Swiss Franc The Euro has fallen by 0.12% to 1.0528 EUR/CHF and USD/CHF, April 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The recovery in equities stalled, and the risk-off mood has helped lift the US dollar, which had been trending lower. Taiwan and Malaysia were notable exceptions in the Asia Pacific regions to the heavier equity tone. The Nikkei gave back almost 0.5% after surging more than 3% on Tuesday. Europe’s Dow Jones Stoxx 600 is ending a five-day rally. The S&P 500 gapped higher yesterday and may test the lower end of the gap (Monday’s high) near 2782.5. Core bond yields are paring recent gains. The US 10-year yield is off seven basis points to 0.68%. Peripheral European bond yields are

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brexit, China, Currency Movement, Featured, newsletter, Sweden, USD, WHO

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

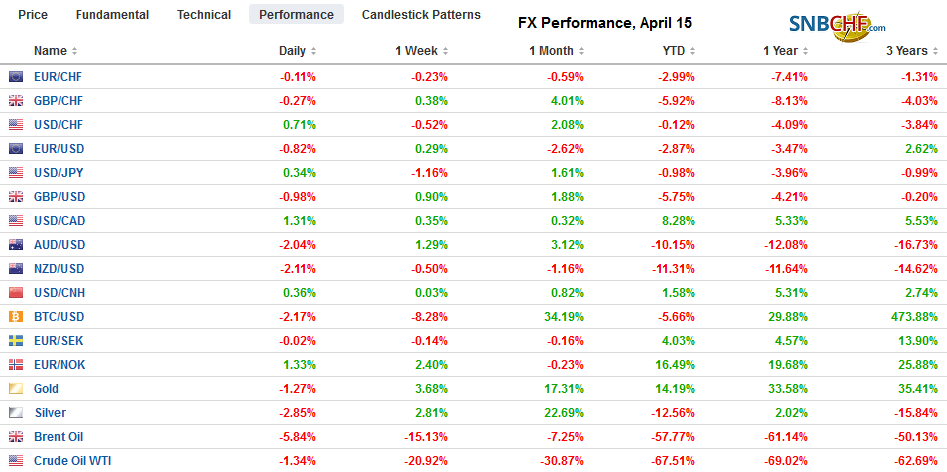

Swiss FrancThe Euro has fallen by 0.12% to 1.0528 |

EUR/CHF and USD/CHF, April 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

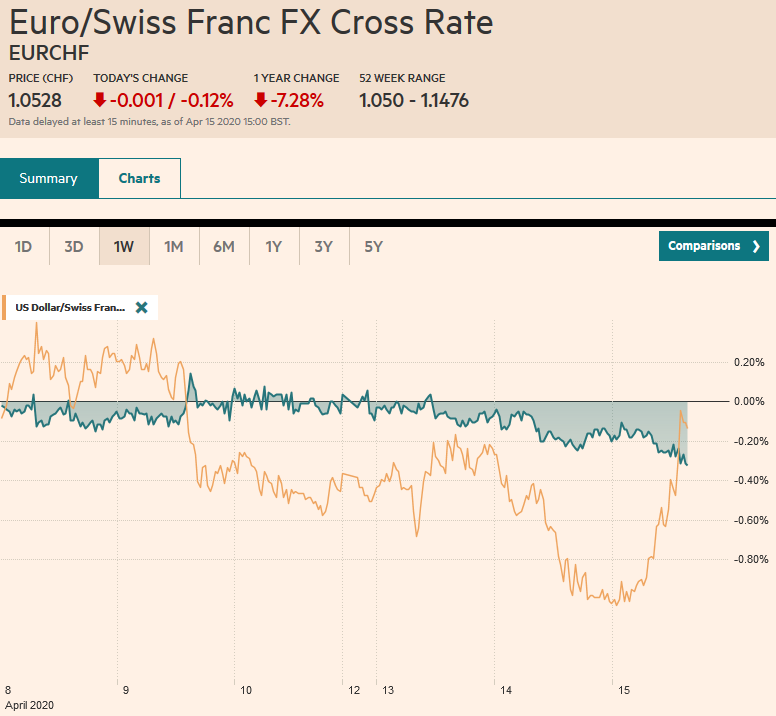

FX RatesOverview: The recovery in equities stalled, and the risk-off mood has helped lift the US dollar, which had been trending lower. Taiwan and Malaysia were notable exceptions in the Asia Pacific regions to the heavier equity tone. The Nikkei gave back almost 0.5% after surging more than 3% on Tuesday. Europe’s Dow Jones Stoxx 600 is ending a five-day rally. The S&P 500 gapped higher yesterday and may test the lower end of the gap (Monday’s high) near 2782.5. Core bond yields are paring recent gains. The US 10-year yield is off seven basis points to 0.68%. Peripheral European bond yields are firmer, with Italy’s benchmark yield up five basis points. The dollar is stronger against all the major currencies, including the Japanese yen. With WTI slipping below $20 and lower tolerance for risk, the Norwegian krone and dollar-bloc currencies are under the most pressure. Outside of a handful of small Asian currencies, the emerging market complex is weaker, led by the Mexican peso and South African rand. Gold continues to trade more like risk assets than a safe haven, and it is snapping a four-day advance. |

