Onward vs. Upward Something both unwanted and unexpected has tormented western economies in the 21st century. Gross domestic product (GDP) has moderated onward while government debt has spiked upward. Orthodox economists continue to be flummoxed by what has transpired. What happened to the miracle? The Keynesian wet dream of an unfettered fiat debt money system has been realized, and debt has been duly expanded at...

Read More »Emerging Markets: What has Changed

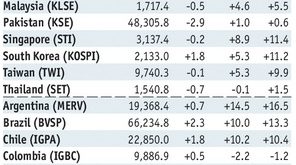

Summay The PBOC increased the rates it charges for OMO and MLF by 10 bp. Indian Prime Minister Modi’s BJP won elections in the state of Uttar Pradesh. Czech central bank broached the possibility of a koruna cap exit later than mid-2017. Kuwait became the first OPEC member to call for extended output cuts. Moody’s raised the outlook on Brazil’s Ba2 rating from negative to stable. Brazilian prosecutor Janot has given the...

Read More »Further Unanchoring Is Not Strictly About Inflation

According to Alan Greenspan in a speech delivered at Stanford University in September 1997, monetary policy in the United States had been shed of M1 by late 1982. The Fed has never been explicit about exactly when, or even why, monetary policy changed dramatically in the 1980’s to a regime of pure interest rate targeting of the federal funds rate. In those days, transparency was no virtue but rather it was widely...

Read More »The Swiss Franc Hits its Lowest Since December

24 Heures. On Monday the franc went as low as 1.0825 to the euro, the lowest since early December last year. © Yulan | Dreamstime.com - Click to enlarge According to some experts, the weaker franc can be partly explained by the market activities of the Swiss National Bank (SNB). The cantonal bank of Thurgau said that the SNB appeared to be targeting a weaker franc ahead of the Dutch elections on Wednesday. Adding that...

Read More »FX Daily, March 17: Dollar Remains Heavy

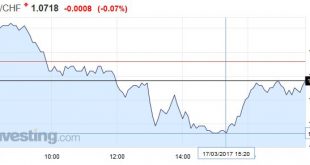

Swiss Franc EUR/CHF - Euro Swiss Franc, March 17(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF Article 50 – Invocation Imminent With the House of Commons voting against amendments to the brexit bill, it was passed to the Queen for approval which was really a formality, more a mark of respect to a bygone age. Article 50 is now ready to be invoked at anytime. It is anticipated to be next week. I am of...

Read More »CS and UBS Tell Wealthy Retail Clients To Buy Stocks…”Here, Can You Please Hold This Bag”

Warren Buffett has frequently advised aspiring investors to take a contrarian view on markets and “be fearful when others are greedy and be greedy when others are fearful.” In fact, being dismissive of the wall street ‘herd mentality’ has resulted in some of Buffett’s most successful trades over the years including his decision to load up on bank stocks during the ‘great recession’. But the market wizards at Credit...

Read More »Gold Sector: Positioning and Sentiment

A Case of Botched Timing, But… When last we wrote about the gold sector in mid February, we discussed historical patterns in the HUI following breaches of its 200-day moving average from below. Given that we expected such a breach to occur relatively soon, the post turned out to be rather ill-timed. Luckily we always advise readers that we are not exactly Nostradamus (occasionally our timing is a bit better). Below is...

Read More »Trump: Unilateralism or Isolationism?

Summary: Many who think that the US is becoming isolationist are wrong. The thrust is now more about unilateralism. Unilateralism can lead to the US being more isolated. Domestic issues have dominated the news of the first 50 days of the Trump Administration. With the German Chancellor’s trip to Washington tomorrow, Secretary of State Tillerson in Asia, and the G20 meeting, foreign affairs may knock the debate...

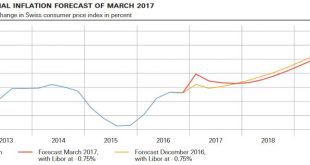

Read More »SNB Monetary Policy Assessment March 2017

Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank (SNB) is maintaining its expansionary monetary policy. Interest on sight deposits at the SNB is to remain at–0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into...

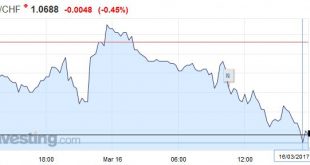

Read More »FX Daily, March 16: Greenback Consolidates Losses as Yields Stabilize

Swiss Franc EUR/CHF - Euro Swiss Franc, March 16(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge GBP/CHF Sterling vs the Swiss Franc has fallen again as the US Federal Reserve have raised interest rates last night. This has seen the Pound fall against most major currencies and the safe haven status of the Swiss Franc has once again helped to improve CHF/GBP rates We now also have the news...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org