Swiss Franc The Euro has fallen by 0.21% at 1.1276 EUR/CHF and USD/CHF, September 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro set a new high for the week in Asia earlier today near $1.1660. It subsequently was sold off to $1.1615 before rebounding. There is a 1.6 bln euro option struck at $1.16 that will be cut today. That it remains firm is impressive given...

Read More »FX Daily, September 05: Continuing EM Pain Helps the Dollar, but does Little for Yen

Swiss Franc The Euro has risen by 0.20% at 1.1305. EUR/CHF and USD/CHF, September 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The dollar is posting gains against most of the emerging market and major currencies. The MSCI Emerging Markets Index is off 1.6% and extending the drop to a sixth consecutive session. Indonesia’s bourse saw the largest decline (~3.75%) in the...

Read More »The Global Financial System Is Unraveling, And No, the U.S. Is Not immune

Currencies don’t melt down randomly. This is only the first stage of a complete re-ordering of the global financial system. Take a look at the Shanghai Stock Market (China) and tell me what you see: Shanghai Stock Exchange Composite Index - Click to enlarge A complete meltdown, right? More specifically, a four-month battle to cling to the key technical support of the 200-week moving average (the red line). Once...

Read More »Cool Video: Emerging Markets Continue to Sell-Off

- Click to enlarge I had the privilege of being on the Bloomberg set with Tom Keene and Francine Lacqua earlier today. Lakshman Achuthan, co-founder of ECRI also joined us for the discussion. This 6.5 min video clip captures the essence of the discussion. The US dollar was rallying against all the major and most EM currencies. The second consecutive quarterly economic contraction in South Africa pushed the rand...

Read More »Swiss Consumer Price Index in August 2018: +1.2 percent YoY, Stable MoM

Neuchâtel, 4 September 2018 (FSO) – The consumer price index (CPI) remained stable in August 2018 compared with the previous month, remaining at 101.8 points (December 2015 = 100). Inflation was 1.2% compared with the same month of the previous year. These are the results from the Federal Statistical Office (FSO). The stability of the index compared with the previous month is the result of opposing trends that...

Read More »Novartis chief hints at job cuts in Switzerland

The president of pharmaceutical giant Novartis has announced job cuts in an interview with Swiss newspaper NZZ am Sonntag. Jörg Reinhardt said the Basel-based company wants to streamline its production sites and administration worldwide. - Click to enlarge The president of pharmaceutical giant Novartis has announced job cuts in an interview with Swiss newspaper NZZ am Sonntag. Jörg Reinhardt said the Basel-based...

Read More »FX Daily, September 04: Dollar Gains Broadly

Swiss Franc The Euro has fallen by 0.01% at 1.1263. EUR/CHF and USD/CHF, September 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is rising against all the major and emerging market currencies today. The signals from the White House suggest strong pressure will be exerted on Canada to sign on to NAFTA 2.0 or risk losing part of its auto sector, which of...

Read More »Emerging Market Week Ahead Preview

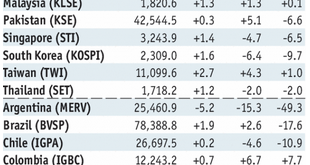

Stock Markets EM FX ended last week on a firm note, but weakness resumed Monday. Higher than expected Turkish inflation hurt the lira, which in turn dragged down BRL, ARS, ZAR, and RUB. We expect EM to remain under pressure this week when the US returns from holiday Tuesday. Stock Markets Emerging Markets, August 29 - Click to enlarge Korea Korea reports August CPI Tuesday, which is expected to rise 1.4% y/y...

Read More »Illicit Arbitrage Cut by Tax Cuts and Jobs Act, Report 3 Sep 2018

This week, we are back to our ongoing series on capital destruction. Let’s consider the simple transaction of issuing a bond. Party X sells a bond to Party Y. We will first offer something entirely uncontroversial. If the interest rate rises after Y buys the bond, then Y takes a loss. Or if the interest rate falls, then Y makes a capital gain. This is simply saying that the bond price moves inverse to the interest...

Read More »Swiss Retail Sales, July 2018: +0.3 percent Nominal and -0.3 percent Real

Neuchâtel, 3 September 2018 (FSO) – Turnover in the retail sector rose by 0.3% in nominal terms in July 2018 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.9% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover in the retail sector also adjusted for sales days and holidays fell by 0.3% in July 2018 compared with the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org