It’s not every day that a clear example showing the horrors of central planning comes along—the doublethink, the distortions, and the perverse incentives. It’s not every year that such an example occurs for monetary central planning. One came to the national attention this week. A company called TNB applied for a Master Account with the Federal Reserve Bank of New York. Their application was denied. They have sued. First, let’s consider TNB. It’s an acronym for The Narrow Bank. A so called narrow bank is a bank that does not engage in most of the activities of a regular bank. It simply takes in deposits and puts them in an account at the Fed. The Fed pays 1.95%, and a narrow bank would have low costs, so it could

Topics:

Keith Weiner considers the following as important: 6) Gold and Austrian Economics, 6a) Gold & Bitcoin, Basic Reports, brittle, capital consumption, central planning, Featured, Federal Reserve, narrow bank, newsletter, perverse incentive, the fed

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

It’s not every day that a clear example showing the horrors of central planning comes along—the doublethink, the distortions, and the perverse incentives. It’s not every year that such an example occurs for monetary central planning. One came to the national attention this week.

A company called TNB applied for a Master Account with the Federal Reserve Bank of New York. Their application was denied. They have sued.

First, let’s consider TNB. It’s an acronym for The Narrow Bank. A so called narrow bank is a bank that does not engage in most of the activities of a regular bank. It simply takes in deposits and puts them in an account at the Fed. The Fed pays 1.95%, and a narrow bank would have low costs, so it could pass most of this to its depositors. This is pretty attractive, and without the real estate and commercial lending risks—not to mention derivatives exposure—it’s less risky than a regular bank. According to Bloomberg’s Matt Levine, saving accounts for large depositors average only 0.08% interest.

So it’s easy to see why many believe that the Fed’s reason to refuse an account to TNB is unsavory: to protecting the crony too-big-to-fail banks. That is a plausible explanation for sure, but there is much more.

The Bank: Spindled, Folded, and Mutilated

There has been a long, slow process—punctuated by big changes in responses to crises—of perverting the banks. Before the first world war, when a retailer received consumer goods he would sign a bill acknowledging delivery. Typically, he had 90 days to pay, which was enough time to sell the goods through to the consumer. The wholesaler could endorse this and pass it to his creditors. The bill traded at a discount to its face value.

The creditor—perhaps the wholesaler—could endorse it and pass it to his supplier. The supplier could bring it to a bank. Banks were happy to discount a bill, because bills earned the discount rate and they were very liquid. The bill was the perfect asset to back demand deposit accounts.

Banks also engaged in lending. They bought loans and bonds. A loan is not a good asset to back a demand deposit account, as it is not liquid. A bond is slightly better, but the problem is that the bond market can go “no bid” at times of stress. Which is precisely when depositors are demanding their money back, and hence banks need to sell.

So the government had a solution: create a rediscounter of bills—the Federal Reserve. Today, economists say the Fed was created as lender of last resort with an important caveat. It would only lend on quality assets. Well, bills are not lending, but clearing. If you had a $2,000 (100 ounces gold!) bill drawn on a baker for his flour delivery, you did not have much worry that the demand for bread would disappear (the commodity was insured).

So in its inception, the Fed was purportedly supposed to rediscount these bills. That is buy them, and provide the gold unexpectedly needed by the banks. They needed the gold because they backed demand deposits with loans or bonds. They didn’t expect the need, because they assumed that the bond market cannot become illiquid and did not understand that they caused the illiquidity by mismatching the saver’s demand deposit with the borrower’s long-term project. The saver said “I might want my money back by next Tuesday” and the bank said “right, 10-year railroad bond!”

Anyways, the theory was that banks could bring in some bills to get some gold, to pay redeeming depositors. The practice was that the Fed began buying Treasury bonds, thus distorting interest rates (which was illegal in 1913 and retroactively legalized in additional legislation many years later).

And the Fed did not just distort the interest rate. It distorted the very business model of the banks. Consider the so called open market operations. The Fed is prohibited from buying new bonds directly issued from the Treasury. So it buys them in the “open market”, which in practice means it buys from the big banks. The big banks now have a business that never existed in a free market—knowing the coming bond purchase schedule, buying those bonds for inventory and then unloading them onto the Fed a few ticks higher in price.

