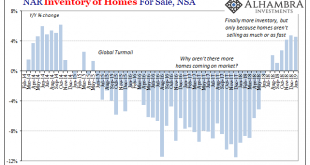

For years, realtors have been waiting for more housing inventory. It had become an article of faith, what was restraining a full-blown recovery was the lack of units available. The level of resales like construction was up, but still way, way less than it was now fourteen years past the prior peak despite sufficient population growth to have absorbed the previous bubble’s overbuilding. All the way back in March 2017,...

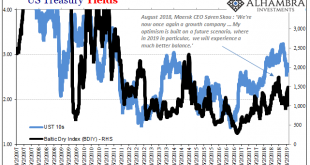

Read More »Sinking Shippers Signal Global Goods Troubles

It infects every boardroom across the world. Big business requires decent forecasting, yet time and again it seems they are deprived of what they desperately need. Instead, even after this last decade, the world’s largest companies continue to be surprised by weakness that is far more prevalent than strength. It has been the one constant. Central bankers declare their policies successful, ignoring mountains of...

Read More »Something Different About This One

In Japan, they call it “powerful monetary easing.” In practice, it is anything but. QQE with all its added letters is so authoritative that it is knocked sideways by the smallest of economic and financial breezes. If it truly worked the way it was supposed to, the Bank of Japan or any central bank would only need it for the shortest of timeframes. That would be powerful stuff. Instead, in June last year the narrative...

Read More »Credit Exhaustion Is Global

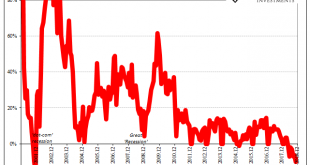

Europe is awash in credit exhaustion, and so is China. The signs are everywhere: credit exhaustion is global, and that means the global growth story is over: revenues and profits are all sliding as lending dries up and defaults pile up. What is credit exhaustion? Qualified buyers don’t want to borrow more, leaving only the unqualified or speculators seeking to save a marginal bet gone bad with one more loan (which will...

Read More »China’s Big Money Gamble

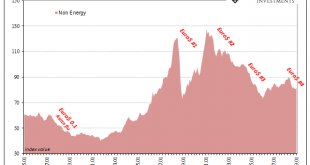

While oil prices rebounded in January 2019 around the world, outside of crude commodities continued to struggle. According to the World Bank’s Pink Sheet, base metal prices fell another 1.8% on average from December. On an annual basis, these commodities as a group are about 16% below where they were in January 2018. The last time they had fallen by that much it was May 2016. World Bank Pink Sheet Commodity Indices...

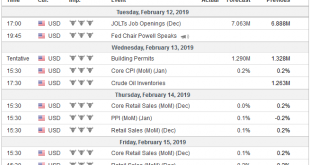

Read More »FX Weekly Preview: Drivers, While Marking Time

The main issues for investors have not changed. There are three dominant ones: Trade, growth, and Brexit. Unfortunately, there won’t be any closure in the week ahead, and that may make short-term participants reluctant to turn more aggressive. United States The US reported exceptionally poor December retail sales and January industrial output figures. Growth forecasts were adjusted. The St. Louis Fed’s GDP Now tracker,...

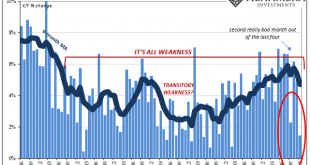

Read More »Retail Sales Landmine

Ignore Black Friday and Cyber Monday. Those are merely an appetizer, an intentional preamble to whet the appetite of hungry consumers looking to splurge. The real action comes in December. People look, some buy, after Thanksgiving, but as anyone counts down the actual twelve days of Christmas and celebrates the eight crazy nights of Hanukkah that’s when the retail industry makes its bank. In 2016, the month of December...

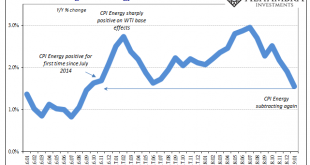

Read More »Inflation Falls Again, Dot-com-like

US inflation in January 2019 was, according to the CPI, the lowest in years. At just 1.55% year-over-year, the index hadn’t suggested this level since September 2016 right at the outset of what would become Reflation #3. Having hyped expectations over that interim, US policymakers now have to face the repercussions of unwinding the hysteria. CPI Changes On Energy 2016-2019 - Click to enlarge Live by oil, now die by...

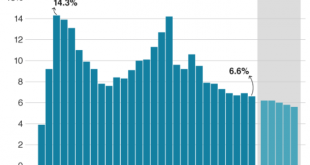

Read More »China: Harbinger of Global Economic Decline

The latest numbers released by China’s statistics bureau fueled widespread concerns about the outlook of the global economy, as the Asian superpower reported its slowest growth rate since 1990. The figures showed a 6.6% growth for 2018, confirming the view that the growth engine of the world economy is running out of steam. Deep-seeded vulnerabilities, far beyond the trade war China’s weakening growth has been widely...

Read More »FX Weekly Preview: Little Resolution in the Week Ahead

According to legend, the person who unraveled the Gordian Knot would rule the world. No one succeeded until Alexandar the Great took his mighty sword and sliced the knot in half. A young boy saw him afterward, crying on the steps of the Temple of Apollo. “Why are you crying?” the boy asked, “you just conquered the world. “Yes'” Alexander wept, ” now there is nothing else for me to do.” Investors are not as cursed as...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org