A U.S. representative who has been pressing the Treasury Department, Federal Reserve, and Commodity Futures Trading Commission (CFTC) with questions about the gold and silver markets has asked Attorney General William P. Barr to try intervene and get answers from the commission. In a letter dated November 1 and made public today, the U.S. representative, Alex W. Mooney, Republican of West Virginia, commends Barr for the Justice Department’s recent criminal...

Read More »FX Daily, November 14: Unexpected German Growth Fails to Buoy the Euro

Swiss Franc The Euro has fallen by 0.17% to 1.0876 EUR/CHF and USD/CHF, November 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Rising trade anxiety and disappointing economic reports from the Asia Pacific region helped unpin the profit-taking mood in equities, while bond yields continued to pullback. The MSCI Asia Pacific Index and the Dow Jones Stoxx 600 are in the red for the fourth time in the last five...

Read More »FX Daily, November 13: Investors Temper Euphoria

Swiss Franc The Euro has fallen by 0.27% to 1.09 EUR/CHF and USD/CHF, November 13(see more posts on EUR/CHF, USD/CHF, ) Source: market.ft.com - Click to enlarge FX Rates Overview: The recent rise in equity markets and backing up in yields spurred many observers to upgrade their macroeconomic outlooks rather than the other way around. Yet we continue to see may worrisome signs. It is not just trade, though, of course, that is part of it. Sentiment itself is...

Read More »FX Weekly Preview: Synchonized Emergence from Soft Patch?

There have been plenty of developments warning of a global economic slowdown. Yet, seemingly to justify the continued advance in equity prices, there has begun to be talk of possible cyclical and global rebound. That is the new constellation, connecting the better than expected Japanese, South Korean, and Chinese September industrial output figures, a slightly stronger than expected Q3 GDP reports from the US and the eurozone. Ahead of the weekend, China reported...

Read More »FX Daily, October 30: All About Perspective

Swiss Franc The Euro has fallen by 0.13% to 1.1026 EUR/CHF and USD/CHF, October 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are mostly treading water ahead of the Federal Reserve meeting. Asia Pacific and European equities drifted lower. The MSCI Asia Pacific Index appears to have snapped a four-day advance, while the Dow Jones Stoxx 600 was trading slightly lower for the second...

Read More »Cool Video: Dollar and Fed

I joined Tom Keene and Marty Schenker (chief content officer) on the set of Bloomberg TV this morning. Schenker discussed some of the geopolitical issues in the Middle East, and Keene asked about the impact on the dollar. I expressed my concern that the chief threat to the dollar’s role in the world economy is the several administrations have increasing weaponized access to the dollar and the dollar funding market. It used to be a public good, a utility if you will....

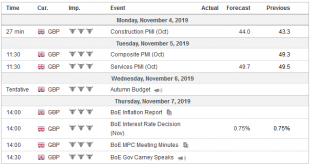

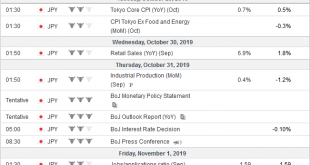

Read More »FX Weekly Preview: Fed’s Mid-Course Correction to be Challenged while ECB Resumes Bond Purchases

The week ahead will help shape the investment climate for the remainder of the year. The highlights include three central bank meetings (Federal Reserve, Bank of Japan, and the Bank of Canada). Among the high-frequency data, the US and the eurozone report the first estimates of Q3 GDP, and the US October jobs data and auto sales will be released. Investors will also get the preliminary Oct CPI for EMU. A few hours before the FOMC meeting concludes on October 30,...

Read More »FX Daily, October 24: Flash PMIs Disappoint Despite Negative Interest Rates

Swiss Franc The Euro has fallen by 0.08% to 1.1014 EUR/CHF and USD/CHF, October 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: As the UK awaits the EU’s decision on its request, disappointing flash PMI readings Japan, Australia, and Germany have filled the news vacuum. Sweden’s Riksbank retained a hawkish tone while keeping rates on hold, and Norway’s Norges Bank also stood pat. The market expects Turkey to...

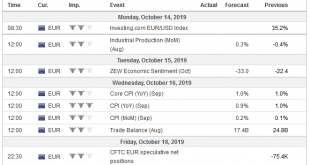

Read More »FX Weekly Preview: Same Three Drivers in the Week Ahead but Changing Tones

Three themes have dominated the investment climate: US-China tensions, Brexit, and the policy response to the disinflationary forces. None have been resolved, which contributes to the uncertainty for businesses, households, and investors. However, the negativity that has prevailed is receding a little. It begins with the most substantive progress on Brexit in months, but also entails a possible new tariff truce between the US and China. Indeed, we irreverently...

Read More »FX Daily, October 9: Hope is Trying to Supplant Pessimism Today

Swiss Franc The Euro has risen by 0.35% to 1.0912 EUR/CHF and USD/CHF, October 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The 1.5% drop in the S&P 500 and the deterioration of US-China relations and the prospects of a no-deal Brexit failed did not carry over much into today’s activity. Asia Pacific equities were mostly a little lower, though China and India bucked the regional trend, while Korea was...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org