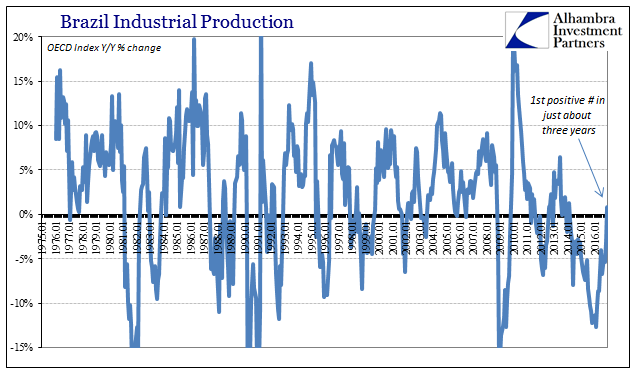

The cruelest part, perhaps, of this economic condition globally is how it plays against type. In all prior cycles, economies of all kinds and orientations all over the globe would go into recession and then bounce right of it once at the bottom. It was often difficult to see the bottom, of course, but once recovery happened there was no arguing against it. Since the Great “Recession”, which was global, no matter what kind of economy was affected by it they have largely all changed in the same way. The “rising dollar” hit EM economies by far the hardest, and for that most of them suffered years of contraction. While numerous statistics here and in other places are starting to suggest an end to that specific downturn, against all prior experience it doesn’t mean recovery. In places like Brazil, you end up with what used to be called “scraping along the bottom” – at best. Brazil Industrial Production 1975 - 2016 - Click to enlarge Last month, the OECD estimated that in November 2016 for the first time in almost three years industrial production was positive year-over-year. It was really flat (+0.8%), but though the number was low it was at least one with a plus sign in front of it.

Topics:

Jeffrey P. Snider considers the following as important: banco do brasil, Brazil, currencies, depression, dollar shortage, dollar standard, Economics, economy, emerging markets, EuroDollar, Featured, Federal Reserve/Monetary Policy, GDP, industrial production, newslettersent, rising dollar, social disorder

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

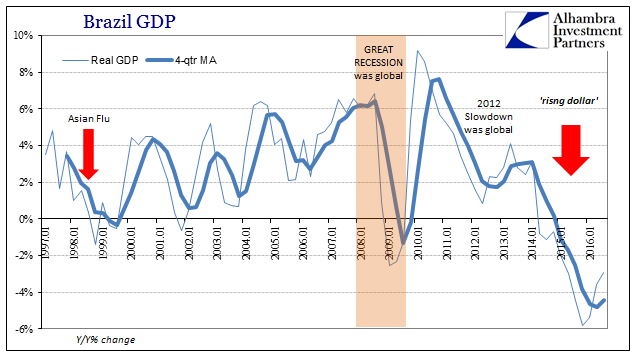

| The cruelest part, perhaps, of this economic condition globally is how it plays against type. In all prior cycles, economies of all kinds and orientations all over the globe would go into recession and then bounce right of it once at the bottom. It was often difficult to see the bottom, of course, but once recovery happened there was no arguing against it. Since the Great “Recession”, which was global, no matter what kind of economy was affected by it they have largely all changed in the same way.

The “rising dollar” hit EM economies by far the hardest, and for that most of them suffered years of contraction. While numerous statistics here and in other places are starting to suggest an end to that specific downturn, against all prior experience it doesn’t mean recovery. In places like Brazil, you end up with what used to be called “scraping along the bottom” – at best.

|

Brazil Industrial Production 1975 - 2016 |

| Last month, the OECD estimated that in November 2016 for the first time in almost three years industrial production was positive year-over-year. It was really flat (+0.8%), but though the number was low it was at least one with a plus sign in front of it. That may seem like the turnaround Brazilians have been waiting and hoping for, the seasonally-adjusted series instead submits that may be more than they should expect. |

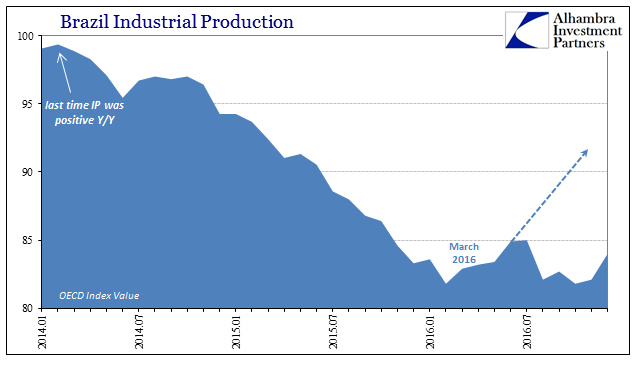

Brazil Industrial Production Jan 2014 - Dec 2016 |

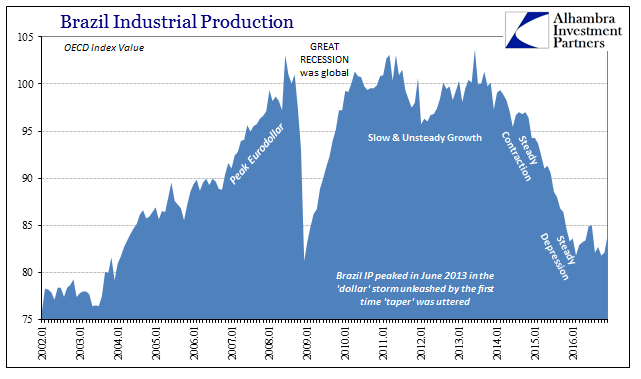

| Even if a more determined rebound were indicated, it doesn’t come close to erasing the contraction that really began in the middle of 2013. Since peaking in June of that year, small coincidence given the “dollar” actions at the time, Brazil’s IP index is down an astounding 19% through November. Some renewed positive numbers are small comfort given what has transpired. |

