The booming Swiss blockchain sector continues to grow: over 600 companies and institutions are now located in the ‘Crypto Nation’ and neighbouring Liechtenstein, according to recently-released data. The industry employs around 3,000 people in Switzerland and Liechtenstein, as well as many more abroad, says investment group Crypto Valley Venture Capitalexternal link (CV VC). Taken together, the top 50 blockchain...

Read More »FX Daily, October 11: Equity Swoon Takes Spotlight, Pushes Dollar to Backfoot

Swiss Franc The Euro has risen by 0.24% at 1.1429 EUR/CHF and USD/CHF, October 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There is one story today, and that is the sell-off in global equities. Although the narratives put the US at the center, the fact of the matter is that US equities have been among the best performers this year, despite the rise of...

Read More »Macro Cheat Sheet

Here is a succinct four-bullet summary of key considerations behind five currencies: USD Rising US rates in absolute terms and relative to other countries, coupled with the policy-mix and US tax reform are the main drivers. The market has nearly completely discounted three more Fed hikes by the end of next year, while the Fed has signaled that four hikes may be appropriate. Despite the fiscal stimulus and robust...

Read More »IMF raises Swiss economic growth forecast

The growing threat of trade wars between the US and China is dampening mid-term economic growth prospects. The Swiss economy is tipped to grow by 3% by the end of this year, according to the International Monetary Fund (IMF). In April, the organisation had forecast Switzerland’s gross domestic product (GDP) to rise by 2.3%. Global economic growth has been downgraded from a previous forecast of 3.9% to 3.7% for both 2018...

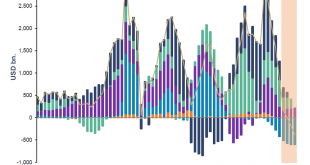

Read More »Fed Credit and the US Money Supply – The Liquidity Drain Accelerates

Federal Reserve Credit Contracts Further We last wrote in July about the beginning contraction in outstanding Fed credit, repatriation inflows, reverse repos, and commercial and industrial lending growth, and how the interplay between these drivers has affected the growth rate of the true broad US money supply TMS-2 (the details can be seen here: “The Liquidity Drain Becomes Serious” and “A Scramble for Capital”)....

Read More »FX Daily, October 10: US Dollar Pullback may Continue in North America

Swiss Franc The Euro has risen by 0.19% at 1.1416 EUR/CHF and USD/CHF, October 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates US Dollar: The euro bottomed yesterday near $1.1430 and reached $1.1515 in Asia. Support is seen near $1.1480 and should hold if the euro’s upside correction is to continue. There are options struck $1.1500-$1.1510 for nearly 1.4 bln euros...

Read More »Squaring off over the Italian budget

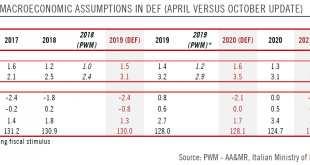

The Italian government’s budget plans set it on a collision course with the European Commission. The road to some kind of agreement is likely to be long and bumpy. The Italian government has confirmed its deficit target at 2.4% of GDP for 2019. This represents significant slippage from a previous budget deficit target of 0.8% in 2019. The deficit target has been set at 2.1% for 2020 and 1.8% for 202. But it is not the...

Read More »UBS tax fraud trial opens in Paris

UBS is being tried for illicit activities in France between 2004 and 2011. (Keystone) A sweeping investigation into UBS bank, accused of tax fraud and money laundering, comes to trial in Paris today. The bank risks a fine of up to €5 billion (CHF5.7 billion). The trial is set to begin on Monday after years of investigations into the Swiss bank’s French activities, as well as aborted negotiations in which authorities...

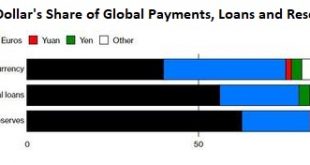

Read More »The Distortions of Doom Part 2: The Fatal Flaws of Reserve Currencies

The way forward is to replace the entire system of reserve currencies with a transparent free-for-all of all kinds of currencies. Over the years, I’ve endeavored to illuminate the arcane dynamics of global currencies by discussing Triffin’s Paradox, which explains the conflicting dual roles of national currencies that also act as global reserve currencies, i.e. currencies that other nations use for global payments,...

Read More »In Gold We Trust – Incrementum Chart Book 2018

The Most Comprehensive Collection of Charts Relevant to Gold is Here Our friends from Incrementum (a European asset management company) have just released the annual “In Gold We Trust” chart book, which collects a wealth of statistics and charts relevant to gold, with extensive annotations. Many of these charts cannot be found anywhere else. The chart book is an excellent reference work for anyone interested in the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org