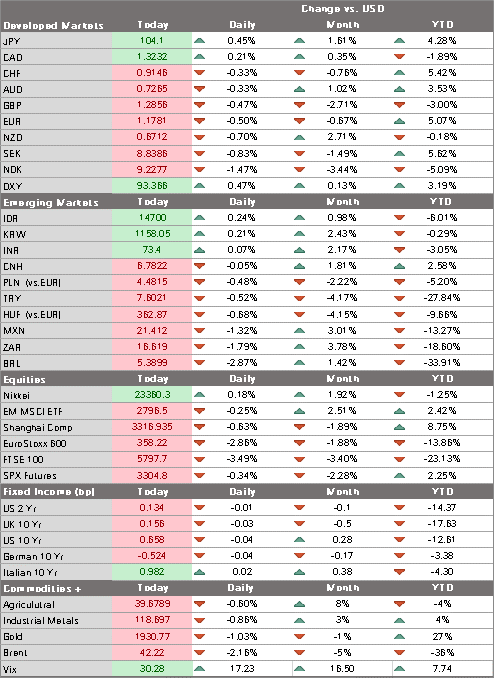

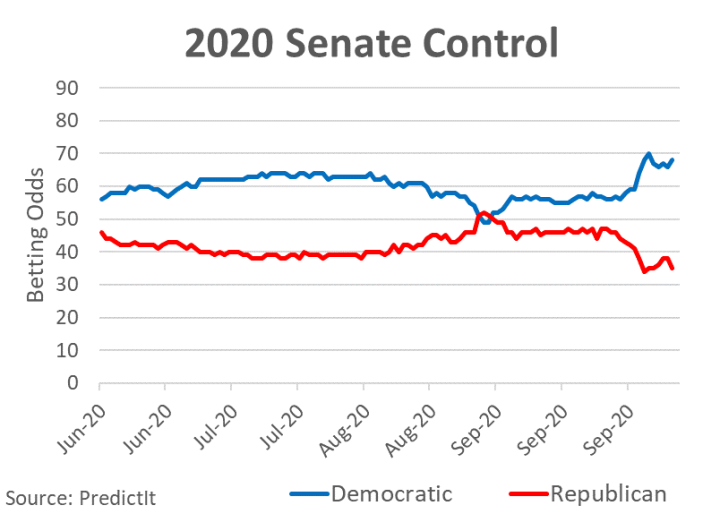

The dollar is coming under pressure again; markets are finally waking up to the fact that a stimulus deal before 2021 is unlikely; 10-year Treasury yields have been trading in a narrow range for months The quiet US data week continues; Ireland broke from the pattern of how other European countries are tightening mobility rules; Hungary is expected to keep the base rate steady at 0.60%. Japan reported September convenience store sales; dovish RBA remains dovish; RBNZ Governor Orr tried to out-dove the RBA PBOC maintained its benchmark loan rates, as expected; Taiwan reported strong September export orders The dollar is coming under pressure again. DXY is trading at the lowest level since October 13 and is nearing the October 9 low near 93. This is the bottom of

