The step away from the edge of the abyss may have stirred the animal spirits, but it remains precarious at best. The formal withdrawal of the extradition bill in Hong Kong is too late and too little at this juncture. The ambitions of the protests have evolved well beyond that. Italy has a new government, but a prolonged honeymoon is unlikely for this unlikely union. Face-to-face talks between the US and China are better than no talks but hardly indicates an end to the tariff war. In fact, the US is planning on raising the 25% tariffs to 30% on October 1. Steps have been taken to avoid a no-deal Brexit, but it is not secure. There are still many moving parts, and kicking the can down the road for the third time may require some convincing for the EC at this point.

Topics:

Marc Chandler considers the following as important: $CAD. $EUR, 4.) Marc to Market, 4) FX Trends, Brexit, ECB, Featured, Federal Reserve, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The step away from the edge of the abyss may have stirred the animal spirits, but it remains precarious at best. The formal withdrawal of the extradition bill in Hong Kong is too late and too little at this juncture. The ambitions of the protests have evolved well beyond that. Italy has a new government, but a prolonged honeymoon is unlikely for this unlikely union. Face-to-face talks between the US and China are better than no talks but hardly indicates an end to the tariff war. In fact, the US is planning on raising the 25% tariffs to 30% on October 1. Steps have been taken to avoid a no-deal Brexit, but it is not secure. There are still many moving parts, and kicking the can down the road for the third time may require some convincing for the EC at this point.

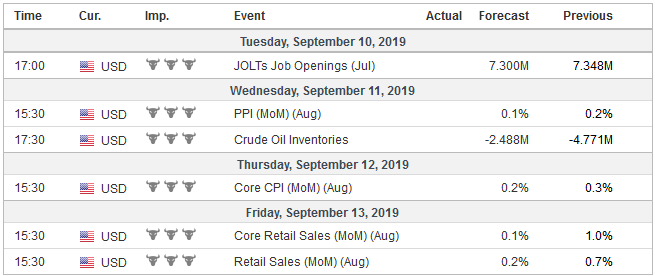

United StatesDespite the somewhat disappointing optics of the US employment report, the general sense of the health of the economy and the outlook for Fed policy has not changed. A rate cut later this month is understood to be virtually a done deal. Moreover, the trajectory for the remainder of the year barely changed. The January fed funds futures contract implies an average effective rate of 1.5250% (~60 bp below the prevailing average). It finished the prior week at 1.54%. The US reports August inflation measures (CPI and PPI) alongside retail sales data in the week ahead. Although many argue that inflation is dead, we see it stirring. Both the headline and core measures have risen by 0.3% in June and July. The headline rate rose at a 2.8% annualized clip in the three-months through July. The 0.3% back-to-back increases in the core rate was the most in a decade. The US consumer is the obvious bright spot of the world’s biggest economy. The 4.7% increase in Q2 consumption (in the GDP report) was the strongest since Q4 14, which itself was the best since Q4 01. Headline retail sales rose 0.7% in July, which matches this year’s average. The average monthly gain in the first seven months of 2018 was 0.4%. Economists expect retail sales moderated to a 0.2% increase in August. The core measure, which is used for GDP calculations, rose by a heady 1% in July and the 2019 average thus far is 0.9%. This is the strongest in seven-month performance in at least a quarter of a century. The median forecast in the Bloomberg survey is for a 0.3% gain in August. It averaged 0.1% last year. |

