Submitted by Thorstein Polleit via The Mises Institute, The US is by far the biggest economy in the world. Its financial markets — be it equity, bonds or derivatives markets — are the largest and most liquid. The Greenback is the most important transaction currency. Many currencies in the world — be it the euro, the Chinese renminbi, the British pound or the Swiss franc — have actually been built upon the US dollar. The...

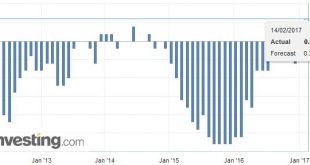

Read More »Swiss Consumer Price Index in January 2017: Consumer prices remain stable

From the official press release by Swiss Statistics: Swiss Consumer Price Index in January 2017: Consumer Prices Remained Unchanged in January 2017 Neuchâtel, 14.02.2017 (FSO) – The Swiss Consumer Price Index (CPI) remained unchanged in January 2017 compared with the previous month at 100.0 points (December 2015=100). Inflation was 0.3% in comparison with the same month in the previous year. These are the findings from...

Read More »What is Good for the Dollar is Bad for Gold

Summary: The Dollar Index is powering ahead, moving higher for the eighth consecutive session. Over the past 100 sessions, gold and the Dollar Index move in the opposite direction more than 90% of the time. The technical condition of gold is deteriorating. The Dollar Index is extending its advancing streak today into its eighth consecutive session. It is at its best level since just before Trump’s...

Read More »Want to Bring Back Jobs? It’s Impossible Unless We Fix these Four Things

It’s your choice, America–you can keep your cartels and the captured government that enables and protects them, or you can fix what’s broken and unaffordable. If there is any goal that might attract support from across the political spectrum, it’s creating more fulltime jobs in the U.S. But this laudable goal is dead-on-arrival (DOA) unless we first fix these four things. Why is job growth stagnating? Many point to...

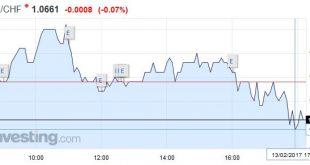

Read More »FX Daily, February 13: Quiet Start of Busy Week

Swiss Franc EUR/CHF - Euro Swiss Franc, February 13(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF Pound to Swiss Franc exchange rates provide strong beginning to the week Pound to Swiss Franc exchange rates have enjoyed a strong boost to begin the week, after what had been a disheartening end to the week for many Franc buyers. The Pound has regularly suffered on Friday’s since the Referendum, with...

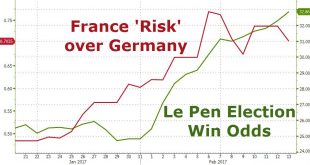

Read More »Here Are The Best Hedges Against A Le Pen Victory

On Friday, after it emerged that as part of Marine Le Pen’s strategic vision for France, should she win, is a return to the French franc as well as redenomination of some €1.7 billion in French (non-international law) bonds, both rating agencies and economists sounded the alarm, warning it would “amount to the largest sovereign default on record, nearly 10 times larger than the €200bn Greek debt restructuring in 2012,...

Read More »New Book: Political Economy of Tomorrow

My new book,Political Economy of Tomorrowhas just been published, and it is available on Amazon. The book is not so much of a sequel to my first book,Making Sense of the Dollar. There is very little about the foreign exchange market in the new book. However, it is not wholly new cloth either. There is a journalist-cum-presidential adviser at the turn of the 20th century, Charles Conant, that I introduce in the first...

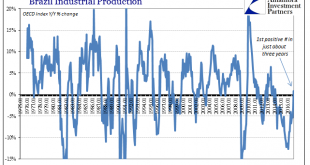

Read More »Brazil: Continuing Problems

The cruelest part, perhaps, of this economic condition globally is how it plays against type. In all prior cycles, economies of all kinds and orientations all over the globe would go into recession and then bounce right of it once at the bottom. It was often difficult to see the bottom, of course, but once recovery happened there was no arguing against it. Since the Great “Recession”, which was global, no matter what...

Read More »Weekly Sight Deposits and Speculative Positions: Another Post-Trump SNB Intervention Record

Headlines Week February 13, 2017 Recently inflation rose more quickly in the euro zone, but this was mostly caused by a temporary oil price effect. Therefore the ECB might be dovish for a longer period than the SNB. Consumer price inflation will decide who is more dovish. Ultimately inflation will depend on the two key parameters wages and rents. Rents will rise first in Switzerland, while the Euro zone has downwards...

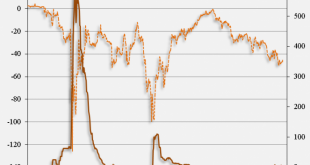

Read More »Weekly Speculative Position: Speculators are long all currencies of the dollar bloc

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org