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

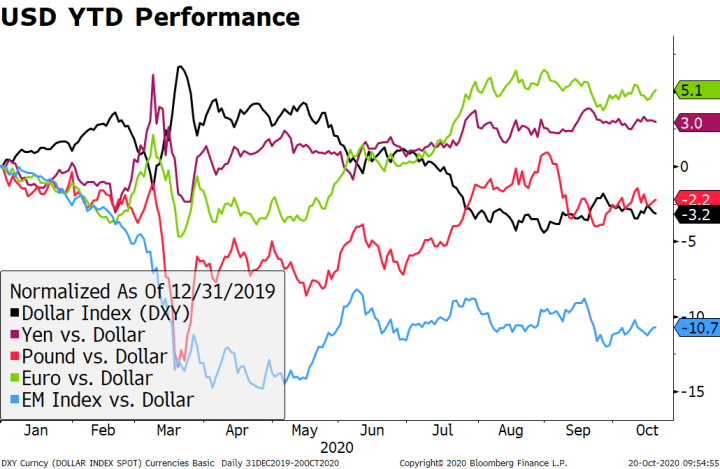

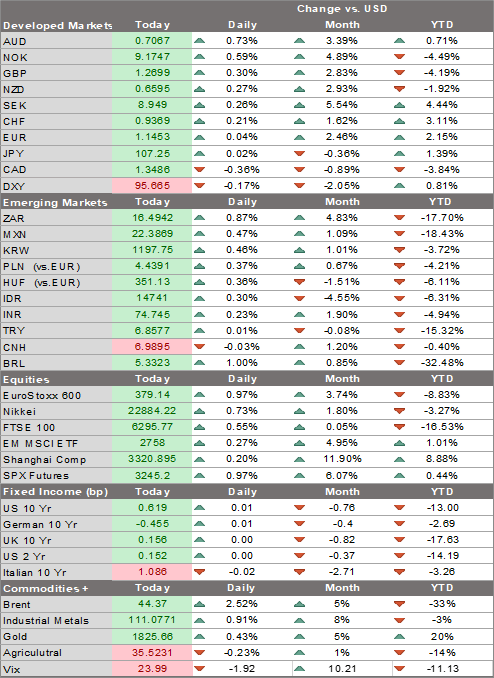

The dollar is coming under pressure again. DXY is trading at the lowest level since October 13 and is nearing the October 9 low near 93. This is the bottom of its recent 93-94 trading and a break below that would set up a test of the September 21 low near 92.749 and then the September 1 low near 91.746. The euro is trading back above $1.18, while sterling is trading just below $1.30 as markets await fresh Brexit news. USD/JPY remains in its narrow 105-106 trading range seen since late September. |

