Geopolitical tensions have risen after US officials accused Russia and Iran of meddling in the elections; the dollar has caught a modest bid today Stimulus talks continue; Pelosi warned that a deal may not come together before the November 3 election; whether Republican Senators change their minds after the elections depends on the outcome Measures of cross-asset volatility suggest a far too generous interpretation of the odds for a clean Democratic sweep; KC Fed survey and weekly jobless claims will be reported; Mexico reports mid-October CPI The UK has agreed to come back to the Brexit negotiating table; Israel is expected to keep rates at 0.10%; Turkey is expected to hike rates 175 bp Japan reported weak September department store sales; LDP tax chief Amari

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Geopolitical tensions have risen after US officials accused Russia and Iran of meddling in the elections; the dollar has caught a modest bid today

- Stimulus talks continue; Pelosi warned that a deal may not come together before the November 3 election; whether Republican Senators change their minds after the elections depends on the outcome

- Measures of cross-asset volatility suggest a far too generous interpretation of the odds for a clean Democratic sweep; KC Fed survey and weekly jobless claims will be reported; Mexico reports mid-October CPI

- The UK has agreed to come back to the Brexit negotiating table; Israel is expected to keep rates at 0.10%; Turkey is expected to hike rates 175 bp

- Japan reported weak September department store sales; LDP tax chief Amari said the government will put together a third supplementary budget this year; China is preparing a possible administrative measure to allow greater capital outflows

Geopolitical tensions have risen after US officials accused Russia and Iran of meddling in the elections. According the intelligence officials, both countries obtained US voter registration information and are attempting to “cause confusion, sow chaos, and undermine” confidence in the democratic process.

