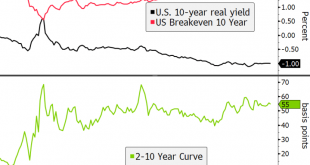

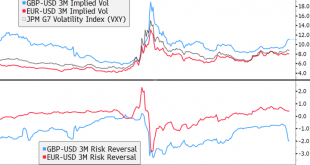

The dollar remains under pressure as market sentiment continue to improve; stimulus talks were extended Two major US airlines announced significant job furloughs starting today; US data for September will continue to roll out; weekly jobless claims will be reported The pound is underperforming as the flurry of optimism in the recent negotiations fades; final eurozone September manufacturing PMI was steady at 53.7 Bank of Japan quarterly Tankan report came in weaker...

Read More »Dollar Softens as Risk-Off Sentiment Ebbs

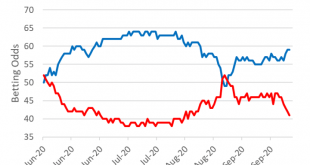

The dollar continues to soften as risk-off sentiment ebbs; the first presidential debate will take place tonight House Democrats have staked out their latest position at $2.2 trln; there is a fair amount of US data out today; Brazil has come under renewed pressure from fiscal concerns The pound continues to outperform as comments from the latest Brexit talks remain skewed to the positive side; latest eurozone CPI and retail sales readings have started coming out...

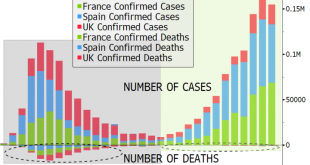

Read More »Dollar Soft as Markets Ignore Virus Numbers and Switch to Risk-On Mode

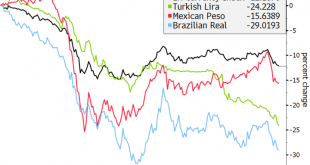

Virus numbers are rising across Europe and the US; the dollar is softening as risk-off sentiment ebbs It is a fairly quiet day in the US; there is a glimmer of hope about a fiscal deal in the US; recent US data support the widely held view that more stimulus is needed The final week of Brexit negotiations is upon us in Brussels and the pendulum is swinging towards optimism; Turkish assets may be one of the biggest causalities of the conflict between Armenia and...

Read More »EM Preview for the Week Ahead

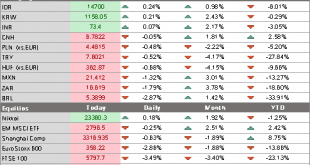

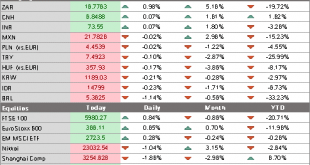

Persistent risk-off impulses weighed on EM last week and that may continue this week. The Asian currencies outperformed last week while MXN, ZAR, and COP underperformed, and we expect these divergences to continue. Despite optimism about a stimulus package in the US, we think it remains a long shot. Meanwhile, virus numbers are rising in Europe and the US, with data from both regions likely to continue weakening. AMERICAS Mexico reports August trade Monday. A...

Read More »Dollar Firm as Markets Digest Rising Virus Numbers

Markets are digesting the rising infection rates across Europe; the dollar is taking another stab at the upside Speculation is picking up that a compromise on a stimulus package could be reached; reports suggest House Democrats are working on a new $2.4 trln package as a basis for these negotiations Reports suggest Fed Governor Lael Brainard is a top candidate for Treasury Secretary if Biden were to win; today is a quiet day in the US Colombia is expected to cut...

Read More »Dollar Remains Firm Ahead of Powell Testimony

The dollar remains firm on continued safe haven flows but we still view this situation as temporary Fed Chair Powell appears before the House Financial Services Panel with Treasury Secretary Mnuchin; the text of Powell’s testimony was released already House Democrats plan to vote on a stopgap bill today; Fed manufacturing surveys for September will continue to roll out; Brazil COPOM minutes will be released UK CBI September industrial trends survey came in weak; BOE...

Read More »Dollar Gains from Risk-Off Trading Unlikely to Persist

Markets are starting the week in risk-off mode; the dollar is firm on some safe haven flows but this is likely to prove temporary US politics is coming in to focus as the election nears; we fear that the likely horse-trading and arm-twisting will take away any residual desire to get another stimulus package done The trend towards more restrictive measures continues with London in focus; between the virus numbers and Brexit risks, sterling remains under pressure China...

Read More »Risk Appetite Ebbs Ahead of BOE Decision

The dollar has gotten some limited traction despite the dovish FOMC decision; the FOMC delivered no surprises We are seeing some more movement on fiscal stimulus; August retail sales disappointed yesterday Fed manufacturing surveys for September will continue to roll out; weekly jobless claims will be reported; Brazil left rates unchanged at 2.0% but introduced some additional dovish guidance BOE is expected to deliver a dovish hold; UK government reached a...

Read More »Dollar Bounce Ends Ahead of ECB Decision

The dollar rally ran out of steam; US Senate will hold a vote today on its proposed “skinny” bill US reports August PPI and weekly jobless claims; US will sell $23 bln of 30-year bonds today after a sloppy 10-year auction yesterday BOC delivered a hawkish hold yesterday; Peru is expected to keep rates steady at 0.25% ECB is expected to keep policy steady; there were some eurozone IP readings; UK published its so-called Internal Market Bill Japan may go to the polls...

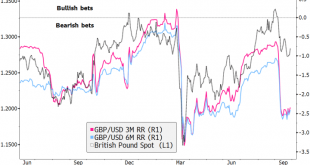

Read More »Sterling Pounded by Brexit Developments

The dollar rebound continues; odds of a near-term stimulus bill in the US are falling; ahead of inflation readings later this week, the US holds a 10-year auction today Bank of Canada is expected to keep policy steady; Mexico reports August CPI; Brazil reports August IPCA inflation The Brexit fallout widens; UK will have trouble striking new trade deals if it can’t be counted on to honor its past agreements; no surprise then that sterling remains under pressure...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org