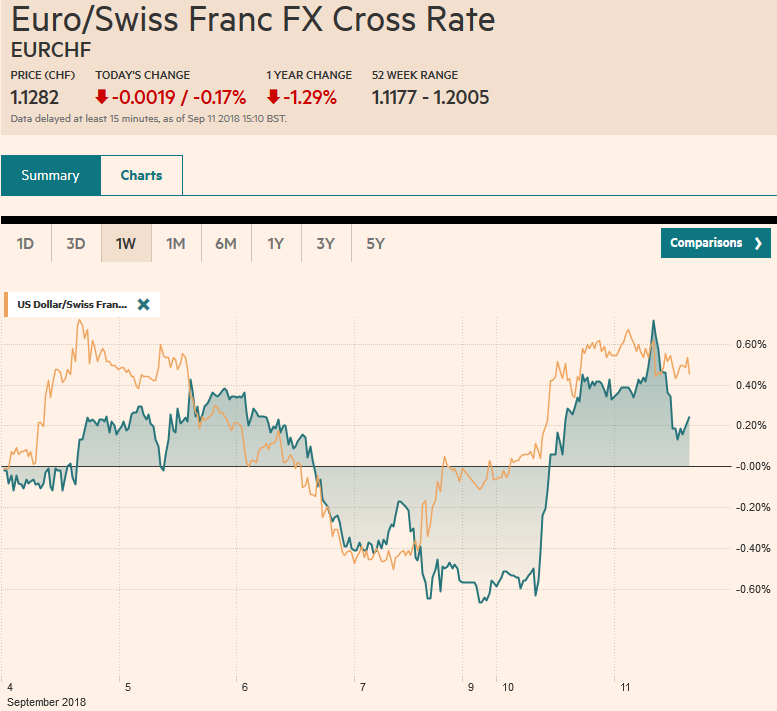

Swiss Franc The Euro has fallen by 0.17% at 1.1282 EUR/CHF and USD/CHF, September 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro and sterling extended their recovery from the US hourly earnings lows seen before the weekend. However, the move stalled in the European morning, after the UK reported better than expected earnings itself. Sterling approached the 61.8% retracement of the decline from the July high (~.3365) found just below .31. It has been correcting higher since reaching almost .2660 on August 15. The Australian dollar remains pinned near %excerpt%.7100. Although the euro and sterling have recovered from the drop seen before the weekend, the

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, Brexit, CAD, EUR, Featured, FX Daily, GBP, JPY, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.17% at 1.1282 |

EUR/CHF and USD/CHF, September 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe euro and sterling extended their recovery from the US hourly earnings lows seen before the weekend. However, the move stalled in the European morning, after the UK reported better than expected earnings itself. Sterling approached the 61.8% retracement of the decline from the July high (~$1.3365) found just below $1.31. It has been correcting higher since reaching almost $1.2660 on August 15. The Australian dollar remains pinned near $0.7100. Although the euro and sterling have recovered from the drop seen before the weekend, the Australian has not. In fact, it made a new two-year low today near $0.7090. The bounce in late Asia fizzled in front of yesterday’s high a little over $0.7130. Only a move above there would lift the tone. |

