This article originally appeared here. Washington has been quite the circus lately. Bret Kavanaugh’s appearance in front of the Senate Judiciary Committee prompted dozens of interruptions from Democrats and numerous protests from leftists. During Twitter CEO Jack Dorsey’s testimony to the House Commerce Committee, journalist Laura Loomer demanded to be verified on the social media platform, and Representative Billy Long...

Read More »FX Daily, September 11: Dollar May Prove Resilient if it is Turn Around Tuesday

Swiss Franc The Euro has fallen by 0.17% at 1.1282 EUR/CHF and USD/CHF, September 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro and sterling extended their recovery from the US hourly earnings lows seen before the weekend. However, the move stalled in the European morning, after the UK reported better than expected earnings itself. Sterling approached the 61.8%...

Read More »Why the Fed Denied the Narrow Bank, Report 9 Sep 2018

It’s not every day that a clear example showing the horrors of central planning comes along—the doublethink, the distortions, and the perverse incentives. It’s not every year that such an example occurs for monetary central planning. One came to the national attention this week. A company called TNB applied for a Master Account with the Federal Reserve Bank of New York. Their application was denied. They have sued....

Read More »Cool Video: What Earth Really Looks Like

Here is the challenge: Representing a three-dimensional object in two-dimensions. It is impossible to do without distortions. Those distortions can reflect cultural biases as well as the function of the map, such as for navigation purposes. The Mercator Projection, which generates the map that may be most familiar, dates back to the 16th century. It projects the image on to a cylinder, where parallels of latitude are as...

Read More »Global Asset Allocation Update – September 2018

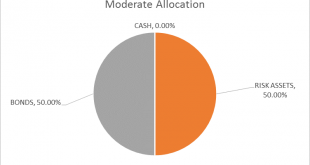

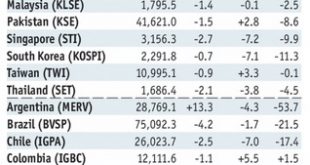

The risk budget is unchanged again this month. For the moderate risk investor, the allocation between bonds and risk assets is 50/50. Decoupling anyone? That’s what the market is whispering right now, that the recent troubles in foreign economies is contained and won’t affect the US. The most obvious example of that trend is the performance of US stocks versus the rest of the world. I am painfully aware of the...

Read More »Takeovers and trade at heart of minister’s China visit

The Swiss economics minister is in Beijing to meet his Chinese counterparts. It is unfair that whilst Chinese investors can buy Swiss companies the reverse is not possible, says economics minister Johann Schneider-Ammann, who is currently on a visit to China. In an interview with the “Schweiz am Wochenende” newspaper, he reiterated his view that this must be rectified. For infrastructure like electricity supply and...

Read More »FX Daily, September 10: Initial Extension of Euro and Sterling Losses Stall

Swiss Franc The Euro has risen by 0.82% at 1.1289 EUR/CHF and USD/CHF, September 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar’s pre-weekend gains were extended against most the major currencies, but the euro, sterling, and Australian dollar have recovered in the European morning. Emerging markets currencies are mixed. The euro fell to almost $1.1525 in...

Read More »Inflation ist nicht Inflation

Das südamerikanische Land Venezuela führt gerade vor, was geschehen kann, wenn die Inflation ausser Kontrolle gerät. Der Internationale Währungsfonds rechnet bis Ende Jahr mit einer Teuerung von 1 Million Prozent. Eine solche Inflation wird etwa erreicht, wenn sich das Preisniveau rund alle vier Wochen verdoppelt. Wenn sich Geld in einem solchen Ausmass entwertet, verliert es jeden Nutzen, denn dann kann es seine...

Read More »Older people marginalized on Swiss labour market, says report

Many older people who lose their jobs are struggling in Switzerland. Despite recent government optimism about the Swiss economy, older people who lose their jobs are struggling, reports Sunday newspaper “Le Matin Dimanche”. The paper cites figures from the Bern University of Applied Sciences that found only 13.9 per cent of unemployed people over 50 in Switzerland find a stable job again. Many end up on social...

Read More »Emerging Markets: What has Changed

Summary Philippine central bank signaled another big hike. Poland central bank appears to be moving its forward guidance out further. Russia officials are sending confusing signals regarding monetary policy. Russia officials stand ready to support the ruble debt market if new US sanctions negatively impact it. South Africa’s African National Congress pledged to undertake land reform responsibly. Moody’s cut its 2018...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org