The virus news stream is mixed; the dollar has stabilized a bit FOMC minutes will be released; Canada reports April CPI and March wholesale trade sales; the news from Brazil keeps getting worse Another group of EU nations will release their own plan in a rebuttal of France and Germany; UK reported April CPI data Japan reported March core machine orders; Australia reported weak preliminary April retail sales China kept its benchmark Loan Prime Rates unchanged; Thailand cut rates 25 bp to 0.50%, as expected The dollar is mostly weaker against the majors. Kiwi and Swissie are outperforming, while yen and sterling are underperforming. EM currencies are mixed. ZAR and RUB are outperforming, while KRW and TRY are underperforming. MSCI Asia Pacific was up 0.5% on the

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- The virus news stream is mixed; the dollar has stabilized a bit

- FOMC minutes will be released; Canada reports April CPI and March wholesale trade sales; the news from Brazil keeps getting worse

- Another group of EU nations will release their own plan in a rebuttal of France and Germany; UK reported April CPI data

- Japan reported March core machine orders; Australia reported weak preliminary April retail sales

- China kept its benchmark Loan Prime Rates unchanged; Thailand cut rates 25 bp to 0.50%, as expected

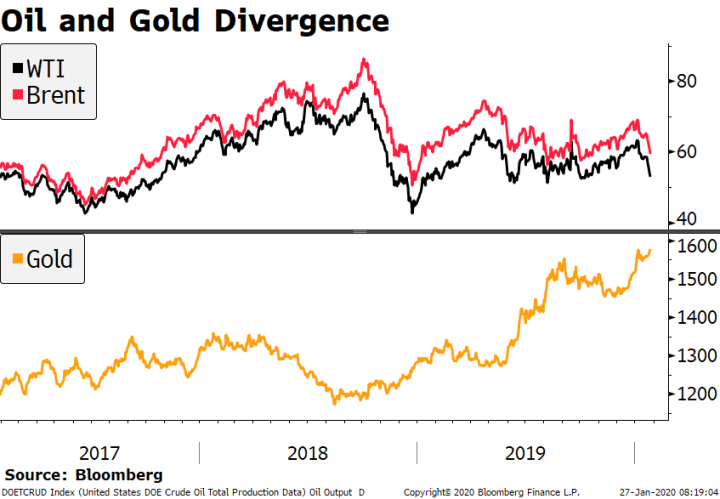

The dollar is mostly weaker against the majors. Kiwi and Swissie are outperforming, while yen and sterling are underperforming. EM currencies are mixed. ZAR and RUB are outperforming, while KRW and TRY are underperforming. MSCI Asia Pacific was up 0.5% on the day, with the Nikkei rising 0.8%. MSCI EM is up 0.6% so far today, with the Shanghai Composite falling 0.5%. Euro Stoxx 600 is up 0.3% near midday, while US futures are pointing to a higher open. 10-year UST yield is flat at 0.69%, while the 3-month to 10-year spread is up 2 bp +59 bp. Commodity prices are mostly higher, with Brent oil up 1.2%, WTI oil up 0.4%, copper down 0.5%, and gold up 0.3%.

The virus news stream is mixed. Further scrutiny of the Moderna vaccine trial suggests that the early euphoria was perhaps not justified. Elsewhere, doctors in China are finding that the virus is likely mutating, as a new cluster of cases in the northeast provinces are taking longer to become symptomatic. On the other hand, the infection rate in Russia fell to its lowest since May 1.

The dollar has stabilized a bit. DXY is trading back below 100 and hit its lowest level yesterday since May 8 before stabilizing. The euro traded at its highest level since May 4 near $1.0975 yesterday before running out of steam. Sterling also reversed but could not break above the $1.23 area. Lastly, USD/JPY has edged higher as risk-on sentiment takes hold, though 108 remains tough to crack.

AMERICAS

FOMC minutes will be released. The Fed took no action at the April meeting but stressed that it stands ready to do more as needed. Next FOMC meeting is scheduled for June 10 but at this point, the calendar means nothing to the Fed. If there are any issues that arise, rest assured the Fed will act quickly to address them. Period. Bostic and Bullard speak today.

