Swiss Franc The Euro has fallen by 0.11% to 1.054 EUR/CHF and USD/CHF, May 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The constructive mood among investors in April has given way to new concerns as May gets underway. Japan and China are still on holiday, but most of the other markets in Asia fell, led by 4.5%-5.5% declines in Hong Kong and India, and more than 2% in most other local markets. Australia...

Read More »FX Daily, April 30: ECB Takes Center Stage

Swiss Franc The Euro has fallen by 0.38% to 1.0545 EUR/CHF and USD/CHF, April 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities continue to recover even as deep economic contractions are reported. Yesterday, the US said Q1 GDP contracted at an annualized pace of 4.8%, while the eurozone reported today that output fell 3.8% quarter-over-quarter in Q1. Hong Kong and South Korea were closed, but the rest...

Read More »China’s Digital Renminbi

In the NZZ, Matthias Müller reports how China’s CBDC plans progress: In China beginnen nun im Viertel Xiangcheng, das zu der unweit von Schanghai gelegenen Millionenstadt Suzhou gehört, in einem geschlossenen System erste Tests. … Die PBoC dürfte ein zweistufiges System entwickelt haben. Auf der ersten Ebene wird die digitale Währung an die Geschäftsbanken ausgegeben. Auf der zweiten Ebene können dann die Haushalte und Unternehmen den digitalen Yuan abheben und verwenden. … In Suzhou...

Read More »An International Puppet Show

It’s actually pretty easy to see why the IMF is in a hurry to secure more resources. I’m not talking about potential bailout candidates banging down the doors; that’s already happened. The fund itself is doing two contradictory things simultaneously: telling the world, repeatedly, that it has a highly encouraging $1 trillion in bailout capacity at the same time it goes begging to vastly increase that amount. Very reassuring. The IMF is becoming like the Federal...

Read More »FX Daily, April 15: Dollar Rises as Equities Slump

Swiss Franc The Euro has fallen by 0.12% to 1.0528 EUR/CHF and USD/CHF, April 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The recovery in equities stalled, and the risk-off mood has helped lift the US dollar, which had been trending lower. Taiwan and Malaysia were notable exceptions in the Asia Pacific regions to the heavier equity tone. The Nikkei gave back almost 0.5% after surging more than 3% on...

Read More »FX Daily, April 14: Equities are Firm but New Developments Needed or Risk Appetites may Become Satiated

Swiss Franc The Euro has fallen by 0.16% to 1.0538 EUR/CHF and USD/CHF, April 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Risk appetites have returned today after taking yesterday off. The MSCI Asia Pacific Index advanced every day last week, slipped yesterday, and jumped back today. Most of the national benchmark advanced at least 1.5%, and the Nikkei led the way with a 3% rally to reach its best level...

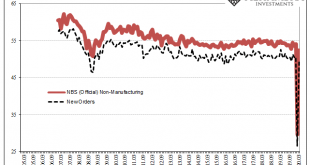

Read More »China’s Back!

The Washington Post began this week by noting how the US economy seems to have lost its purported zip just when it needed that vitality the most. Never missing a chance to take a partisan swipe, of course, still there’s quite a lot of truth behind the charge. An actual economic boom produces cushion, enough of one that President Trump and his administration may have been counting on it when opting for full-blown shutdown. The coronavirus recession is exposing how...

Read More »FX Daily, March 31: March Ends like a Lion, No Lamb in Sight

Swiss Franc The Euro has fallen by 0.26% to 1.056 EUR/CHF and USD/CHF, March 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The coronavirus plague upended the world in March. Equities are finishing the month on a firm note. Strong gains in the US yesterday and an unexpectedly strong Chinese PMI (yes, to be taken with the proverbial grain of salt) helped lift most Asia Pacific and European markets today....

Read More »Was wir von China lernen können

Oder: Warum wir im derzeitigen Corona-Schock mal einen Blick auf die wirtschaftlichen Folgen in China werfen sollten. Trotz Maskenpflicht sind die Geschäfte wieder weitgehend geöffnet: Einkaufszentrum in Peking. Foto: Keystone Nachdem die meisten Wirtschaften der westlichen Welt wegen des Coronavirus in künstlichen Tiefschlaf versetzt wurden, haben die Menschen mehr Zeit. Das gilt auch für Politiker und Ökonomen, die uns mit Vorschlägen zur Bekämpfung der drohenden...

Read More »Helikoptergeld als Folge des Coronavirus

Das Coronavirus bedroht die Wirtschaft. Deshalb werden Massnahmen diskutiert, die jüngst noch für extrem gehalten wurden. Geldschübe helfen der Wirtschaft nicht: Alltag in Zeiten des Coronavirus in Hongkong. Foto: Kin Cheung (Keystone) Die Sorgen um die Folgen des Coronavirus für die Weltkonjunktur nehmen mit jedem Tag weiter zu. Und nicht nur für die Heilung der Krankheit sind die vorhandenen Medikamente ungenügend, auch im ökonomischen Bereich fehlt es an wirksamen...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org