Swiss Franc The Euro has risen by 0.04% to 1.0641 EUR/CHF and USD/CHF, July 1(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The resurgence of the contagion in the US has stopped or reversed an estimated 40% of the re-openings, but the appetite for risk has begun the second half on a firm note, helped by manufacturing PMIs that were above preliminary estimates or better than expected. Except for Tokyo and...

Read More »What The PMIs Aren’t Really Saying, In China As Elsewhere

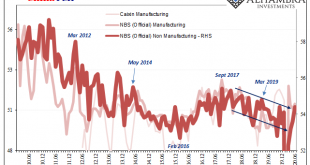

China’s PMI’s continue to impress despite the fact they continue to be wholly unimpressive. As with most economic numbers in today’s stock-focused obsessiveness, everything is judged solely by how much it “surprises.” Surprises who? Doesn’t matter; some faceless group of analysts and Economists whose short-term modeling has somehow become the very standard of performance. According to one such group, China’s official manufacturing index, the one calculated and...

Read More »FX Daily, June 30: When Primary is Secondary

Swiss Franc The Euro has fallen by 0.40% to 1.0647 EUR/CHF and USD/CHF, June 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The gains in US equities yesterday carried into Asia Pacific trading today, but the European investors did not get the memo. The Dow Jones Stoxx 600 is succumbing to selling pressure and giving back yesterday’s gain. Energy and financials are the biggest drags, while real estate and...

Read More »FX Daily, June 29: USD is Offered in Quiet Start to the New Week

Swiss Franc The Euro has risen by 0.29% to 1.0671 EUR/CHF and USD/CHF, June 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The combination of rising virus cases and the sell-off in the US before the weekend dragged nearly all the Asia Pacific bourses lower. The Nikkei led the way with more than a 2% drop, but most bourses were off more than 1%. China and Taiwan were also greeted with selling as markets...

Read More »FX Daily, June 24: Risk Appetites Satiated for the Moment

Swiss Franc The Euro has fallen by 0.07% to 1.0672 EUR/CHF and USD/CHF, June 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The rally in risk assets in North America yesterday is failing to carry over into today’s activity. Asia Pacific equities were mixed. Korea and Indonesia led the advances with more than 1% gain. China and Taiwan also gained. Japan and Hong Kong. Europe’s Dow Jone’s Stoxx 600 is giving...

Read More »FX Daily, June 23: Weebles Wobble but they Don’t Fall Down

Swiss Franc The Euro has risen by 0.22% to 1.069 EUR/CHF and USD/CHF, June 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After early indecision, investors ramped the demand for risk assets, encouraged perhaps by indications that the Trump Administration going to support at least another trillion-stimulus package. The NASDAQ rallied to new record highs, and the dollar got thumped across the board. However,...

Read More »FX Daily, June 22: Dollar Begins Week on Back Foot

Swiss Franc The Euro has risen by 0.12% to 1.0664 EUR/CHF and USD/CHF, June 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors begin the new week, perhaps slowed a bit by the weekend developments and the growth of new infections. Equities are mixed. The MSCI Asia Pacific Index snapped a four-day advance, though India bucked the regional trend and gained 1%. Europe’s Dow Jones Stoxx 600 is recovering...

Read More »FX Daily, June 17: Correction Phase does not Appear Over

Swiss Franc The Euro has fallen by 0.48% to 1.066 EUR/CHF and USD/CHF, June 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors have not yet completely shaken off the angst that saw equities slide last week. All equity markets in the Asia Pacific region, but Japan, edged higher today, including China, India, and South Korea, where political/military tensions are elevated. Europe followed suit, and the...

Read More »A Chinese Outbreak (of Li v. Xi, Round 2)

Here they are again, seemingly at odds over how to proceed. Reminiscent of prior battles over whether to revive the economy or just let it go where it will, it appears as if China is in for Xi vs. Li Round 2. Or is it all just clever politics? Li Keqiang may be nominally the Chinese Premier but he’s a very distant second on every list of power players. Xi Jinping holds all the top spots, including a 2017-18 consolidation of power that left Xi rivaling only Mao in...

Read More »FX Daily, June 15: Unwind Continues

Swiss Franc The Euro has fallen by 0.19% to 1.0688 EUR/CHF and USD/CHF, June 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The swing in the pendulum of market sentiment toward fear from greed began last week and has carried over into today’s activity. Global equities are getting mauled. In the Asia Pacific region, no market was spared as the Nikkei’s 3.5% drop, and South Korea’s 4.7% fall led the way. In...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org