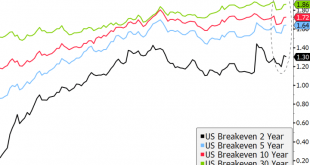

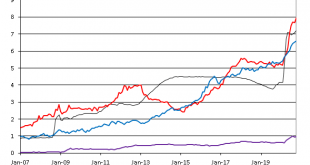

The interplay of a vaccine-driven reflation rally and the (likely) split government in the US are emerging as the driving themes for markets in the months ahead. We think reflation will win out in the end, but it could manifest itself differently this time around. While the policy-driven (fiscal and monetary) reflation theme from earlier in the year helped backstop the worst of the economic fallout, its reflationary impact was skewed towards asset price inflation....

Read More »Markets Gyrate Ahead of Protracted Period of Uncertainty

Markets likely facing an extended period of uncertainty; the dollar is seeing some safe haven bid but is well off its highs Despite President Trump’s claim of victory and his call to halt vote counting and go to the Supreme Court, it’s important to emphasize that the election is simply not over yet; asset prices are sending a cacophony of signals as investors struggle to price multiple possibilities The two day FOMC meeting starts today and concludes with a likely...

Read More »FOMC Preview: Coronavirus Daily Change

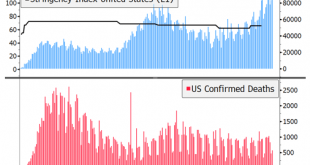

The two-day FOMC meeting starts tomorrow and wraps up Thursday afternoon. While no policy changes are expected, we highlight what the Fed may or may not do. We expect a dovish hold, with Powell underscoring the growing downside risks facing the US economy in Q4. While we are confident about our call for this meeting, the medium-term outlook will remain highly uncertain until we get a firm result from the US elections and a better grasp of how the pandemic will impact...

Read More »Dollar Firm at Start of Very Eventful Week

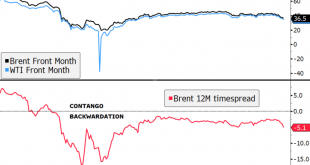

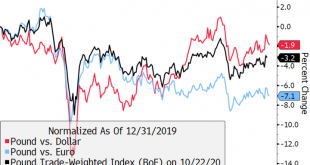

Oil prices continue their rapid decline due to both supply and demand concerns; the dollar is trading at the top end of recent trading ranges This is one of the most eventful weeks for the markets in recent memory; one day ahead of the elections, the implied odds remain roughly at the same levels as they have been for the last few weeks; October ISM manufacturing PMI will start the ball rolling for a key US data week The outlook for the virus in Europe continues to...

Read More »Dollar Bid as Markets Steady Ahead of ECB Decision

Global equity markets are gaining limited traction today after yesterday’s bloodbath; that sell-off helped test a now prevalent hedging thesis for investors The dollar remains bid; US Q3 GDP data will be the data highlight; weekly jobless claims will be reported BOC delivered a dovish hold yesterday; Canada Finance Minister Freeland defended the government’s aggressive fiscal stimulus plans; Brazil left rates unchanged, as expected ECB is expected to deliver a...

Read More »ECB Preview

The ECB meets Thursday and is widely expected to stand pat until the next meeting. Macro forecasts won’t be updated until the December 10 meeting, but the bank will have to acknowledge the deteriorating outlook now. There’s a small risk of more jawboning against the stronger euro, but it should otherwise be an uneventful meeting. We expect the ECB to increase QE in December but another rate cut seems very unlikely, as does activation of OMT. POSSIBLE NEXT STEPS...

Read More »Dollar Bid as Markets Start the Week in Risk-Off Mode

Increasing virus numbers have pushed European governments to once again start imposing national measures; the week is starting off on a risk-off note Today may see the official end of stimulus talks; odds for Biden victory are increasing again but is already mostly priced in US manufacturing surveys for October will continue to roll out; Chile’s referendum on a new constitution passed in a landslide Brexit negotiations have been extended; Germany’s October IFO survey...

Read More »EM Preview for the Week Ahead

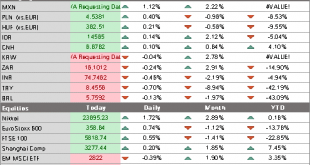

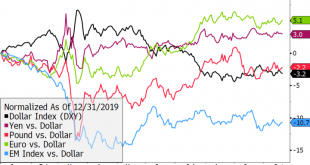

EM FX took advantage once again of broad dollar weakness. Most EM currencies were up last week against the dollar, with the only exceptions being ARS, TRY, INR, THB, PEN, and MYR. We expect the dollar to remain under pressure this week and so EM should remain bid. However, the growing spread of the virus in Europe and the US supports our view that Asia is likely to continue outperforming. AMERICAS Chile held a referendum Sunday on whether to draft a new constitution....

Read More »Dollar Catches Modest Bid but Weakness to Resume

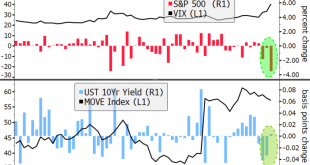

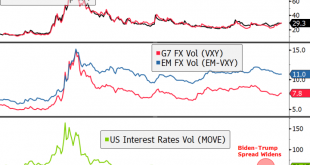

Geopolitical tensions have risen after US officials accused Russia and Iran of meddling in the elections; the dollar has caught a modest bid today Stimulus talks continue; Pelosi warned that a deal may not come together before the November 3 election; whether Republican Senators change their minds after the elections depends on the outcome Measures of cross-asset volatility suggest a far too generous interpretation of the odds for a clean Democratic sweep; KC Fed...

Read More »Dollar Soft as Markets Await Fresh News and Rumours

The dollar is coming under pressure again; markets are finally waking up to the fact that a stimulus deal before 2021 is unlikely; 10-year Treasury yields have been trading in a narrow range for months The quiet US data week continues; Ireland broke from the pattern of how other European countries are tightening mobility rules; Hungary is expected to keep the base rate steady at 0.60%. Japan reported September convenience store sales; dovish RBA remains dovish;...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org