– Art Market Bubble Bursting?– Russian Billionaire Takes 74% Loss On “Investment”– $85 Million Gauguin Bought By Dmitry Rybolovlev in 2008– Christie’s auctioned the work at its evening sale in London– Global art sales plummet, but China rises as ‘art superpower’– China soon to dominates global art and gold market– Art price volumes doubled since 2009– As currencies debase super rich seek out stores of value– Gold...

Read More »FX Daily, February 28: Markets Little Changed as Breakout is Awaited

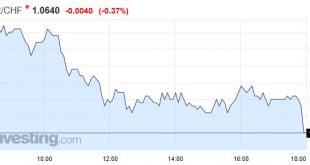

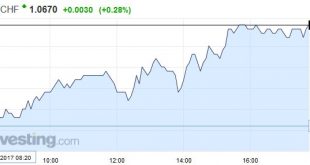

Swiss Franc EUR/CHF - Euro Swiss Franc, February 28(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge GBP/CHF GBH CHF continues to see a volatile period with the general global uncertainty which has seen investors favour the safe haven currency. GBP CHF currently sits at 1.25 for this pair and there is resistance at these levels which is preventing the pound from driving higher. Brexit is now...

Read More »The Misplaced Animosity toward Imports

Summary: Pity imports, they are misunderstood. Imports create jobs directly and indirectly. Restricting US imports would likely also curb exports. The mercantilist inclination by the Trump Administration makes it seem as if exports are good and create jobs and imports are bad and cost jobs. This is simply not true. This assessment is not based on newfangled thinking about trade. Rather Adam Smith argued...

Read More »The Gold-Silver Ratio Curiously Failed to Fall – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Gold Scarcity Intensifies Further Last week (a holiday-shortened week, as Monday was President’s Day in the US), the price of the dollar fell. In gold, it fell almost half a milligram to 24.75mg, and prices in silver it dropped 30mg, to 1.7 grams of the white monetary metal. Looks good… and since last week, costs...

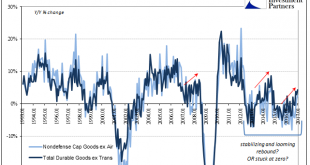

Read More »Durable Goods Groundhog

If the economy is repeating the after-effects of the latest “dollar” events, and it does seem more and more to be that case, then analysis starts with identifying a range for where it might be in the repetition. New orders for durable goods (ex transportation) rose 4.3% year-over-year in January 2017 (NSA, only 2.4% SA), the highest growth rate since September 2014 (though not meaningfully faster than the 3.9% rate in...

Read More »Virtue-Signaling the Decline of the Empire

Virtue-signaling doesn’t signal virtue–it signals decline and collapse. There are many reasons why Imperial Rome declined, but two primary causes that get relatively little attention are moral decay and soaring wealth inequality. The two are of course intimately connected: once the morals of the ruling Elites degrade, the status quo seeks to mask its self-serving rot behind high-minded “virtue-signaling” appeals to...

Read More »It Was ‘Dollars’ All Along

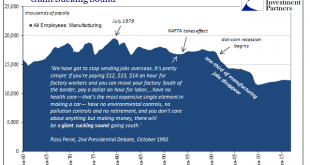

Ross Perot famously declared the “giant sucking sound” in the 1992 Presidential campaign. The debate over NAFTA did not end with George H. W. Bush’s defeat, as it simmered in one form or another for much of the 1990’s. Curiously, however, it seemed almost perfectly absent during the 2000’s, the very decade in which Perot’s prophecy came true. Americans didn’t notice because there was a bubble afoot. That bubble,...

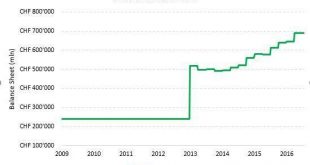

Read More »It Is Time To Short The Swiss National Bank!

(originally published on Seeking Alpha at end of October 2016) The current article will take a closer look to the incredible rise of the Swiss National Bank stock and suggest why taking a short position could be the right trade at this level. The Swiss Central Bank: Mandate and Monetary Policy According to the Swiss Federal Constitution (Art. 99) the Swiss Central Bank is an independent institution with the mandate to...

Read More »FX Daily, February 27: Asia Stumbles, Europe Recovers, Waiting for Trump

Swiss Franc EUR/CHF - Euro Swiss Franc, February 27(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The late recovery in US equities before the weekend did little good for Asian markets. Nearly all the Asian equity markets moved lower, led by the 1.0% decline in Japan’s Topix. It was the third successive loss for the Topix, which is the long losing streak of the year so far. The MSCI Asia Pacific Index...

Read More »Employment barometer in the 4th quarter 2016: Employment growth remains stable

Neuchâtel, 27.02.2017 (FSO) – In the 4th quarter 2016, total employment (number of jobs) rose by 0.3% in comparison with the same quarter a year earlier (+0.2% with previous quarter). In full-time equivalents, employment in the same period grew by 0.1%. The Swiss economy counted 3,800 more vacancies than in the corresponding quarter of the previous year (+7.8%). The other indicators also showed positive growth. These...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org