Another example is that the big banks sell various products to hedge the artificial and unnecessary risks created by a central bank. One is interest rate moves. A free market has a stable interest rate, and there’s no need to hedge. Once the Fed is created, the interest rate is destabilized. Another is currency exchange moves. Gold is universal, but when each country imposes its own irredeemable paper, the value of one currency in terms of another can move all over the map. So businesses seek to hedge these risks, and the banks find themselves in the business of manufacturing hedging products to sell.

Last week, we wrote about the business of advance refunding bonds, created by the long-term falling interest rate trend.

Or there is the government-guaranteed loan for housing, college education, and small business. This distorts the price of credit to these markets—the interest rate is lower, and hence the price of the asset is higher. It also distorts the banking business. The government is, in essence, giving banks a license to make risk-free profits by finding borrowers upon whom to dump cash.

The government needs to make sure that the borrowers are creditworthy (or at least politically eligible). So a major part of bank operations becomes compliance. Especially because the bank itself has various forms of government guarantee, including deposit insurance and bailouts for so called too-big-to-fail banks. Imagine if you could walk into a casino, and start betting on roulette and blackjack, with a guarantee that the government would cover your losses.

So after more than a century of creeping change, the big banks today have become distorted beyond recognition. Keynes and Friedman shared the same great vision (though we expect they would not agree with this statement, nor our summary of the vision itself). They believed you can boost economic activity by increasing the quantity of dollars. Sometimes this causes rising prices of consumer goods, but since 1981, we’ve had rising asset prices. Rising asset prices is a process of conversion of one speculator’s wealth into another’s income, to be spent. Which adds to GDP.

The banks today have balance sheets, workforces, business activities, and revenues derived from such money multiplier effects. This is completely perverse, completely destructive, completely unsustainable, and completely popular. From Wall Street to Left-leaning academia, from Republicans to Democrats, from property and business owners to homeless advocates, everyone loves Plank #5 from the Communist Manifesto and its modern manifestation—the Fed which presides over the falling interest rate, cheaper financing for the deficit spending of the welfare state, and endlessly rising asset prices. From 2009 to 2017, Obama supporters pointed to rising stocks, employment, and GDP as proof of his good policies. Since 2017, Trump supporters point to the same trend as proof of his.

Monetary Policy

Continuing to apply steady perverse incentive pressure on a dynamic economy demands a complex array of institutions and so called policy tools. The goal is to incentivize behavior A, but not allow B and C to creep into the system. There must be sticks of course, but carrots work better.

One such carrot policy tool is that the Fed pays interest on so called excess reserves (remember, earlier we touched on government guarantees and the compliance this brings?) The banks are required to have cash reserves. Cash above this threshold is deemed to be excess, and the Fed pays the banks 1.95% on excess reserves at present.

This is not a free handout for the sake of a free handout. It is there, because the Fed relies on those excess reserves to fund its portfolio of government bonds. The Fed ballooned this portfolio in the various so called quantitative easings imposed in reaction to the financial crisis of 2008. It has to fund this portfolio by borrowing. The bank’s excess reserves are one and the same with the Fed’s borrowing.

That is true, by the way, for every financial asset. One party’s asset is another’s liability. What you think of as your money is what someone else thinks of as his debt. Which he borrowed in order to fund the purchase of his asset in turn.

We don’t know what, precisely, would happen if the banks attempted to withdraw over $4 trillion and the Fed were forced to sell over $4 trillion in Treasury bonds. The Treasury bond is the central asset in the system. If its price collapsed, in the face of such selling (and the front-running that every trader with access to the Internet would do), then that would bankrupt the banks.

The Fed hopes never to find out, and so it offers interest to keep its funding in place. This is just like ordinary banks raising the rate for deposits, when they want to retain or grow their deposit base.

It is also a component of monetary policy, central planning of money and credit. The Fed obviously can’t just let any Tom, Dick, or Harry mess up their intricate and brittle plans for our economy.

The Narrow Bank

Enter: The Narrow Bank.

The Narrow Bank intends to raise deposits, but instead of using them as a conventional bank to prop up the entire asset price syndrome, multiplying the Fed’s magic money woo and boosting GDP, TNB just wants to deposit the funds at the Fed.