Economic Events: United States, Week September 09 |

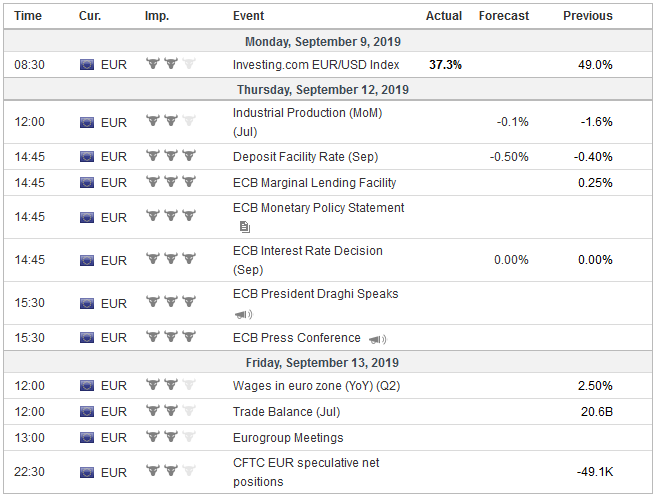

EurozoneThe main event next week is the ECB meeting. Draghi has laid the groundwork for a move on September 12, when the ECB’s staff updates its forecasts. Investors have had to weigh conflicting signals in recent days. On the one hand, several central bankers cautioned against the need to resume asset purchases. These were really the usual naysayers about QE, such as Germany and the Netherlands. On the other hand, the economic locomotive, Germany, is still sputtering. July industrial production fell 0.6%. The median forecast in the Bloomberg survey was for a 0.4% gain. Adding insult to injury, the outlook is not particularly favorable. July factory orders slumped 2.7%, which was nearly twice what was expected. Many investors and economists worry that the efficacy of monetary policy has been exhausted, but that will not stop the ECB from trying harder. Draghi has called on countries with fiscal space, notably Germany and the Netherlands, to do so. Under-recognized, German government spending rose 0.5% in Q2 after a 0.8% increase in Q1. It averaged a little less than 0.4% increase a quarter in 2018. Reports suggest the German government is contemplating a 50 bln euro stimulus package (~1.4% of GDP) and maybe scrapping the 5.5% unification tax next year instead of 2021 that is currently envisioned. Most of the countries in the EMU are obligated under the Stability and Growth mandates and have limited fiscal space, though it does not stop some like France and Italy from pressing. |

Economic Events: Eurozone, Week September 09 |

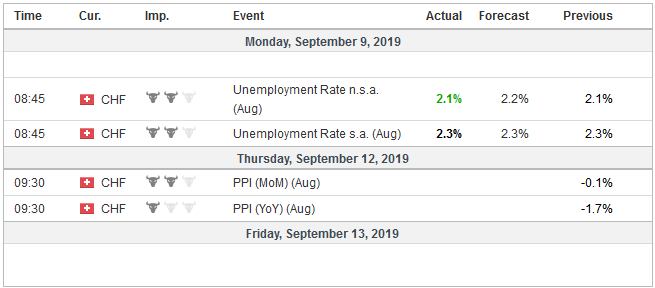

Switzerland |

Economic Events: Switzerland, Week September 09 |

The market is most convinced that the ECB will cut the minus 40 bp deposit rate. It is divided between a 10 bp and a 20 bp cut. We suspect the former is more keeping with the ECB’s modus operandi. Recognizing that risks remain biased to the downside will keep the door open for another rate cut, maybe toward the end of the year. There is some speculation that to mitigate the undesirable consequences of negative interest rates and to forge a compromise with the creditor members, a tiering system may be introduced. It would exclude more deposits from the full brunt of the negative deposit rate.

As Draghi’s term winds down, it is worth noting that throughout his tenure, he took an expansive view of the ECB power (which the courts affirmed) and often was more dovish than the market expected. This, coupled with the fact that inflation is half of the target and is not converging to its target compels action. The ECB is has a goal. It has tools that historically made it possible to reach the goal. It is well shy of the goal, even though the base effect means that it may tick up a little in Q4. Draghi’s successor, Lagarde, also seems sympathetic with using the policy tools to their fullest to satisfy the mandated objective. If an asset purchase program is not announced, it would likely trigger a jump in bond yields as many anticipate a resumption of QE.

If a new round of asset purchases are announced, which we think likely, attention will focus on the dimensions–the size, instruments, and time period. The expected range that has been reported the press seems to be for 30-60 bln euros a month. We anticipate something in toward the middle of the range (40-50 bln euros). The ECB will likely include agency bonds as well as governments. A resumption of corporate bond-buying is possible, though the precise details may not be immediately available. Some suggested that the ECB ought to buy equities (like the BOJ does), but we find little interest among our contacts. The duration of the program is likely to be a year, though a nine-month operation is possible.

The euro fell 2.6% in August, the largest monthly decline since May last year. The euro bounced off the $1.0925 area, the low since May 2017, seen at the start of last week. The technical indicators were stretched and are improving. However, the upside is likely to be limited ahead of the ECB meeting. It may take a move above the high from the second half of August, near $1.1165 to signal anything more than a consolidative phase after a sharp drop.

Brexit, the gift that keeps giving, will offer more high drama next week. Here is where the last act ended before the weekend intermission. Parliament, which has been suspended as of the end of next week, has wrestled control of the Brexit agenda away from the Prime Minister. He has been instructed to make a deal with the EU by the middle of October or seek an extension. He has categorically rejected an extension. He wanted to call an election in mid-October before a key EU summit ahead of the October 31 purported exit. He was blocked. He will try again early next week, but it will fail.

There is another card for Johnson to play, and we fear it would turn the tragedy into a farce. The Prime Minister could arrange for one of his own MPs to submit a vote of confidence. The idea is that the Tory Party itself would topple its own government. That would ironically if not comically force the opposition to vote to support the government. The pathos.

There will be an election this year, the third in about four years. Although there is some talk of a late October timeframe, we think an election in November would offer a more compelling reason to the EU when a request for yet another delay is made. Another wrinkle is that there will be a new European Commission as of November 1. President-elect Von der Leyen will submit her proposals for the new commission next week. One of the implications in this context, there will be a new EU chief negotiator who will replace Barnier.

While we expect an extension will be granted, it may require some commitment by the UK and/or acceptance that it either leaves after the extension or revokes the triggering of Article 50. At the heart of the matter are contradictory demands that are impossible to reconcile. The Good Friday Agreement and leaving the EU in the particular way the Brexit camp has pursued. Cart. Horse.

Tags: $CAD. $EUR,Brexit,ECB,Featured,Federal Reserve,newsletter