Summary: Trump has moderated in several areas, he is being checked in others, and less impactful in others. This will underscore the focus on Yellen’s testimony this week. At same time, many will be reluctant to short the dollar ahead of the tax reform plans that may be unveiled in Trump’s upcoming speech to Congress. There is a lull in the maelstrom launched by the Trump Administration. His ban on...

Read More »Emerging Market Preview of the Week Ahead

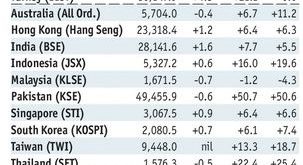

Stock Markets EM FX ended last week on a firm note. Falling US rates allowed many foreign currencies to gain some traction. This week, a heavy US data slate is likely to test the market’s convictions on the Fed, with January PPI, CPI, IP, and retail sales all being reported. Yellen also testifies before Congress on Tuesday and Wednesday. Stock Markets Emerging Markets February 08 Source: economist.com - Click...

Read More »FX Weekly Review, February 06 – 11: Further Dollar and CHF Strength versus Euro weakness ahead?

Swiss Franc Currency Index The major information about the Swiss economy since the beginning of the year were: New record in exports and in the trade surplus, albeit mostly driven by a few sectors: pharmaceuticals and chemicals. Considerable improvement of the consumer sentiment Improvement of the UBS consumption indicator. While in 2015, the trade surplus still expanded, we see clear tendencies that in 2017 the...

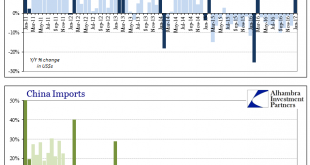

Read More »No China Trade Interpretations

The National Bureau of Statistics (NBS) of China does not publish any of the big three data series (Industrial Production, Retail Sales, Fixed Asset Investment) for the month of January. It combines January data with February data because of the large distortions caused by Lunar New Year holidays. Unlike Western holidays that are but a single day, the Golden Week is a week, and therefore when the calendar points do not...

Read More »Swiss Might Drop Daylight Savings

20 Minutes. © Jibmeyer | Dreamstime.com - Click to enlarge Switzerland could drop daylight savings. Currently, Switzerland’s Federal Council sees no reason to abandon it, however if Switzerland’s neighbours did it would follow, mainly for economic reasons said the Federal council. National councilor Yvette Estermann (UDC/SVP), who is fiercely opposed to daylight saving, took the opportunity to point out the negative...

Read More »The Dollar’s Underlying Trend Resumes

For the last several weeks, we have been looking for the dollar correction that began around the Fed’s rate hike in the middle of December to be completed and for the uptrend to resume. The precise timing of the turn is difficult to get right, but our view is anchored by our macroeconomic assessment and is understanding of the key drivers. Our technical work suggests the dollar indeed has been carving out a bottom, and...

Read More »Emerging Markets: What Has Changed

Summary Reserve Bank of India signaled an end to the easing cycle. S&P moved the outlook on Indonesia’s BBB- rating from stable to positive. The ruling Law and Justice party in Poland may be backing off of plans to force banks to convert $36 bln in foreign currency loans. Romanian Justice Minister Lordache resigned. Local press is reporting that Brazil’s central bank may cut the 2019 inflation target from 4.5% to...

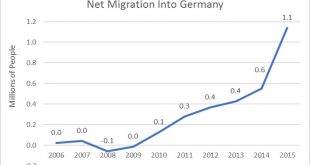

Read More »Martin Armstrong: “EU in Disintegration Mode”

Martin Armstrong Frames the Issue Famous market forecaster Martin Armstrong wrote a recent article describing the current situation in Europe. Similar to our article, “Trouble Brewing in the EU”, the Armstrong’s piece discusses growing discontent and fractures in the E.U. Martin Armstrong observes that, “The EU leadership is really trying to make Great Britain pay dearly for voting to exit the Community. Like the...

Read More »FX Traders Have To (Re)Learn A New Skill

Dear FX traders: forget the dot plot, and prepare to learn a new – or to some forgotten – skill: how to read trade flows. As Bloomberg’s Vincent Cignarella and Andrea Wong point out, currency traders accustomed to analyzing the Fed’s dot plot and monthly U.S. jobs figures to predict the direction of the world’s reserve currency are having to learn, or in some cases re-learn, a largely forgotten ability: how to...

Read More »When Trumponomics Meets Abenomics

Thirty Year Retread What will President Trump and Japanese Prime Minister Shinzo Abe talk about when they meet later today? Will they gab about what fishing holes the big belly bass are biting at? Will they share insider secrets on what watering holes are serving up the stiffest drinks? [ed. note: when we edited this article for Acting Man, the meeting was already underway] Indeed, these topics are unlikely. Rather,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org