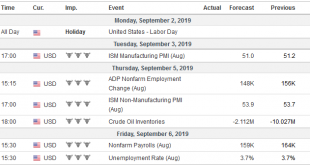

Equity markets and the US dollar closed last week and August on a firm note. Ahead of the weekend, the dollar rose to new highs for the year against the euro, Swedish krona, Norwegian krone, and the New Zealand dollar. While the next set of US and Chinese tariffs start September 1, the market is making the most of the lull. At the same time, US and Chinese officials probe each other to see if sufficient disruption has been felt to force concessions. Talking and...

Read More »FX Daily, August 26: Trump’s “Call from China” helps Markets Recover

Swiss Franc The Euro has risen by 0.11% to 1.0873 EUR/CHF and USD/CHF, August 26(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The anticipated growth implications of the heightened tensions between the world’s two largest economies is dominating activity at the start of the new week. These considerations that drove the 2.6% drop in the S&P 500 before the weekend is carrying over into today’s...

Read More »That Can’t Be Good: China Unveils Another ‘Market Reform’

The Chinese have been reforming their monetary and credit system for decades. Liberalization has been an overriding goal, seen as necessary to accompany the processes which would keep the country’s economic “miracle” on track. Or get it back on track, as the case may be. Authorities had traditionally controlled interest rates through various limits and levers. It wasn’t until October 2004, for example, that the upper limit on lending rates was rescinded. In August...

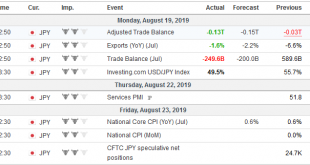

Read More »FX Daily, August 19: China’s Rate Reform Helps Markets Extend End of Last Week Recovery

Swiss Franc The Euro has risen by 0.27% to 1.0879 EUR/CHF and USD/CHF, August 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: China announced some changes in its interest rate framework that is expected to lead to lower rates. This helped lift equity markets, which were already recovering at the end of last week from the earlier drubbing. Chinese and Hong Kong shares led the regional rally with 2-3% gains....

Read More »FX Weekly Preview: A Vicious Cycle Grips Markets

The capital markets are in their own doom loop. Poor data from Germany and China, coupled with the escalation of the US-China trade dispute and rising tensions in Hong Kong spur concerns about the risks of a global recession. Interest rates are driven lower, and curves flatten or go inverted, spurring more concern about the outlook. The problem is that it is not clear how this vicious cycle ends. To be sure, the end is conceivable but it seems beyond which the...

Read More »Die Risiken von Trumps absurdestem Vorwurf

Das kommt den USA entgegen: Seit einigen Jahren tut Chinas Notenbank alles, um einen Preisanstieg des Dollars auf über 7 Yuan zu verhindern. Foto: AP Vor rund einer Woche hat das US-Finanzministerium (Treasury) China als unfairen Währungsmanipulator gebrandmarkt. Dieser Schritt ist der bisherige Höhepunkt an Absurdität in Trumps Handelskrieg mit China. Noch in seinem jüngsten Bericht vom Mai sprach das Treasury China explizit von exakt diesem Vorwurf frei. Die Kriterien des Ministeriums...

Read More »FX Weekly Preview: Macro Deterioration

The US-China tensions remain the dominant driver of investor risk appetites. President Trump has repeatedly accused China of manipulating its currency on twitter, and finally Treasury Secretary Mnuchiin acquiesced after China failed to prevent the dollar from rising above CNY7.0. China set the reference rate for the dollar lower than models based on the basket the PBOC uses implied for the past three sessions, and this...

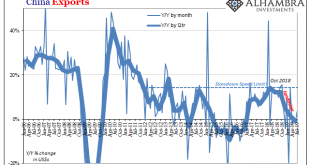

Read More »The Myth of CNY DOWN = STIMULUS Won’t Die

On the one hand, it’s a small silver lining in how many even in the mainstream are beginning to realize that there really is something wrong. Then again, they are using “trade wars” to make sense of how that could be. For the one, at least they’ve stopped saying China’s economy is strong and always looks resilient no matter what data comes out. Even after all that supposed “stimulus” starting in the middle of last year...

Read More »FX Daily, July 31: Sterling Steadies, Attention Shifts to FOMC

Swiss Franc The Euro has fallen by 0.15% to 1.1026 EUR/CHF and USD/CHF, July 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After a shellacking in recent days, sterling has stabilized though there is not much of a bounce to speak of, suggesting the adjustment to the risk of a no-deal Brexit may not be complete. After the S&P 500 posted back-to-back...

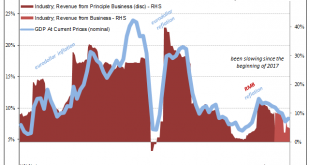

Read More »China’s Big Gamble(s): Betting on QE Again?

As an economic system, even the most committed socialists had come to realize it was a failure. What ultimately brought down the Soviet Union wasn’t missiles, tanks, and advanced air craft, it was a simple thing like bread. You can argue that Western military spending forced the Communist East to keep up, and therefore to expend way too much on guns at the expense of butter. Even if that was the case, the Soviet system...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org