USD YTD Performance, 2020 |

| AMERICAS

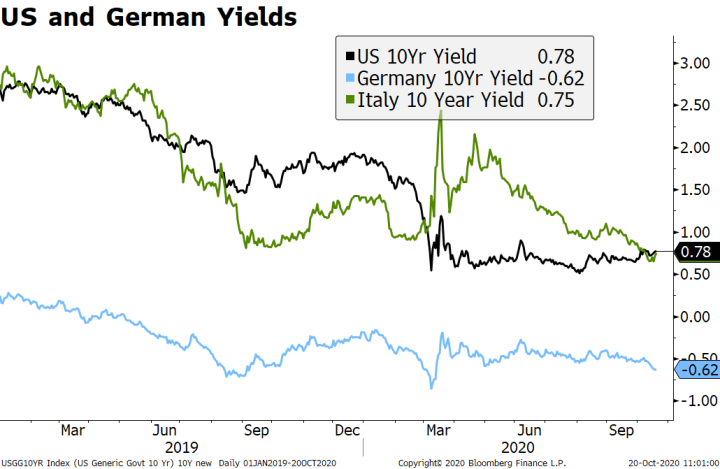

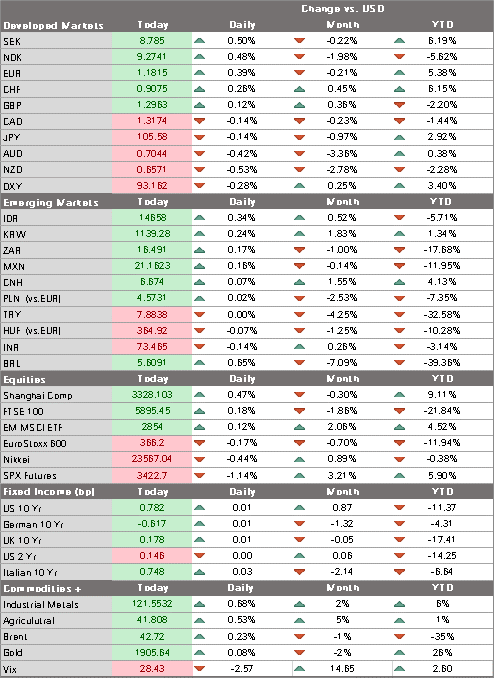

This is second hand news but markets are finally waking up to the fact that a stimulus deal before 2021 is unlikely. We cannot stress how important this is for the US economy. Past fiscal stimulus was meant to keep the economy on life support until the virus was under control and the economy could reopen. With virus numbers rising, economic activity will remain constrained and there is risk of real long-term damage if another round of aid is not forthcoming soon. The labor market has been stalling out and, with the exception of last week’s retail sale reports, the US data has been getting sequentially weaker. This will continue in Q4 without more stimulus. Yet dreams of a deal continue. House Speaker Pelosi and Treasury Secretary Mnuchin reportedly spoke yesterday. A Pelosi aide said they “continued to narrow their differences” and that the two will speak again today. Pelosi spokesman Hammill said, “the Speaker continues to hope that, by the end of the day Tuesday, we will have clarity on whether we will be able to pass a bill before the election.” Still, Pelosi reportedly told House Democrats that significant areas of disagreement remain that will likely prevent a deal. These include (but are not limited to) the scope of aid to state and local governments, tax credits for lower-income families, and liability protections for businesses that reopen. Pelosi and Mnuchin may never go back again to the negotiating table after today. With the election two weeks from today, time is simply running out. We continue to believe that Pelosi’s deadline today is likely to pass with no stimulus deal in sight. Mnuchin is now travelling to Israel, Bahrain, and the UAE. That he would leave while talks are ongoing is not a good sign, as we feel it removes a key player from the direct negotiations. Many can’t stop thinking about tomorrow. Indeed, Pelosi said after her talks with Mnuchin yesterday “We’ll see what tomorrow will bring.” Elsewhere, President Trump continues to claim that if the White House and House Democrats can seal a deal, he can quickly convince Senate Republicans to support it. Yet it seems that Senate Republicans will go their own way. Reports suggest that they plan to vote on a standalone bill today that would allow unused money from the package passed in March to be repurposed for use in the Paycheck Protection Program. A Senate vote is then planned on Wednesday on another skinny bill totaling around $500 bln that House Democrats have already rejected. Despite the haggling over the US stimulus, 10-year Treasury yields have been trading in a narrow range for months. In contrast, yields in Europe have been trending down, under pressure from the impact of the pandemic’s second wave, further lockdowns, and more ECB action.

|

US and Germany Yields, 2019-2020 |

| The quiet US data week continues. Only September building permits and housing starts will be reported today and are expected to rise 3.0% m/m and 3.5% m/m, respectively. These will be followed by September existing home sales Thursday, which are expected to rise 5.0% m/m and 0.7% m/m, respectively. We do not believe the strong housing market is a sign of economic strength, not when mortgage delinquencies are rising as businesses and families struggle. The Fed’s Quarles, Evans, and Bostic speak.

