higher, and, with revisions, maintained a 3.1% year-over-year pace, which is a bit disappointing. United States The jobs report trumps the PMI/ISM data and suggests...

Read More »FX Daily, July 03: Yields Extend Decline

Swiss Franc The Euro has fallen by 0.05% at 1.112 EUR/CHF and USD/CHF, July 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Interest rates are lurching lower. The US 10-year yield is at new two-year lows, but the driver is European bonds where peripheral yields are 6-7 bp lower, though Italy’s benchmark is off 12 bp, while core yields are down 2-3 bp to new...

Read More »FX Weekly Preview: Macro Update: Melodrama Subsides but Capriciousness Remains

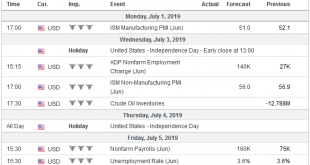

Since President Trump declared the end of the tariff truce with China in early May, an important focus for investors was the G20 meeting. It was only as it drew near was a meeting between the two heads of state confirmed. What was billed as an extraordinary meeting reportedly lasted less than 90 minutes, and the results were broadly as expected. The press quotes US officials confirming that the talks are “back on track”...

Read More »FX Weekly Preview: FOMC, EMU PMI, and Pre-G20 Positioning: Crossroads and Crosswinds

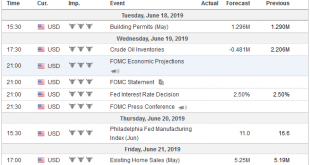

The week ahead is likely to provide some clarification for investors on three fronts that have been a source of uncertainty. The FOMC meeting, with updated forecasts, is center stage. The credit markets are pushing the Fed to be aggressive but can be disappointed. In the eurozone, the preliminary PMI may confirm a modest, even if uneven recovery. The G20 summit is the focus of much attention as many see it as the last...

Read More »FX Daily, June 05: Dollar Remains on Back Foot

Swiss Franc The Euro has fallen by 0.09% at 1.115 EUR/CHF and USD/CHF, June 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Federal Reserve’s patience never excluded a rate cut should conditions warrant. The acknowledgment of this without signaling a change its stance is being seized upon to justify aggressive pricing of rates. At the same time, there has...

Read More »FX Weekly Preview: The Evolution of Three Issues are Key in the Week Ahead

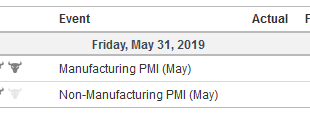

As May winds down, the light economic calendar will allow investors to take their cues from the evolution of three disruptive forces–trade, Brexit and the US economy. With actions against Huawei and possibly a handful of Chinese surveillance equipment producers, the US raised the stakes. The retaliatory tariffs are effective on June 1, but Beijing has not formally responded to the moves against Chinese companies. ...

Read More »THE CURRENT MONETARY ORDER IS NEARING ITS END

Interview with Dimitri Speck Given the massive intervention and monetary manipulation experiment by central banks over the last decade, the amount of distortions created in the market, as well as the record debt accumulation at all levels of the economy, have given rise to considerable risks for investors. For a more detailed understanding of these issues and for his outlook, I turned to Dimitri Speck, a renowned expert in the development of trading systems and in seasonal analysis,...

Read More »THE CURRENT MONETARY ORDER IS NEARING ITS END

Interview with Dimitri Speck Given the massive intervention and monetary manipulation experiment by central banks over the last decade, the amount of distortions created in the market, as well as the record debt accumulation at all levels of the economy, have given rise to considerable risks for investors. For a more detailed understanding of these issues and for his outlook, I turned to Dimitri Speck, a renowned expert...

Read More »FX Daily, May 03: Ahead of US Jobs Report, the Greenback Remains Firm

Swiss Franc The Euro has fallen by 0.13% at 1.1374 EUR/CHF and USD/CHF, May 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US April jobs data stand before the weekend, and the greenback is holding on to most of yesterday’s gains as participants wait for the report. Equities in the Asia Pacific region were mixed without leadership from China and Japan, where...

Read More »FX Daily, May 02: Dollar Consolidates Fed-Inspired Recovery

Swiss Franc The Euro has risen by 0.07% at 1.1402 EUR/CHF and USD/CHF, May 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is consolidating yesterday’s post-Fed rally, and this is giving it a slightly heavier tone today. Equities are mostly lower and Europe’s Dow Jones Stoxx 600 is off about 0.5% in late morning turnover, which if sustained would...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org