The capital markets are in their own doom loop. Poor data from Germany and China, coupled with the escalation of the US-China trade dispute and rising tensions in Hong Kong spur concerns about the risks of a global recession. Interest rates are driven lower, and curves flatten or go inverted, spurring more concern about the outlook. The problem is that it is not clear how this vicious cycle ends. To be sure, the end is conceivable but it seems beyond which the constellation of political forces allows. After the US has broken two tariff truces with China, will another one be credible? Meanwhile, the US continues to weaponize access to the dollar market, blacklisting four more Chinese companies who attempted to acquire US nuclear technology for China’s use. Several

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, China, Cold War, Featured, Federal Reserve, Germany, newsletter, trade, US

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The capital markets are in their own doom loop. Poor data from Germany and China, coupled with the escalation of the US-China trade dispute and rising tensions in Hong Kong spur concerns about the risks of a global recession. Interest rates are driven lower, and curves flatten or go inverted, spurring more concern about the outlook. The problem is that it is not clear how this vicious cycle ends.

To be sure, the end is conceivable but it seems beyond which the constellation of political forces allows. After the US has broken two tariff truces with China, will another one be credible? Meanwhile, the US continues to weaponize access to the dollar market, blacklisting four more Chinese companies who attempted to acquire US nuclear technology for China’s use. Several companies stand accused of diverting the nuclear technology from civilian to military purposes. One of the companies, China General Nuclear Power, has been accused of an espionage operation going back almost 30 years. The blacklisting will put several European countries, including France and the UK who have partnered and contracted with China General Nuclear Power.

There have been several opportunities to end the trade tensions between the US and China. Neither side appears eager to seize the opportunity. There was a deal worked out in May 2018 that would have reduced the bilateral imbalance but was rejected by President Trump. A year later, the US accused China of backtracking and ending the first tariff truce. The US did not grant licenses to allow companies to sell product to Huawei (though a 90-day grant may be announced on Monday). And at least until the week ending August 1, China refrained from purchasing US agriculture. Trump ended the second tariff truce shortly after the first round of new trade talks and within 24 hours of the Federal Reserve signaling that it was prepared to ease policy more if trade adversely impacted the US economy.

The hawkish camp has moved into ascendancy in both the US and China. The US is demanding China stop being China. The IMF also is encouraging China to change its developmental model. But both the US and the IMF do not acknowledge that the old model was very successful over their objections. China enjoyed one of the most rapid jumps into industrialization and modernization. Per capita income grew eightfold between 1980 and 2010. Hundreds of millions were pulled out of poverty. At the same time, it is has become clear to many observers that China’s strategy has reached the point of diminishing returns. A new unit of capital investment is not generating the new incremental unit of growth. Chinese officials seem to be very ambivalent about risking the end of a credit cycle by minimizing moral hazard and encouraging efficient, risk-adjusted allocation of capital, or no. The stop-go policy leads to conflicting signals to investors.

The US actions lend credence to what the Chinese hawks have been saying for several years. Recall that they had argued that Obama’s Asian pivot was about containing the rise of China. Trump has been explicit: China will not surpass the US on his watch. The US is trying to frustrate China’s desire to become more a leader in the commanding heights of the new economy (Made in China 2025) and its signature global infrastructure project (Belt Road Initiative). The US sells fighter jets to Taiwan, which the US formally recognizes as part of China, but protests Chinese (and Russian) support for Maduro in Venezuela. Sometimes the US claims that Huawei is about national security, and other times it links it to a trade deal. Sometimes Trump referred to the demonstration in Hong Kong as “riots” and other times he deigns to advise Xi and links a peaceful resolution to new trade talks.

The Democrat leaders in the House and Senate have encouraged Trump’s hardline toward China. If anything, they wanted a tougher stance on not sacrificing security for commerce, as Trump had suggested. If Xi does prefer to wait for another US Administration, it may be an issue of style, not substance. The Trump Administration lacks consistency. It is hard to deal with a person who announces policy reversals over Twitter. Opinion polls confirm that there has been a hardening of the US attitude toward China. One must assume Chinese officials look past jockeying for political advantage and see that there is a broad bipartisan consensus in the US.

The conflict between the US and China is best understood as an escalation ladder. We would still locate the conflict in the lower rungs. Neither side is causing very much damage to the other yet. Economists project the tariffs to slow the Chinese economy by a bit more than 1%, while China’s counteractions could have about 2/3 of a percentage point off US GDP. Both economies had appeared to be slowing due to their own internal dynamics as well.

That will not stop further escalation. China will feel compelled to respond to the US tariff hike on September 1 and the next round in mid-December. We have not reached peak escalation. The journey may be rocky, but the destination is becoming clearer: Disengagement. Not always and everywhere; even at the peak of the Cold War, there were some bilateral commercial ties between the USSR and the US. Chinese companies are leading the foreign direct investment surge in Vietnam, which has already moved on the US radar screen for its currency practices.