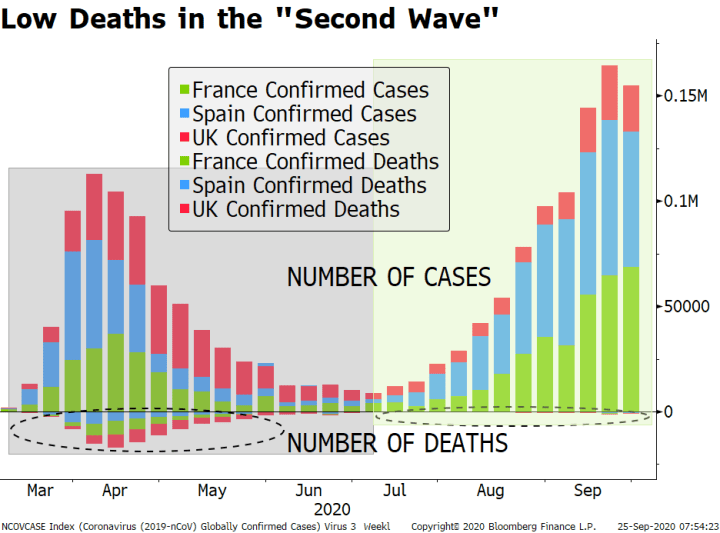

EUROPE/MIDDLE EAST/AFRICA Ireland broke from the pattern of how other European countries are tightening mobility rules in the face of a second wave of infections. The country decided on a six-week closure of non-essential businesses, along with a requirement that people stay within 5 km of their homes. We expect this type of top-down measure to be the exception rather than the rule. As seen in the parts of the UK and Germany, lockdown measures are being greeted with increased hostility by the population. That said, we can see from measures of mobility (Open Table reservations, Uber trips) that rational people will tend to self-restrict when the risks of infection rise. National Bank of Hungary is expected to keep the base rate steady at 0.60%. On September 24, Hungary surprised markets with a 15 bp emergency hike in the one-week deposit rate to 0.75% just two days after a regularly scheduled meeting saw an unchanged base rate. It seems the bank will now use the weekly one-week deposit rate fixing rather than the monthly base rate decision. It said the hike was “to prevent the current uncertain environment from causing an increase in inflation risks.” Much of that concern was coming from a weak forint. After that emergency hike, EUR/HUF fell about 2.5% but has since recovered to pretty much flat. If the forint continues to weaken, we cannot rule out another hawkish surprise this Thursday when it sets the one-week deposit rate. ASIA Japan reported September convenience store sales. Sales contracted -3.0% y/y vs. -5.5% in August. This will be followed by supermarket sales Wednesday and department store sales Thursday. Consumption continues to improve modesty but Japan’s recovery has lagged much of DM. As a result, it’s no surprise that Prime Minister Suga will push through another supplemental budget before year-end. On the other hand, the BOJ is expected to stand pat at its meeting next week. |

. |

Dovish Reserve Bank of Australia minutes were released. Similar to the message delivered at the meeting, minutes show the bank “agreed to maintain highly accommodative policy settings as long as required and to continue to consider how additional monetary easing could support jobs as the economy opens up further.” It noted that further policy easing is likely to “gain more traction” as restrictions are lifted across the country and that it should shift to targeting actual rather than forecast inflation. Lastly, the bank felt that relatively more aggressive QE by other central banks was contributing to lower sovereign yields abroad and impacting the AUD exchange rate from investment inflows.

Ahead of the minutes, RBA Assistant Governor Kent made similarly dovish comments. He said there is still room to compress short-term rates, adding it would not be unexpected for the bank bill swap rate (BBSW) fixings to turn negative. Kent noted that while the RBA hasn’t conducted a formal policy framework review, it will wait until inflation is in the 2-3% range before it considers tightening. A cut at the November 3 seems very likely at this point, with the futures market implying more than an 80% chance, according to the Bloomberg WIRP model.

It’s a race to the bottom as RBNZ Governor Orr tried to out-dove the RBA. Orr pushed back against criticism of negative rates, stressing that the RBNZ is developing a suite of instruments “that can be highly effective and highly efficient” and is actively talking to lenders about what to expect. Orr reiterated that the RBNZ will update markets on its plans for its Funding for Lending program at the November 11 policy meeting, which many see as the precursor for negative rates. Orr added there is still “plenty of room” to ease within the current QE framework.

People’s Bank of China maintained its benchmark loan rates, as expected. The 1- and 5-yaer Loan Prime Rates have been kept unchanged since April at 3.85% and 4.65%, respectively. Yet money and loan data reported last week support our view that policymakers are relying on credit growth to sustain this recovery and this should continue for the time being.

Taiwan reported strong September export orders. Orders rose 9.9% y/y vs. 8.0% expected and 13.6% in August. This is the seventh straight month of y/y gains and points to a strong export performance will into 2021. Strong growth in mainland China is dragging much of the region up with it, including Taiwan. Tomorrow, Korea reports trade data for the first twenty days of October. For the first ten days, exports fell -28.8% y/y and imports fell -19.5% y/y but weakness was largely due to two fewer working days this year. Adjusting for that, average daily exports rose 2.8% y/y. Like Taiwan, Korea another regional economy that is benefitting from strong mainland growth.

Tags: Articles,Daily News,Featured,newsletter