The idea is simple. Keep costs low by flying point-to-point, thus avoiding costly hubs, use one model of aircraft to contain pilot and aircraft maintenance costs, and charge passengers for everything from coffee to checked-in luggage. Southwest Airlines was first to launch the model and copycats like EasyJet followed. First transatlantic flight of an Airbus A321LR © Airbus Now a new, yet to be named, airline plans to...

Read More »Europe Starting To Reckon Eurodollar Curve

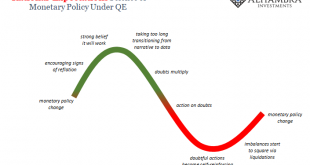

We’ve been here before. Economists and central bankers become giddy about the prospects for success, meaning actual recovery. For that to happen, reflation must first attain enough momentum. If it does, as is always forecast, reflation becomes recovery. The world then moves off this darkening path toward the unknown crazy. The problem has been that officials mistake reflation for what it is. Each time they believe it...

Read More »FX Daily, September 13: Vulnerable To Disappointment

Swiss Franc The Euro has risen by 0.27% at 1.1312 EUR/CHF and USD/CHF, September 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro has fallen on ECB meeting days this year and the last two meetings in 2017. The euro is trading in the upper end of the $1.1525-$1.1650 trading range. The intraday technicals suggest that the $1.1600 area may hold until at least the...

Read More »Swiss Producer and Import Price Index in August 2018: +3.4 percent YoY, unchanged MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More »The Next Financial Crisis Is Right on Schedule (2019)

Neither small business nor the bottom 90% of households can afford this “best economy ever.” After 10 years of unprecedented goosing, some of the real economy is finally overheating: costs are heating up, unemployment is at historic lows, small business optimism is high, and so on–all classic indicators that the top of this cycle is in. Financial assets have been goosed to record highs in the everything bubble.Buy the...

Read More »Is the tide turning for social media platforms in Switzerland?

In a ranking of 170 media brands, Facebook had the lowest credibility. The Swiss appear to be switching off from social media, according to a survey, which suggests that the image of Facebook and Twitter have taken a hit. Some 55% of the Swiss population used social media in 2017, down 4% compared with a year earlier, a media brand study for the consultancy firm Publicomexternal link revealed. The report, published on...

Read More »FX Daily, September 12: Dollar Chops in Narrow Ranges

Swiss Franc The Euro has fallen by 0.03% at 1.1277 EUR/CHF and USD/CHF, September 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The dollar has been confined to about 10 pips on either side of JPY111.55. There are $1.13 bln of options struck between JPY111.50 and JPY111.65 that expire today. Dollar support extends to JPY111.20-JPY111.30. It has not traded above JPY112.00...

Read More »Die zehn schönsten liberalen Frauen der Schweiz

Sie kämpfen gegen Bevormundung, Umverteilung und hohe Steuern und tun dies mit viel Charme, Eleganz und Leidenschaft. Ausserdem sind sie der beste Beweis gegen die Frauenquote. Über das ganze Land verteilt streiten junge Damen für mehr Freiheit. Zeit für eine Lagebeurteilung. Das folgende...

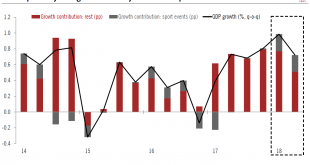

Read More »Switzerland Q2 growth numbers are impressive, but details are mixed

The latest headline Swiss GDP figures were impressive. According to the State Secretariat for Economic Affairs’ (SECO) quarterly estimates, Swiss real GDP grew by 0.7% q-o-q in Q2 (2.9% q-o-q annualised, 3.4% y-o-y), slightly above our 0.6% projection and consensus (0.5% q-o-q). This was the fifth consecutive quarter with an above average rate. Q1 GDP growth was significantly revised up to 1.0% q-o-q (from 0.6%). Thus,...

Read More »Great Graphic: Did the CRB Bottom?

The CRB index has been trending lower since late May. It fell nearly 10% to retrace 50% of the rally come June 2017. This Great Graphic shows the 4 1/2 month trendline. It had been violated in late August but fell back under it at the end of last week. On Monday, it gapped higher, above the trendline. Today it filled the gap and rallied to new session highs. A move above 192.00 would likely confirm a bottom of some...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org