The fragile ice shelf of speculative bets and debt clinging to the mountainside is making strange creaking sounds– will you listen or will you ignore it because ‘the Fed has our back’? Feast your eyes on the chart below of the Nasdaq 100 stock market Index, which is dominated by the six FAAMNG (rhymes with “famine”) stocks: Facebook, Apple, Amazon, Microsoft, Netflix and Google which now account for over 20% of the entire U.S. stock market’s capitalization. Notice...

Read More »Restricted Market Trading Comments

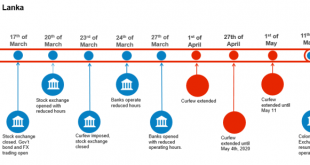

By Dara O’Sullivan, Derrick Leonard, and Ilan Solot Covid-19 related measures for restricted markets remain largely unchanged this week. Philippines, Bangladesh and Kuwait have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity. Please see trading comments below Sri Lanka: The Colombo Stock Exchange (CSE) resumed operations on May 11, 2020 following an extended period of closure. Foreign exchange trading is still permitted...

Read More »Re-Opening the Economy Won’t Fix What’s Broken

Re-opening a fragile, brittle, bankrupt, hopelessly perverse and corrupt “normal” won’t fix what’s broken. The stock market is in a frenzy of euphoria at the re-opening of the economy. Too bad the re-opening won’t fix what’s broken. As I’ve been noting recently, the real problem is the systemic fragility of the U.S. economy, which has lurched from one new extreme to the next to maintain a thin, brittle veneer of normalcy. Fragile economies cannot survive any impact...

Read More »The Pandemic Gives Us Permission To Get What We Always Wanted

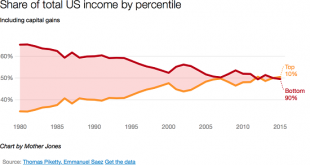

Dear Corporate America: maybe you remember the old Johnny Paycheck tune? Let me refresh your memory: take this job and shove it. Put yourself in the shoes of a single parent waiting tables in a working-class cafe with lousy tips, a worker stuck with high rent and a soul-deadening commute–one of the tens of millions of America’s working poor who have seen their wages stagnate and their income becoming increasingly precarious / uncertain while the cost of living has...

Read More »Dollar Firm as China’s Hong Kong Gambit Triggers Risk-Off Trading

Legislation was introduced that allows Beijing to directly impose a national security law on Hong Kong; US-China tensions are still rising; the dollar is bid as risk-off sentiment takes hold There are no US data reports or Fed speakers today; Canada reports March retail sales; Mexico reports mid-May CPI ECB publishes the account of its April 30 meeting; UK reported April retail sales and public sector net borrowing; parts of the UK curve remain negative China...

Read More »Dollar Firm as US-China Tensions Flare

The virus news stream is mixed; the dollar has stabilized; US-China tensions continue to ratchet up We will get some more US economic data for May; weekly jobless claims are expected at 2.4 mln Eurozone and UK reported firm preliminary May PMI readings; BOE officials continue to take a very dovish tone South Africa is expected to cut rates 50 bp to 3.75%; Turkey is expected to cut rates 50 bp to 8.25% Japan and Australia reported preliminary May PMIs; Korea reported...

Read More »Dollar Treads Water Ahead of FOMC Minutes

The virus news stream is mixed; the dollar has stabilized a bit FOMC minutes will be released; Canada reports April CPI and March wholesale trade sales; the news from Brazil keeps getting worse Another group of EU nations will release their own plan in a rebuttal of France and Germany; UK reported April CPI data Japan reported March core machine orders; Australia reported weak preliminary April retail sales China kept its benchmark Loan Prime Rates unchanged;...

Read More »Consumer Spending Will Not Rebound–Here’s Why

Any economy that concentrates its wealth and income in the top tier is a fragile economy. There are two structural reasons why consumer spending will not rebound, no matter how “open” the economy may be. Virtually everyone who glances at headlines knows the global economy is lurching into either a deep recession or a full-blown depression, depending on the definitions one is using. Everyone also knows the stock market has roared back as if nothing has happened. While...

Read More »Restricted Market Trading Comments

By Dara O’Sullivan, Derrick Leonard, and Ilan Solot Covid-19 related measures for restricted markets remain largely unchanged this week. Philippines, Bangladesh and Kuwait have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity. Please see trading comments below Sri Lanka: The Colombo Stock Exchange (CSE) resumed operations on May 11, 2020 following an extended period of closure. Foreign exchange trading is still permitted...

Read More »The Collapse of Main Street and Local Tax Revenues Cannot Be Reversed

The core problem is the U.S. economy has been fully financialized, and so costs are unaffordable. To understand the long-term consequences of the pandemic on Main Street and local tax revenues, we need to consider first and second order effects. The immediate consequences of lockdowns and changes in consumer behavior are first-order effects: closures of Main Street, job losses, massive Federal Reserve bailouts of the top 0.1%, loan programs for small businesses,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org