Overview: The combination of the volatility and a large number of central bank meetings have exhausted market participants, and the holiday phase appears to have begun. Equities are under pressure following the sell-off yesterday in the US. Japan, China, and Hong Kong suffered more than 1.2% losses, while Australia, South Korea, and Taiwan posted minor gains. It was the fifth loss in the past six sessions for the MSCI Asia Pacific Index. Europe's Stoxx 600 is off...

Read More »Has the Market Carried the Fed’s Water? Is the Dollar Vulnerable to Buy the Rumor and Sell the Fact?

Overview: The US dollar is trading with a bit of heavier bias against most of the major currencies as the focus turns to today's FOMC meeting, where a clear consensus has emerged in favor of faster tapering and a dot plot pointing to a steeper pace rate hikes. Emerging market currencies led by Turkey and South Africa are mostly lower. The JP Morgan Emerging Market Currency Index is lower for the third straight session. The US 10-year Treasury yield is flat, near...

Read More »Dollar Starts the Week Bid ahead of the FOMC

Overview: Equities, bonds, and the dollar begin the new week on a firm note. Japanese, Chinese, Australian, and New Zealand equities advanced in the Asia Pacific region. Europe's Stoxx 600 is snapping a three-day decline, and US futures are 0.25%-0.35% higher. The US 10-year yield is a little softer at 1.48%. European benchmark yields are mostly 1-2 bp lower, and near 0.71%, the UK Gilt's yield is at a three-month low. The dollar is rising against all the major...

Read More »Weekly Market Pulse: Discounting The Future

The economic news recently has been better than expected and in most cases just pretty darn good. That isn’t true on a global basis as Europe continues to experience a pretty sluggish recovery from COVID. And China is busy shooting itself in the foot as Xi pursues the re-Maoing of Chinese society, damn the economic costs. But here in the US, the rebound from the Q3 slowdown is in full bloom. Just last week we had pending home sales, ADP employment, both ISM reports,...

Read More »FX Daily, December 6: Semblance of Stability Returns though Geopolitical Tensions Rise

Swiss Franc The Euro has risen by 0.26% to 1.041 EUR/CHF and USD/CHF, December 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The absence of negative developments surrounding Omicron over the weekend appears to be helping markets stabilize today after the dramatic moves at the end of last week. Asia Pacific equities traded heavily, and among the large markets, only South Korea and Australia escaped unscathed...

Read More »FX Daily, December 02: Calm Surface Masks Lack of Conviction

Swiss Franc The Euro has risen by 0.09% to 1.0587 EUR/CHF and USD/CHF, December 2(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The downside reversal in US stocks yesterday seemed to accelerate after the first case of the Omicron variant was found in the US. In itself, it should not be surprising, but perhaps, what was especially disheartening is that the person had been fully vaccinated. The S&P 500...

Read More »Fragile Calm Returns and Powell’s Anti-Inflation Rhetoric Ratchets Up

Overview: Into the uncertainty over the implications of Omicron, the Federal Reserve Chairman injected a particularly hawkish signal into the mix in his testimony before the Senate. These are the two forces that are shaping market developments. Travel restrictions are being tightened, though the new variant is being found in more countries, and it appears to be like closing the proverbial barn door after the horses have bolted. Equities are higher. The MSCI Asia...

Read More »Jobs (US) and Inflation (EMU) Highlight the Week Ahead

The new covid variant and quick imposition of travel restrictions on several countries in southern Africa have injected a new dynamic into the mix. It may take the better part of the next couple of weeks for scientists to get a handle on what the new mutation means and the efficacy of the current vaccination and pill regime.The initial net impact has been to reduce risk, as seen in the sharp sell-off of stocks. Emerging market currencies extended their losses. ...

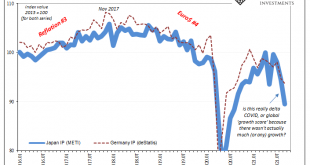

Read More »The ‘Growth Scare’ Keeps Growing Out Of The Macro (Money) Illusion

When Japan’s Ministry of Trade, Economy, and Industry (METI) reported earlier in November that Japanese Industrial Production (IP) had plunged again during the month of September 2021, it was so easy to just dismiss the decline as a product of delta COVID. According to these figures, industrial output fell an unsightly 5.4%…from August 2021, meaning month-over-month not year-over-year. Altogether, IP in Japan is down just over 10% since June, nearly 11% since...

Read More »The Greenback Slips to Start the New Week

Overview: While the Belarus-Poland border remains an intense standoff, there have been a couple other diplomatic developments that may be exciting risk appetites today. First, Biden and Xi will talk by phone later today. Second, reports suggest the UK has toned down its rhetoric making progress on talks on the implementation of the Northern Ireland Protocol. Equities in the Asia Pacific region were mostly firmer, with China a notable exception among the large...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org