Diversifying out of US Treasuries is a bit trickier for China but has taken place. In 2005, almost 80% of China’s reserves were in dollars. By 2014, it had fallen to around 58%. This was below the global average of the time (~65%). Since then, China’s Treasury holdings were reduced by roughly $133 bln through June 2019. However, the reduction of Treasury holdings is not necessarily the same thing as diversifying away from dollars. For example, in June, China bought about $16.5 bln of US Agency paper. China has an animal protein shortage problem, and it purchased 10.2k metric tons of pork from the US in the week ending August 8 after canceling nearly 15k tons in late July.

II

There has been a precipitous decline in interest rates over the past month. The US 10-year benchmark yield is off 54 bp, Sweden, Switzerland, Australia, and New Zealand saw 50 bp or more decline in their benchmarks. Germany, France, Netherlands, Spain, and Portugal have seen a 45 bp drop. The combination of the escalation of US-China trade tensions and poor Chinese and German data were the primary drivers as easier monetary policy is anticipated.

Many argue that monetary policy has been exhausted and encourage a fiscal response. In some ways, they are bouncing from one horn to the other of a dilemma since the Great Financial Crisis. There was a pushback against the fiscal response to the crisis. How can more debt solve a debt crisis? After racking up large deficits and accumulating more debt, the political will for more was lost. Monetary policy had to work overtime, re-inventing a playbook. Now that the zero barrier has bust, and not just for sovereign bonds (~$15 trillion), but some corporate bonds as well (~$1 trillion), and the yields curves are flat to inverted, there is more interest in fiscal policy.

JapanThe focus is Europe and Japan, not so much the United States, even though there are some reports that the Trump Administration is still pushing for indexing capital gains. This would amount to a tax cut as the capital gains would be adjusted for inflation before taxed. Although Japan reported stronger than expected Q1 and Q2 GDP (0.7% and 0.4% respectively), there is concern that the sales tax hike (from 8% to 10%) will stall the economy or worse, as previous hikes have done. The UK appears to be increasing its spending on preparations for exiting the EU in about 10 weeks. Italy seems to want to increase spending, but it is already bumping against the EC limits. The underlying economic problem in Italy is being expressed as a political problem. Tuesday, August 20, is the critical day. Prime Minister Conte speaks to Parliament. Afterward, he may go to President Mattarella submit his resignation. Alternatively, there could be a vote of confidence. His resignation or defeat would not necessarily produce new elections. There will be an opportunity to see if another government can be forged from the existing configuration. League leader and Deputy Prime Minister Salvini has pulled out of the government seemingly because he wants to be Prime Minister, and polls suggest that this is a reasonable possibility. The idea of a League majority government is enough to spark new interest in a center-left alliance with the Five Star Movement to block it. Whether petty politics and egos can be overcome may be a different matter. |

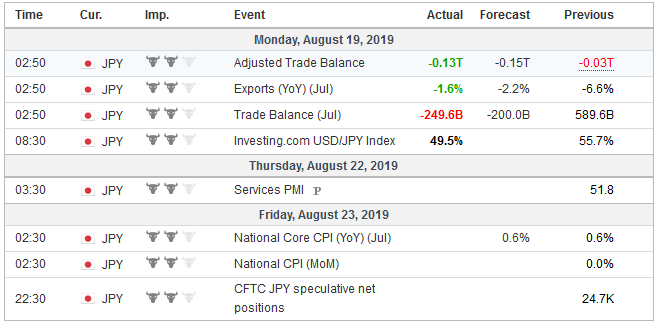

Economic Events: Japan, Week August 19 |

GermanyThe real focus in Germany. It can borrow for 30-years and get paid a little more than 20 bp a year to do so. Germany’s ordoliberalism is a rejection of Keynesian demand-side management. It has run a budget surplus since 2014, and the “Schwarze Null” (Black Zero) policy is a cornerstone. Germany has been loath to provide fiscal stimulus, but the poor economic performance and the risk of a recession may be tempering the resolve. The German economy has contracted in two of the past three quarters, and Q3 is not off to a promising start. This will be underscored by the flash August PMI on August 22. Between the diesel dependence and the change in China regulations and slowdown, the German auto industry, and manufacturing more generally was weakened. However, as long as the service sector held up, the problem seemed manageable. The service PMI rose in the first four months of the year, and the composite PMI rose from 51.6 in December 2018 to 52.2 in April. The service PMI has fallen in two of the past three months and is expected to have fallen in August (to 54.0 from 54.5). The composite PMI is expected to fall to a new cyclical low of (50.6 from 50.9). The markets hardly responded to the headlines suggesting some easing of resistance to fiscal stimulus by the Germany government. What economic conditions are required is not clear. There is no official definition of a recession. The two consecutive quarterly contractions is a rule of thumb and not so much a true technical definition. Surely contracting two of three quarters meets the spirit of the concept. The government has already agreed to eliminate the hated Solidarity Tax 30 years after the Berlin Wall came down. It is worth about 19 bln euros a year. There is some thought for new spending on green projects (shades of Green New Deal). Some sense of urgency may be coming from the upcoming state elections (Saxony and Brandenburg on September 1). The SPD and CDU have weakened, and the AfD may come in first in Brandenburg, which the SPD has governed since 1990. |