Earlier, we referred to the Fed’s planning as both complex and brittle. Now TNB wants to start pumping cash into the Fed’s hands, forcing the Fed to buy more Treasury bonds, bidding up the price and hence pushing down the interest rate. To the monetary mandarins who centrally plan our little economy for us, this is most unwelcome meddling.

Last week, we discussed how municipal governments may get a lower interest rate than Treasury bonds, because munis are tax-exempt to the investor. We described the trade of selling a lower-rate bond to fund the purchase of a higher-rate Treasury. We called this illicit arbitrage.

TNB wants to perform a different kind of illicit arbitrage. The Fed has set the rate it pays on excess reserves at 1.95% in response to a complex array of parameters. These are all based in the conventional models and cost structures of the big banks.

For a lean and mean TNB, the rate is far too high and presents a fat opportunity. So naturally if the market is offering a risk-free opportunity, someone will take it. Which is what TNB intends.

The Fed said “no.”

The rule of law does not govern where central planning occurs. The central planner needs discretion, precisely because his schemes become complex and brittle. He needs to be able to react to changes swiftly, otherwise illicit arbitragers will hoist the central planner by his own petard, and bring crashing down his brittle system.

If TNB were allowed to do this, and if TNB grew big, the outcome is certainly unpredictable. But one thing is for sure. If depositors have a choice between 0.08% with unknowable risks vs, say, 1.45% (giving TNB a gross spread of 50 basis points) and only the risk of the Fed/Treasury, then they will choose the latter. Deposits will be pulled from the big banks. Economists have a technical term to describe the trend that results.

A run on the bank.

Also, the banks do have an important activity mixed in with all the perverted activities in the current mix. They do lend to businesses, who need cash to finance inventory, buy tools, plant fields, etc. TNB would suck the capital out of the banks, and hence out of these not-politically-favored but vitally important activities.

The Fed cannot allow this, obviously. They must stop it, no matter what the law says. The law be damned, the Fed is not going to allow a new business model to collapse the banking system and the dollar.

Conclusion

To recap, this system is perverse, complex, brittle, and it makes it profitable to consume capital. It will come to an end one way or the other. If we don’t do it sooner and voluntarily, it will collapse in the end involuntarily.

The path out of this is to replace dollar debt with gold debt. Dollar debt is irredeemable. That is, someone must borrow more so that all debtors can make the payments on their debts.

Gold debt is redeemable. That’s because a lump of gold is not someone else’s liability, the way a dollar is. A lump of gold just is. When you hand it to someone, then that is final payment on the debt. By contrast, when you hand someone a dollar, then you merely shift the debt to the Federal Reserve.

Keith is working with Nevada, to help them issue a gold bond. He has put up a petition to show the state government that there is support for their move forward, and demand to buy it if they sell it. Please click here for the petition at Monetary Metals, especially if you would consider buying a gold bond. If you’d like to sign, but prefer not to give us your email address, please click here for the petition at Change.org.

Supply and Demand FundamentalsThe price of gold dropped five bucks, and that of silver 40 cents this week. But let’s take a look at the supply and demand fundamentals of both metals. Also, we continue to follow the development in the gold-silver ratio. First, here is the chart of the prices of gold and silver. |

Gold and Silver Price(see more posts on gold price, silver price, ) |

Gold:Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It rose to a decade high this week. |