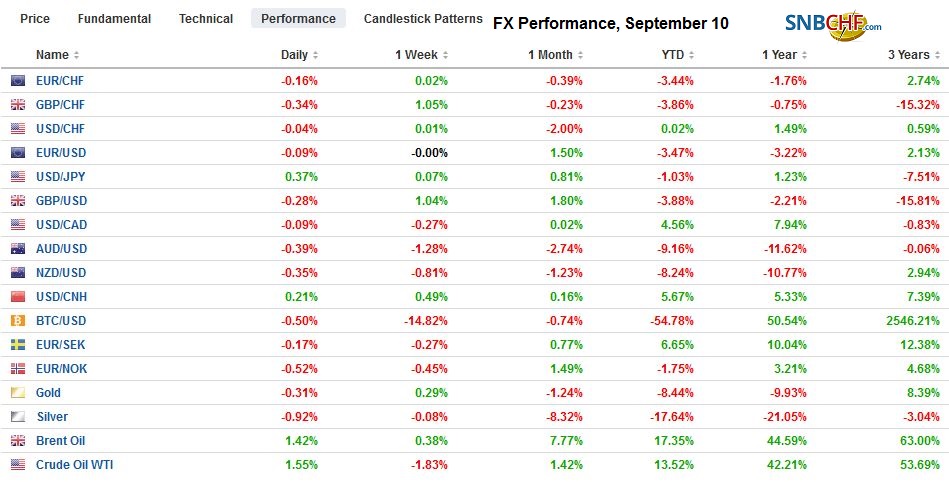

FX Performance, September 11 |

The position adjustment has been helped by more constructive comments from the EC on Brexit, with Barnier’s comments suggesting that a deal could be reached in the next eight weeks. This follows perceptions that the risks of a Brexit without a deal had increased. UK economic data, including a strong service PMI, yesterday’s GDP figures, and today stronger than expected weekly earnings data also helped lift sterling to its best level since early August today.

Excluding bonus payments, weekly earnings rose 2.9% in the three-months year-over-year through July. This was stronger than expected and matches the cyclical high from March, which was the highest in nearly three years. However, below the surface, there were some warning signs. The claimant count increased by 8.7k after an upward revision to 10.2k in July. It has risen by an average of 10.2k this year after being virtually flat in the same 2018 period. Employment growth has also slowed.

We argue that UK Prime Minister faces a trilemma. We do not think she can please three different parties: her cabinet, Parliament, and the EU. The EC has sounded more constructive, the basis of it, May’s Chequers plan, faces domestic pressure from within her cabinet and Parliament. May’s strategy seems to be to secure a deal with the EU and then sell it domestically. Also, the way the negotiations seem to work, the most difficult issues are addressed last and even at this late date; more work needs to be done on the Irish border.

The implication of this, and especially with the backdrop of a strong US dollar environment, is to view sterling’s gains as corrective in nature. Recall that the speculative position in the futures market has the largest gross short position in over a year and roses sharply (~60%) in August.

That corrective forces grip the market is illustrated by the euro’s price action today too. It recorded the session high in late Asia./early Europe near $1.1645, just shy of the pre-US jobs data high (~$1.1650). By the time the better than expected German ZEW survey was reported, the euro was already coming off, and could not bounce on the news. Both the assessment of the current situation and expectations improved more than expected (76.0 from 72.6 and -10.6 from -13.7). It is the second consecutive monthly advance, something not seen since last fall. Initial support today is seen near $1.1580.

The greenback’s gains were extended against the yen. It neared JPY111.60, the best level since the middle of last week when it saw JPY11.75. The dollar has not traded above JPY112 since early August. There is a $1.7 bln option struck at JPY111.25 that expires today. Some link the yen’s weakness to the Nikkei’s gain today. It gapped higher and closed on its highs, and although the momentum appears strong, the 23,000 area offers formidable resistance and it is about two percent away.

Other markets in the region were mixed, but on balance lower so the MSCI Asia Pacific Index edged slightly lower, but extended its losing streak for the ninth consecutive session. Within the region, a preference by foreign investors for Taiwan over Korean equities continued. European shares are also lower, with the Dow Jones Stoxx 600 giving back yesterday’s gains (~0.5%). Energy is the only sector gaining today, helped perhaps by firmer oil prices as one of the hurricanes in the past 20-years is set for landfall in the US Carolina’s within 48 hours. In addition to oil, hogs and cotton prices have been reportedly lifted by the potential impact and share in home improvement companies did well in anticipation of reconstruction.

We have been tracking the recovery of Italian bonds and bank shares over the past week or so. Several banks are taking the more constructive comments from government officials at face value and are recommending Italian bonds outright or in a relative value strategy against Germany or Spain. Italy’s 10-year yield is flat today at 2.90% and after a 4.2% gain yesterday, the index of bank shares if off 0.75% near midday in Milan.

The US economic calendar features the JOLTS report on the labor market and wholesales trade and inventories. These are not typically market movers. The week’s highlights still lie ahead: CPI and retail sales. After selling $90 bln in three- and six-month bills yesterday, the US will sell another $71 bln in four- and 52-week bills today and $35 bln in three-year notes. Canada reports August housing starts. They are expected to recover after a sharp fall in July (-16.2%). The Bloomberg survey produced a median forecast of a 216.3k (SAAR). The average through July this year is 219.5k. Lastly, late in the session, Argentina’s central bank will announce its rate decision. We expected the key seven-day rate to remain steady at the elevated rate of 60%

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,Brexit,Featured,FX Daily,newsletter