An unknown but likely staggeringly large percentage of small business owners in the U.S. are an inch away from calling it quits and closing shop. Timothy Leary famously coined the definitive 60s counterculture phrase, “Turn on, tune in, drop out” in 1966. (According to Wikipedia, In a 1988 interview with Neil Strauss, Leary said the slogan was “given to him” by Marshall McLuhan during a lunch in New York City.) An...

Read More »The Beginning of the End for Angela Merkel

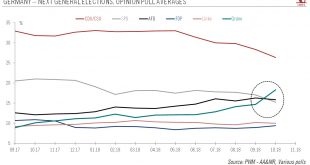

The transition to new leadership in Germany could have implications for Europe as a whole. As a consequence of the heavy drop of support in recent regional elections, Chancellor Merkel has declared she would not run again for leadership of the CDU at the 6-8 December party convention. Merkel also said she would retire from politics at the end of the current parliament in 2021. It is questionable whether she will get...

Read More »Geneva Aims for a New Company Tax Rate of 13.79 percent

According to bilan.ch, Geneva’s Council of State, or executive, has put forward a proposed corporate tax rate of 13.79% as part of its tax reform project, work triggered by international pressure on Switzerland and its cantons to remove preferential tax treatment for certain international companies. ©-Sam74100-_-Dreamstime.com_ - Click to enlarge This rate is the same as the rate already accepted by the government and...

Read More »What’s Behind the Erosion of Civil Society?

Rebuilding social capital and social connectedness is not something that can be done by governments or corporations. As the mid-term elections are widely viewed as a referendum of sorts, let’s set aside politics and ask, what’s behind the erosion of our civil society? That civil society in the U.S. and elsewhere is fraying is self-evident. It isn’t just the rise of us-or-them confrontations and all-or-nothing...

Read More »Crypto bond catapults Swiss franc onto blockchain

Stable coins are proliferating as a means to counter the effects of huge price swings of cryptocurrencies. A new bond has been launched in Switzerland to help investors and blockchain start-ups escape the volatility of cryptocurrencies. Issued by Swiss Crypto Tokens, the bond is a representation of the safe haven currency on the blockchain. The first 10 million units of the bond, each worth a franc and pegged to the...

Read More »Top Finance Ministry Official to Step Down

Jörg Gasser wants to pursue a new career path (Keystone) The State Secretary for International Finance, Jörg Gasser, is to step down in February after three years in office. It was Gasser’s decision to leave the post, according to a statement by the finance ministry on Wednesday. Among his most important tasks was the development of bilateral relations and cooperation with new and emerging markets, notably in Asia, the...

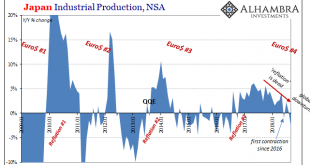

Read More »China Now Japan; China and Japan

Trade war stuff didn’t really hit the tape until several months into 2018. There were some noises about it back in January, but there was also a prominent liquidation in global markets in the same month. If the world’s economy hit a wall in that particular month, which is the more likely candidate for blame? We see it register in so many places. Canada, Europe, Brazil, etc. It does seem as if someone flipped a switch...

Read More »Swiss Retail Sales, September 2018: -2.3 percent Nominal and -2.7 percent Real

02.11.2018 – Turnover in the retail sector fell by 2.3% in nominal terms in September 2018 compared with the previous year. This is the sharpest decline since December 2016. Seasonally adjusted, nominal turnover fell by 1.6% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover in the retail sector also adjusted for sales days and holidays fell by 2.7%...

Read More »Die SNB hat den Währungskrieg selbst angezettelt – und schon wieder eine Schlacht verloren

SNB Trade War - Click to enlarge Die SNB befürchtet einen Handelskrieg, der in einen Währungskrieg münden und schliesslich zu einer grossen Depression führen könnte. Wir alle wissen, dass nach der grossen Depression der Weltkrieg kam. Die Ökonomen und Zentralbanker sind also aufs äusserste gefordert. Eine exakte ökonomische Analyse hat höchste Priorität. SNB-Chef Jordan sagte vorgestern vor der Volkswirtschaftlichen...

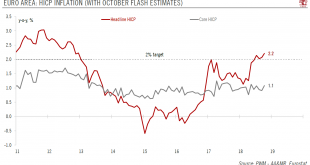

Read More »Rebound in inflation data brings some relief to the ECB

Strong wage growth should support the recovery of euro area inflation in the coming months. Euro area flash HICP rose from 2.1% year on year (y-o-y) in September to 2.2% in October, in line with expectations and the highest level since December 2012. Crucially, core inflation (HICP excluding energy, food, alcohol and tobacco) rebounded from 0.9% to 1.1% in October. Energy inflation rose to 10.6% y-o-y from 9.5% y-o-y in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org