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

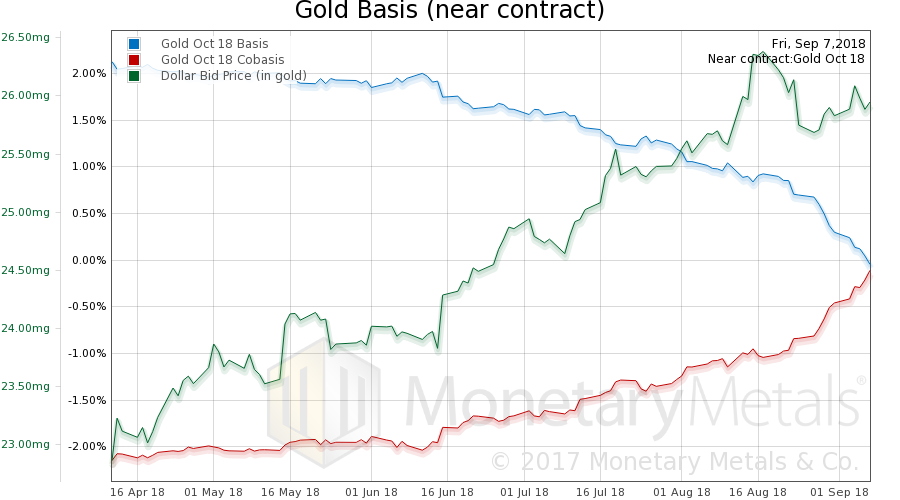

Gold Basis and Co-basisHere is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. The October contract is under selling pressure, as longs must close their positions in the next few weeks before First Notice Day. The Dec contract shows rising scarcity, but not this much and not close to backwardation. This, by the way, is one proof that there is no massive naked short selling of futures. If there were, the banks would be buying the expiring contract with urgency. They would be pushing its price up. Instead, we see its price going down. The banks are arbitragers, happy to make their small spread without betting on price. It is the naked longs who must sell the contract with urgency. Thus the expiring contract always has a falling basis, which means a falling price relative to spot (basis = future – spot). This week, the Monetary Metals Gold Fundamental Price fell $5, from $1,376 to $1,371. |

Gold Basis and Co-basis(see more posts on dollar price, gold basis, Gold co-basis, ) |

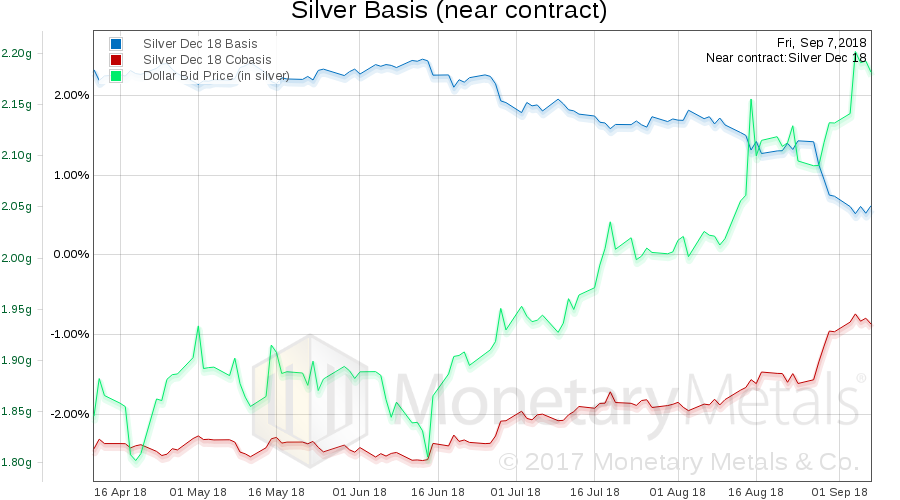

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. Not a lot of change in the scarcity of silver. The Monetary Metals Silver Fundamental Price fell $0.22, from $16.08 to $15.86. Last week, we said: This is the best time to trade gold for silver in the last three months, alright. But if basis ratio gets over 1.05 then it will be the best time in the last three years (this ratio hasn’t spent more than two weeks or so above 1.05 since 2009). This time, the gold-silver ratio is higher, currently 82.7 as of Friday’s close. Correction: the above should have said 1.005. This week, the ratio of gold to silver closed at 84.65. And the ratio of the gold basis to the silver basis hit 1.0054 on Wednesday, and closing the week over 1.005. Is now a good time to trade silver for gold? Well, you’d have to go back to October 2008 to the last time the ratio was higher than this (it only got above this level on four days, the most notable being Oct when it spiked to 87.88 intraday, only to close below 84). Before that, was Feb 1993. The ratio got above 85 from Oct 1990 through Feb 1993, peaking at 100 in Jan 1991. We don’t have basis data going back prior to 1996. We can say that the ratio of the gold basis to silver basis hit over 1.019 in October 2008. There were a few other instance of spikes in this ratio. The balance of upside to downside would seem to favor silver at this point. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

© 2018 Monetary Metals

Tags: Basic Reports,brittle,capital consumption,central planning,Featured,Federal Reserve,narrow bank,newsletter,perverse incentive,the fed