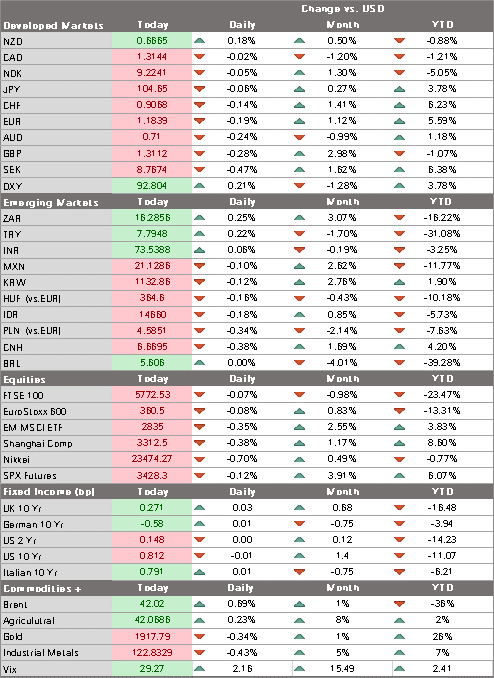

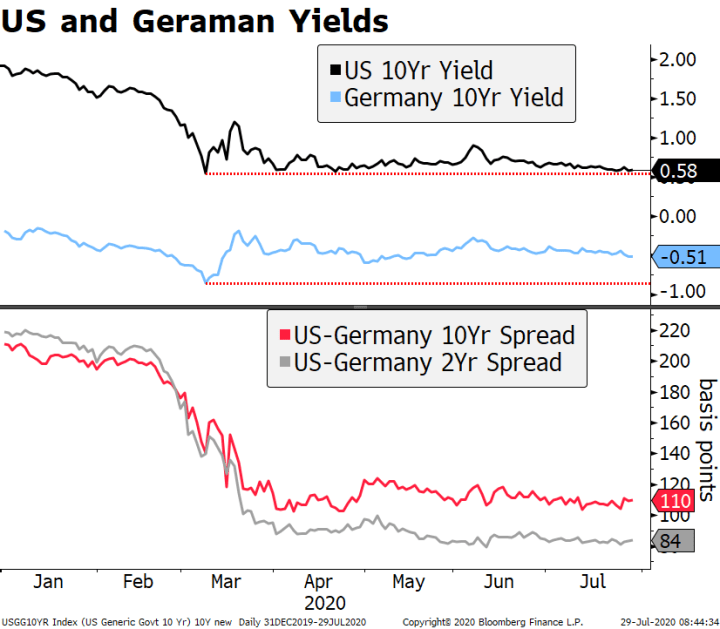

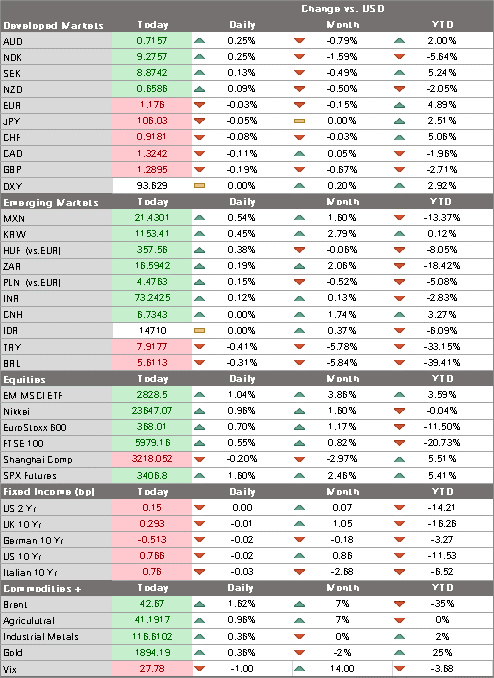

The dollar has caught a modest bid today. DXY traded yesterday at the lowest level since September 2 but has gotten some traction today with the return of some risk-off sentiment. When the dust settles, we think the broad weak dollar trend will remain intact and DXY remains on track to test the low for the cycle near 91.746 from September 1. The euro is holding above $1.18 while sterling is holding above $1.31. It appears USD/JPY is in a new trading range after breaking below its previous 105-106 trading range and should eventually test its cycle low near 104 from September 21.

AMERICAS

Stimulus talks continue. White House Chief of Staff Meadows said Wednesday morning that the goal in talks with House Speaker Pelosi was to get a deal done within 48 hours, which means Friday. Talks will reportedly continue today to narrow the differences. Yet we can’t help thinking that this will all be for naught.

Indeed, Pelosi warned that a deal may not come together before the November 3 election. She added that Senate Majority Leader McConnell “might not mind doing it after the election.” White House economic advisor Kudlow also chimed in, noting that if a vote on a compromise bill had to wait until after the election, announcing a deal beforehand would still be “very helpful to the economy and markets.”