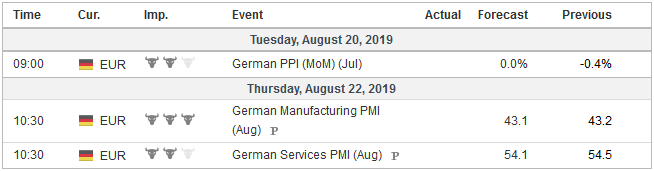

Economic Events: Germany, Week August 19 |

United States

The FOMC minutes from the July 31 meeting that resulted in the first rate cut since 2008 will be released on August 21. They will be reviewed for insights into the “midcycle adjustment” framing. However, the real focus and color will be the annual confab in Jackson Hole, culminating in Powell’s speech on August 23. The market is aggressively pricing in a little more than 70 bp in Fed cuts to be delivered by the end of the year. There are three meetings left. The CME model and Bloomberg “WIRP” calculation show quite different odds of a 50 bp move at the September 18 meeting. With the Sept and October contract implying 1.995% and 1.785% effective average fed funds rate respectively, the CME’s model says there is about a 21 % chance of a 50 bp move. Bloomberg estimates that almost a one-in-three chance has been discounted. The 3-month bill to 10-year note curve has been inverted for several months. The 2-10-year curve briefly inverted last week and finished the week at about six basis points. The significance of the yield curve will no doubt be discussed. We expect that on balance, the inversion will be played down. First, the drop in the long-end of the curve has something to do with the fact that more than a quarter of bonds globally have a negative yield but not the US. Second, it could point to some recent BIS research suggesting that the relationship may be weakening and that other indicator such as credit/GDP or debt/servicing ratios may offer a better warning. Third, the Fed may point to recent economic data, like 2.8% annualized increase in core CPI over the past three months, and the increase in the long-term inflation expectations component of the University of Michigan’s survey. At 2.6%, it matches the high since March 2016. The components of retail sales that are used in GDP calculations jumped 1% in July. The Atlanta Fed GDP tracker estimates Q3 growth at a solid even if not spectacular 2.2%. The NY Fed’s version has the economy expanding at about a 1.8% rate, which is in line with the median Fed forecast sees as trend growth. |

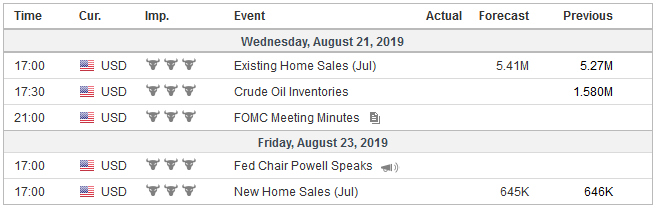

Economic Events: United States, Week August 19 |

Switzerland |

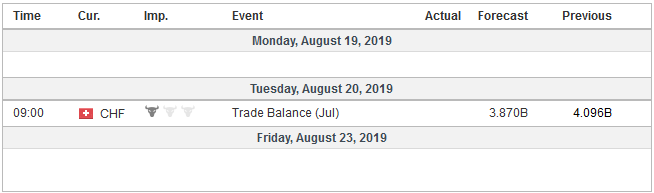

Economic Events: Switzerland, Week August 19 |

OPEC offered a downbeat assessment at the end of last week and shaved its forecast for this year’s growth in demand. The US rig count grew (albeit by one) for the first time since the end of May, which itself was the first since early April. It is the third weekly increase since the middle of February. There are 935 rigs in operation now compared with 1057 a year ago.

Oil prices appear to be the key driver of the five-year forward-forward that is a market-based gauge of inflation expectations. It traded at new three year lows on August 15 (almost 1.80%) before stabilizing ahead of the weekend. The 10-year break-even (the difference between the conventional 10-year note yield and the inflation-linked security) fell stood a little below 1.55% at the end of last week, the lowest level since September 2016. This is why the Fed can still ease policy and push against much speculation about how the central bank is behind the curve.

Tags: China,Cold War,Featured,Federal Reserve,Germany,newsletter,Trade,US