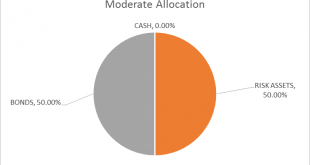

The risk budget is unchanged again this month. For the moderate risk investor, the allocation between bonds and risk assets is evenly split. The only change to the portfolio is the one I wrote about last week, an exchange of TIP for SHY. Interest rates are on the rise again, the 10 year Treasury yield punching through 3% again this morning. That is an indication that growth and/or inflation expectations have risen...

Read More »Switzerland’s young socialists restart the debate on first class train seats

Recently, members of the young socialists raised the debate of the social inequalities associated with two ticket classes again while on trains travelling between Fribourg and Bern. ©-Justforever-_-Dreamstime.com_ - Click to enlarge They complain that at periods of peak demand second class carriages are overflowing, while first class ones often have space and spare seats. Yvan Rime, co-president of the young socialists...

Read More »Revising our euro area 2018 GDP growth forecast down

The cut to our growth forecast reflects slippage in euro area data. According to Eurostat’s preliminary flash estimate, euro area real GDP expanded by 0.3% q-o-q in Q2 2018 (0.346% q-o-q unrounded, 1.4% q-o-q annualised, 2.1% y-o-y), below consensus expectations (0.4%). This was the weakest growth in two years and comes after a GDP growth of 0.4% q-o-q in Q1. The carryover effect for 2018 reached 1.7 %, meaning that...

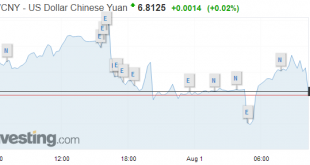

Read More »FX Daily, August 01: Trade and Japan Drive Markets Ahead of Stand Pat Fed

Swiss Franc The Euro has risen by 0.11% to 1.1588 CHF. EUR/CHF and USD/CHF, August 01(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Investors recognize the risks to growth posed by the tariffs and counter-tariffs being imposed, but the way the US is going about it is also disconcerting. Within a few hours of signals that the US and China were looking to re-engage...

Read More »Russia Sells 80 percent Of Its US Treasuries

Description: In just over 2 months Russia has sold-off over 85% of its holdings of U.S. Treasuries, should the U.S. be concerned? – Russia has liquidated 85% of its US Treasury holdings in just two months – Russia dumps over $90 billion of Treasuries in April and May as holdings collapse from near $100 billion to just $9 billion – Deepening geo-political tensions between Russia and U.S. and Russian concerns about the...

Read More »Tensions Beyond Trade

Chinese officials do not seem to appreciate the extent of its isolation. The disruption from the US as Trump positions the US as a revisionist power-one that wants to alter the world order, which it was instrumental in constructing, may have obscured the fact that China’s practices are a source of frustration and animosity broadly and widely. Chinese officials do not seem to understand why Europe, for example, does not...

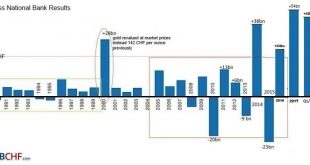

Read More »Central bank back in the black after shaky 2018 start

Swiss National Bank Chairman, Thomas Jordan, pictured in April 2018. The Swiss National Bank (SNB) has reported strong profits for the first half of the year, largely thanks to a weakening franc and gains in the foreign currency market. The results, published in an SNB press releaseexternal link on Tuesday, show overall profits of CHF5.11 billion ($5.17 billion) for the first six months of 2018, compared with CHF1.22...

Read More »Separating Signal from Noise

Claudio Grass in Conversation with Todd “Bubba” Horwitz Todd Horwitz is known as Bubba and is chief market strategist of Bubba Trading.com. He is a regular contributor on Fox, CNBC, BNN, Kitco, and Bloomberg. He also hosts a daily podcast, ‘The Bubba Show.’ He is a 36-year member of the Chicago exchanges and was one of the original market makers in the SPX. Before you listen to the podcast, I would like to provide...

Read More »FX Daily, July 31: BOJ Prepares for QE Infinity

Swiss Franc The Euro has risen by 0.15% to 1.1582 CHF. EUR/CHF and USD/CHF, July 31(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The Japanese yen has been sold following the adjustments to policy and outlook by the BOJ that will allow the unconventional policies continue for an “extended period of time.” Cross rate pressure and month-end demand have lifted the...

Read More »SNB reports a profit of CHF 5.1 billion for the first half of 2018

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org