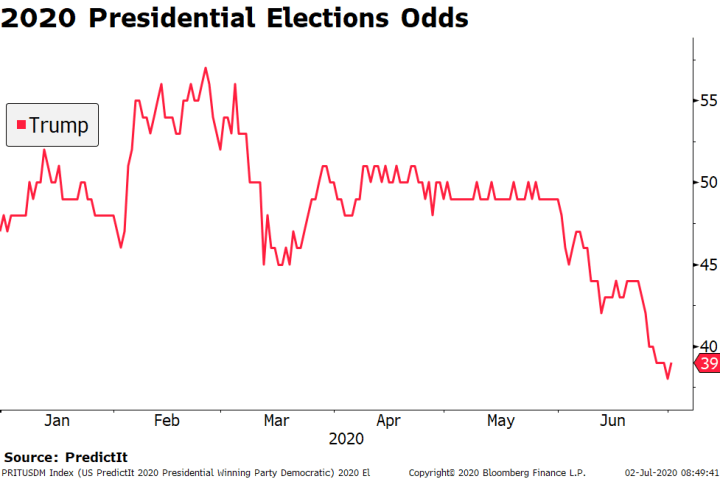

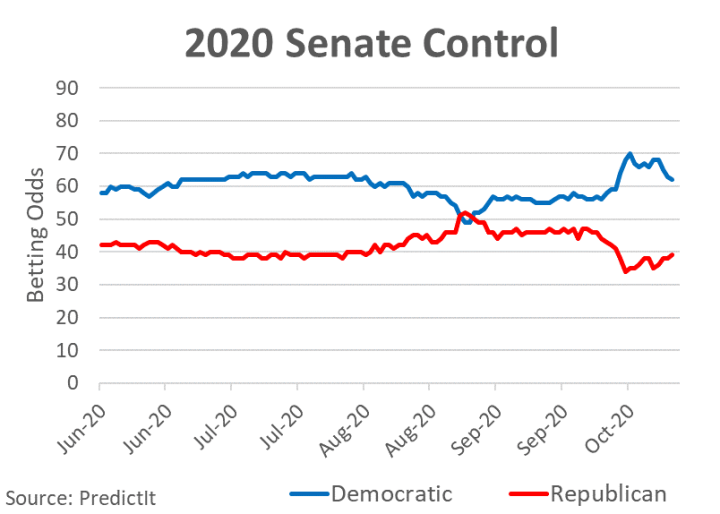

Whether Republican Senators change their minds after the elections depends on the outcome. If Biden wins, the Republicans have no political incentive to pass a large package as that would only help him when he takes over. If Trump wins, the Republicans would have more incentive to pass a large package in order to help him kick off his second term. That said, it would seem Senate Republicans have placed their election bets. Senior Senators Blunt, Grassley, Thune, and Cornyn have all downplayed this notion. After meeting with Republican Senators, White House Chief of Staff admitted that “I don’t think our chances get better after election.”