FX Performance, April 15 |

Asia Pacific

The People’s Bank of China cut the one-year medium-term lending rates by 20 bp to 2.95% and injected $14 bln in the banking system. The rate move underscores expectations that the benchmark Loan Prime Rate, which was unexpectedly left unchanged last month, will be cut when it is set next week. The one-year LPR stands at 4.05% and is expected to be reduced by at least 20 bp. Separately, China will be the first large country to report Q1 GDP estimate tomorrow. Many expect China to admit to around a12% quarter-over-quarter decline, which translates into about a 6% year-over-year contraction.

Baseball is not particularly popular in China, but the handling of the corona crisis may be Secretary-General Xi’s third strike. Admittedly, the pall over Chinese politics, which it assuredly has, despite being a one-party state, makes it hard to know with a high degree on confidence. And it goes contrary to the idea that Xi has tenure for life. The sustained demonstrations in Hong Kong and the trade war with the US had already spurred subtle but clear criticism for the mishandling. And now, Covid-19. In his concentration of power, Xi has made numerous enemies.

Even others were slow to respond to intelligence reports or were ill-prepared despite warnings of a pandemic risk, Beijing is widely understood to has misportrayed and deceived about the virus. That the factory and pharmacy of the world, achieved often with the help of state funds, has sent PPE and medical supplies to other countries is fine and good, but it is not like there is a scale that commerce offsets the deception. The handling of the crisis can only accelerate the re-thinking of supply chains that had been spurred by the increase in the US tariffs, most of which remain in place. As we have noted, Japan has budgeted funds to help companies re-onshore from China. Other countries concerned about Chinese businesses buying their companies are considering tightening the relevant rules. Taiwan has also used the opportunity to build goodwill. Not that there are no other pressing issues, but is it really too early to begin thinking about Xi’s succession like conventional thinking has it? His second term five-year term is half over.

The dollar slipped below JPY107 before finding a bid. Today’s high near JPY107.50 was set in the European morning. There is an option for a little more than $500 mln at JPY107 that rolls off today. The greenback needs to resurface above the JPY107.80 to take the downside pressure off it. On the downside, the next support area is seen near JPY106.50. An option for A$1 bln struck at $0.6450 that expires today was just above yesterday’s high, and today the Australian dollar has been sold back down to about $0.6325. The selling pressure has subsided in the European morning. A break of $0.6300 could spur a move toward $0.6265. The dollar is firmer against the Chinese yuan and is trading at the lower end of the CNY7.05-CNY7.12 range that has mostly confined it mid-March.

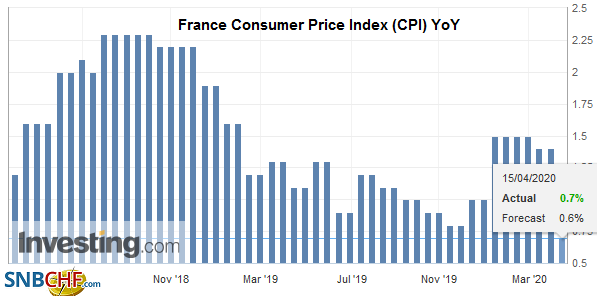

EuropeThe drop in oil prices will knock headline measures of inflation lower, and this poses a particular challenge for Sweden’s Riksbank, which is loath to push rates back below zero. The Riksbank had been the first central bank to exit negative policy rates, though it still has a negative deposit rate. March CPI slowed to 0.6% from 1.0%. The underlying rate, which uses fixed-rate mortgages, also fell to 0.6%. Excluding energy, the underlying rate slowed to 1.5% from 1.6%. The UK’s trade negotiations with the EU resume today, and the UK continues to commit to the end of the year exit from the standstill arrangement. Many are skeptical and see the coronavirus as an extra hurdle that made the already ambitious timeframe even less realistic. The rules of engagement allow the UK to request in by the end of H1 a one or two-year delay, but this seems unlikely. To be ready, the UK still faces Herculean tasks of 1) enhanced border checks, 2) new immigration system, and 3) introduce a new and complicated customs border with Northern Ireland. |

France Consumer Price Index (CPI) YoY, March 2020(see more posts on France Consumer Price Index, ) Source: investing.com - Click to enlarge |

The euro initially firmed to a two-week high just shy of $1.10, where a 2.2 bln euro option expires tomorrow. It was pushed to $1.0920 in the European morning. Yesterday’s low was a little above $1.09, and a close below it today would likely confirm a near-term high is in place. Sterling peaked yesterday at almost $1.2650 and is flirting with $1.25. The next area of support is seen in the $1.2450 area. Implied volatility is rising as the euro and sterling move lower.