Brazil Industrial Production 2002 - 2017 |

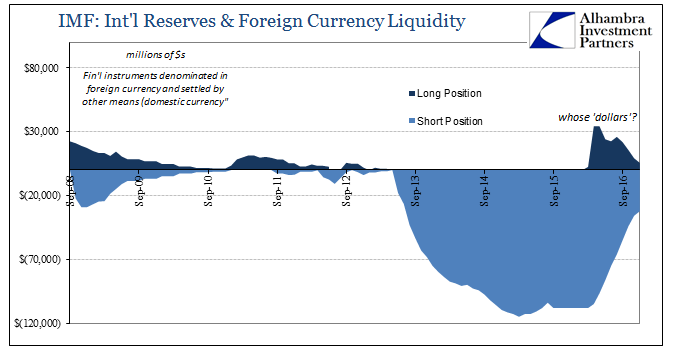

| Further, there are still lingering doubts as to even the sustainability of those positive numbers. For one, as noted a few days ago, whatever “dollar” source that showed up around March 2016, where IP started up again, has trailed off or even disappeared. There is the nontrivial possibility that the lack of further contraction might just be temporary. That might leave Brazil susceptible to further strains even where “dollar” funding issues aren’t as immediate again (uncertainties are more than enough to depress real economic functions). |

International Reserves and Foreign Currency Liquidity, September 2008 - 2016 |

| In terms of Brazilian GDP, year-over-year it has been negative for 10 straight quarters, a length and a depth far and away worse than during the Great “Recession.” And there is every expectation that streak continued in Q4 (we will have to wait until early March for the initial estimates).

Absent a true and credible recovery outlook, Brazil will be mired further in depression even where some statistics may show plus signs again for the first time in years. If GDP, for instance, should turn positive in Q4 (current expectations are for about -2% again) unless it is plus by a lot it isn’t meaningfully different or even all that helpful. After suffering enormous contraction for so long what is needed, demanded, is equally enormous recovery. Anything short of that is more of the same. |

Brazil Gross Domestic Products January 1991 - 2016 |

That is what is observed practically everywhere in the world, as it has been since around August 2007 (which the events of February 2007 warned us all about). Though incredibly spanning ten years now, economists and officials still have no answers. Because of this cost measured in times not plus or minus signs, the problem is no longer strictly an economic one:

Ignorance as established doctrine is no longer tolerable and hasn’t really been for a full decade now. So long as it is tolerated, this depression will continue, at least until that can no longer be tolerated.

Japan has pioneered many of the daily or real world aspects which have gripped the global economy. Brazil, however, may represent an offshoot of Japanification, where certain less stable societies cannot cope with or endure multiple lost decades; and so they won’t.

More than 100 people have been reported killed during a six-day strike by police in the Brazilian state of Espirito Santo, as hundreds of troops patrolled streets attempting to keep order with schools and businesses closed and public transport frozen…

Police in Espirito Santo are demanding a pay rise amid an economic downturn that has hammered public finances in Brazil, with many states struggling to ensure even basic health, education and security services.

There are fears strikes could spread to other cash-strapped states that are not paying police and other public servants on time.

Luiz Pezao, governor of Rio de Janeiro state, one of Brazil’s most indebted, has already warned federal officials he may urgently need the backing of troops or federal police soon.

Brazil, as did most if not all the other EM’s, including China, rode the eurodollar as if it was the path to prosperity. And because of Economists’ ignorance about it, it has left them facing not the fruits of wealth but a persisting nightmare of “dollars.” Again, positive numbers won’t correct this course. History demonstrates conclusively that continued stagnation and depression, not just contraction, ends in the worst sorts of ways. There is something very disquieting about a future where we hope we end up more like Japan than the other actually available options.

I wrote in August 2013 that Brazil May Already Be Toast. It is utterly criminal that that was allowed to be true, but what if it goes further than just Brazil? It’s a realistic scenario that needs to be considered amongst “reflation” euphoria that will likely amount to wasting more time, just as it did in 2013-14. Everything now is measured in time. The sad and frustrating part is that there is a recovery to be had, and very likely an enormous one, if the right things are ever to be changed. The clock is ticking.

Tags: banco do brasil,Brazil,currencies,depression,dollar shortage,dollar standard,Economics,economy,EuroDollar,Featured,Federal Reserve/Monetary Policy,GDP,industrial production,newslettersent,rising dollar,social disorder