Canada reports April CPI and March wholesale trade sales. Headline inflation is expected at -0.1% y/y vs. +0.9% in May, while common core is expected to remain steady at 1.7% y/y. March retail sales will be reported Friday, with headline sales expected to fall -11.8% m/m and ex-autos by -4.8% m/m. Next Bank of Canada meeting is June 3.

The news from Brazil keeps getting worse. It has now overtaken the UK to have the third-highest covid-19 cases worldwide, behind only the US and Russia. The rates of infection and mortality are still rising and Brazil now accounts for 13% of all new cases globally over the past week. To make matters worse, Brazil is without a Health Minister. In an effort to increase social distancing, the mayor of Sao Paulo signed a decree moving the holidays of Corpus Christi (June 11) and Zumbi Dos Palmares Day (November 20) to today and tomorrow, respectively. Work this Friday May 22 will not be mandatory, and a state holiday was moved from July 9 to Monday May 25. Exchanges will reportedly remain open the entire time, however.

EUROPE/MIDDLE EAST/AFRICA

Another group of EU nations will release their own plan in a rebuttal of France and Germany. Austria, the Netherlands, Denmark, and Sweden expect to publish their own framework for a virus package sometime today. No details have been seen yet but we suspect the focus will be more on loans instead of outright grants. The Franco-German proposal was sure to be controversial and so a response from the critics was to be expected. And it’s not only these four. Countries in Eastern Europe appear to be skeptical too, with Czech Prime Minister Babis saying he still had “many questions” and Polish officials expressing doubts. Still, we expected pushback but hold out hope that the EU will be able to work out a compromise.

UK reported April CPI data. Headline inflation came in a tick lower than expected at 0.8% y/y, while CPIH inflation came in at the expected 0.9% y/y. Both slowed sharply from 1.5% in March. Rising deflation risks come as the negative rates debate hits the UK. The Treasury today sold GBP3.75 bln of 3-year paper at a yield of -0.003%. Some short-end Gilts have been trading at negative yields in the secondary market, but this is the first time for negative rates at a primary auction for the UK. WIRP suggests negative UK policy rates will be seen by early 2021, though we continue downplay this risk. Baily, Broadbent, and Cunliffe speak today before the Treasury Committee and will surely be questioned about negative rates.

ASIA

Japan reported March core machine orders. Orders were expected to contact -8.9% y/y but fell only -0.7%. As we know, the economy improved slightly in Q1 but is expected to fare worse in Q2 as the lockdowns began in April and are only now being lifted in phases. Still, this is a rare bit of good news regarding Japan’s economy.

Australia reported weak preliminary April retail sales. Sales fell -17.9% m/m and compares to a gain of 8.5% m/m in March. In its most recent minutes, the RBA reiterated its forecast of a -10% contraction in H1, noting that reports suggest strong March consumption was followed by weakness in April. Final retail sales data will be reported June 4. Preliminary May PMI readings will be reported Thursday. For now, clues suggest the RBA is in wait and see mode. Next policy meeting is June 2 and no change is expected then. For now, WIRP suggests no risk of negative rates from the RBA.

China kept its benchmark Loan Prime Rates unchanged. The 1- and 5-year rates remain at 3.85% and 4.65%, respectively. Given the PBOC’s dovish bias and promise of more “powerful” easing measures, however, we would not rule out a drop in lending rates in the coming months. April data show that production is starting to recover while consumption has not, so further easing is likely.

Bank of Thailand cut rates 25 bp to 0.50%, as expected. A small handful of analysts saw steady rates. The vote was 4-3, and the bank said that the downturn this year may be deeper than its forecast -5.3% as the impact to exports and tourism has so far been worse than expected. The bank stressed that it “stands ready to use additional monetary policy tools if needed.” The bank also expressed concern about recent baht strength, which could delay the economic recovery. If the economic outlook remains weak, we expect further easing at the next policy meeting June 24.

Tags: Articles,Daily News,Featured,newsletter