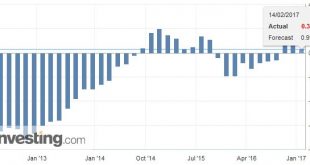

Le Matin. The unemployment rate across Switzerland climbed by 0.2% to 3.7% in January, and regional differences were clear. Across French and Italian-speaking cantons the rate averaged 5%, while across the German-speaking cantons it was 3.1%. © Beat Bieler | Dreamstime.com - Click to enlarge The unemployment rate climbed across Switzerland’s French-speaking cantons with Neuchâtel remaining the worst affected. There the...

Read More »Swiss unemployment rises. French-speaking cantons worst affected.

Le Matin. The unemployment rate across Switzerland climbed by 0.2% to 3.7% in January, and regional differences were clear. Across French and Italian-speaking cantons the rate averaged 5%, while across the German-speaking cantons it was 3.1%. © Beat Bieler | Dreamstime.com - Click to enlarge The unemployment rate climbed across Switzerland’s French-speaking cantons with Neuchâtel remaining the worst affected. There the...

Read More »Bi-Weekly Economic Review

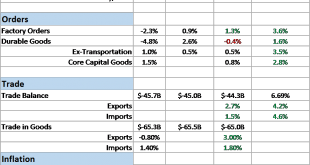

Economic Reports Scorecard The economic data since my last update has improved somewhat. It isn’t across the board and it isn’t huge but it must be acknowledged. As usual though there are positives and negatives, just with a slight emphasis on positive right now. Interestingly, the bond market has not responded to these slightly more positive readings with nominal and real yields almost exactly where they were in the...

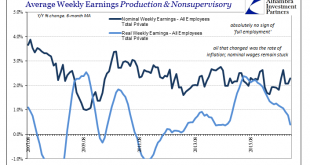

Read More »Real Wages Really Inconsistent

Real average weekly earnings for the private sector fell 0.6% year-over-year in January. It was the first contraction since December 2013 and the sharpest since October 2012. The reason for it is very simple; nominal wages remain stubbornly stagnant but now a rising CPI subtracts even more from them. Consumers receive no significant boost to their incomes, but are starting to pay more (in comparative terms) for things...

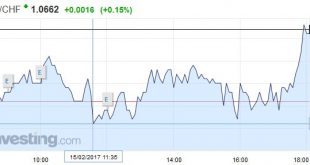

Read More »FX Daily, February 15: Yellen Helps the Dollar Extend Streak

Swiss Franc EUR/CHF - Euro Swiss Franc, February 15(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The pound to Swiss Franc exchange rate remains in a volatile position susceptible to risks of deterioration from outside global events. The Franc being a safe haven currency leaves it at the mercy of some international events which can cause a flight to safety as investors use the Franc’s stability and...

Read More »China Net Imported 1,300t Of Gold In 2016

For 2016 international merchandise trade statistics point out China has net imported roughly 1,300 tonnes of gold, down 17 % from 2015. The importance of measuring gold imports into the Chinese domestic gold market – which are prohibited from being exported – is to come to the best understanding on the division of above ground reserves in and outside the Chinese domestic market. Kindly be advised to have read my...

Read More »Silver Futures Market Assistance – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Silver Is Pushed Up Again This week, the prices of the metals moved up on Monday. Then the gold price went sideways for the rest of the week, but the silver price jumped on Friday. Is this the rocket ship to $50? Will Trump’s stimulus plan push up the price of silver? Or just push silver speculators to push up the price,...

Read More »A New Frame Of Reference Is Really All That Is Necessary To Start With

In the middle of 1919, the United States was beset by a great many imbalances. Having just conducted a wartime economy, almost everything before then had been absorbed by the World War I effort. With fiscal restraint subsumed by national emergency, inflation was the central condition. Given that the Federal Reserve was by then merely a few years old, no one was quite sure what to do about it. Chairman of the Federal...

Read More »Lies, Damn Lies, and Taxes

President Trump hinted at the end of last week that the Administration’s tax proposals would be aired in the next two or three weeks. This seems to be a signal of its inclusion in his address to both houses of Congress on February 28. This is not quite a State of the Union speech, but similar and precisely what Obama did in February 2009. Taxes are complicated. Much of the discussion so far has been on the border...

Read More »Greece and the Return of the Repressed

Summary: Don’t expect a deal between Greece and its official creditors until late spring or early summer. Grexit is still not a particularly likely scenario. It was the European governments not Greece which put other taxpayers’ skin in the game. Freud warned that unresolved psychological conflicts might be repressed but they keep returning. So too with Greece debt problems. A new crisis is at hand. Investor...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org