America

The Federal Reserve’s efforts to stabilize the funding market is yielding positive results. The benchmark three-month LIBOR fell for the fifth consecutive session on Tuesday to about 1.175%. It peaked at the end of March around 1.45%. It remains elevated, but the direction is encouraging. The Fed’s commercial paper facility started on Tuesday. The central bank is committed to buying three-month commercial paper, asset-backed, and muni paper as well. This will help reduce another troubled spot–the spread between CP and the overnight index swap (OIS), which metric of the transmission of the Fed’s monetary policy. The Fed’s other efforts that have ensured that the capital markets are functioning has encouraged flows back into prime money market funds that are the largest buyers of CP. Euribor also is elevated but may have been begun easing after the premium over OIS reached an eight-year high last week. The ECB has also started buying CP. A funding challenge is still evident in Japan, and there is talk that the BOJ may boost its CP purchases later this month and/or boost the range of acceptable collateral.

It is difficult to know what to make of President Trump’s 60-day suspension of funding to the World Health Organization. It has been threatened recently on the grounds that it took too much of China’s claims at face value. Before the pandemic, Trump had sought to reduce funding for the WHO, and in January and February, he had been praising China, despite intelligence reports (according to some press accounts). Moreover, the decision to fund WHO is a Congressional decision. Bottom-line the optics are likely worse than the material impact.

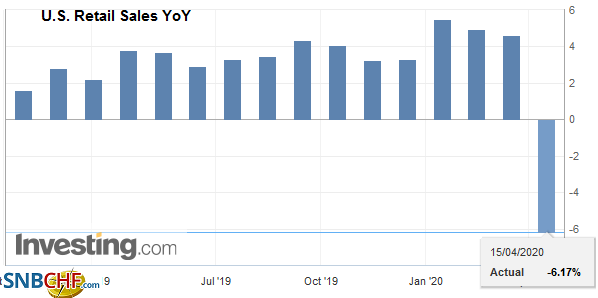

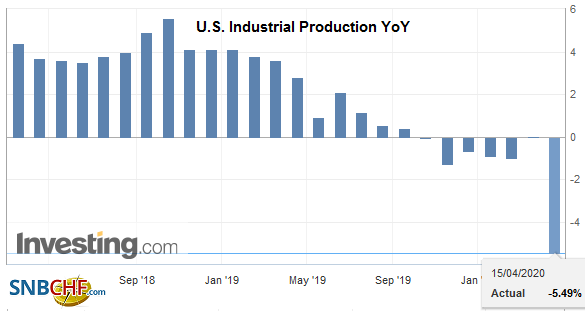

| The US reports March retail sales and industrial output figures today. The shutdown of the US economy widened and deepened as the month progressed. Broadly speaking, retail sales are expected to have fallen around 8% on the month, and industrial output is thought to have contracted half as much. |

U.S. Retail Sales YoY, March 2020(see more posts on U.S. Retail Sales, ) Source: investing.com - Click to enlarge |

| The Empire State manufacturing survey is for April, and another large drop is expected. The Beige Book will be released late in the session and offers an anecdotal survey of the different regions of the US economy. At the close of equity trading, February’s Treasury International Capital (TIC) report will be released, but it too dated to be very insightful. |

U.S. Industrial Production YoY, March 2020(see more posts on U.S. Industrial Production, ) Source: investing.com - Click to enlarge |

The Bank of Canada meeting is largely a non-event as it has not waited for the scheduled meeting to move. The US dollar found support this week near CAD1.3850-CAD1.3860. It is now at a four-day high around CAD1.4030. Falling equities and oil prices do the Canadian dollar no favors. The near-term potential extends into the CAD1.4130-CAD1.4160 area. Similarly, the greenback has carved out a shelf against the Mexican peso in the MXN23.25-MXN23.30 area. It has approached MXN24.00 today. The 20-day moving average is seen near MXN24.03. Above there, the MXN24.20 area may attract prices.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,China,Currency Movement,Featured,newsletter,Sweden,WHO