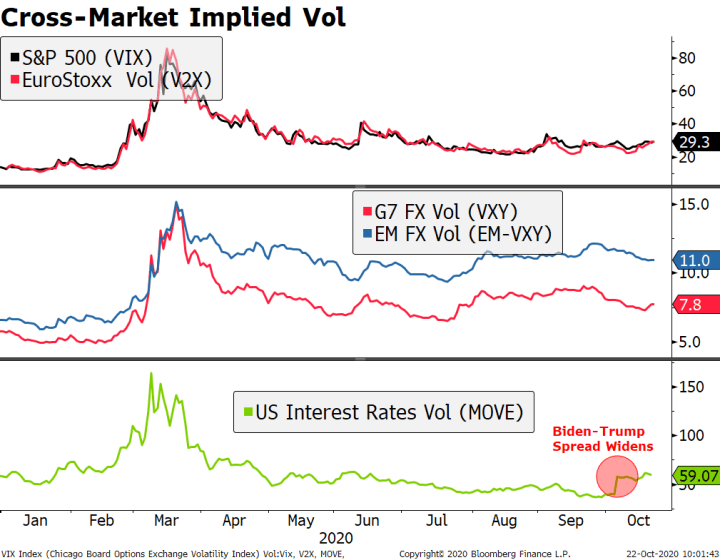

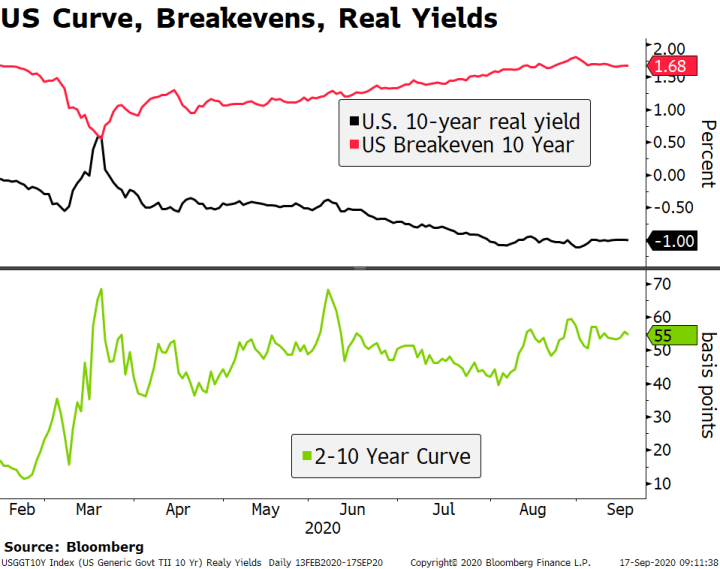

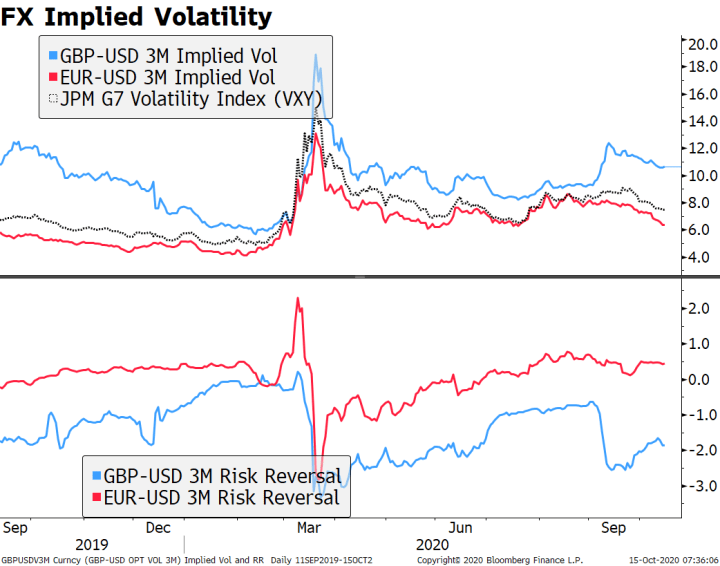

| Measures of cross-asset volatility suggest a far too generous interpretation of the odds for a clean Democratic sweep. To see why, we imagine the combined probability of (a) a surprise Trump victory, and/or (b) a surprise Republican Senate win, and/or (c) a shock event in next two weeks that shifts the odds, and/or (d) a disputed election outcome. Any of these – let alone a combination of them – could send equity, FX and fixed income markets into a tailspin. Yet with 12 days until the elections, equity market implied volatility (VIX and V2X) have seen only a gentle increase, remaining well within the range of the last several months. The same goes for broad FX vol indices, with the interesting twist that EM implied vol continues to decline. The most notable move has been in US fixed income (MOVE index), with a small upward shift earlier in the month when Biden pulled ahead in the polls. We wouldn’t go as far as saying markets are being complacent, but insurance does look cheap right now considering the magnitude of the risk event ahead of us.

The Fed released its Beige Book report. It was prepared for the upcoming FOMC meeting November 4 and 5 and was based on information collected through October 9. The tone was fairly upbeat, noting that “Economic activity continued to increase across all districts, with the pace of growth characterized as slight to modest in most districts.” However, it added that “Districts characterized the outlooks of contacts as generally optimistic or positive, but with a considerable degree of uncertainty.” Since the September 16 FOMC decision, the labor market has stalled out and the economy has lost more momentum and so we had expected a more sober tone in this Beige Book. That said, it’s clear that the Fed recognizes the high degree of uncertainty going forward. Still, we do not think that the report will dissuade anyone that is expecting steady policy from the Fed at this meeting, including us. Yesterday, Fed Governor Quarles said he expects the Fed to discuss bond buying at their coming meetings. To us, this is clearly dovish. If the Fed is going to discuss QE, it will be in the context of more, not less. We think it will ultimately depend in large part on the size and timing of fiscal stimulus. No stimulus deal means no QE increase, while a big stimulus deal means QE will likely see a big increase. Barkin and Kaplan speak today. Fed manufacturing surveys for October will continue to roll out. Kansas City Fed index is expected to remain steady at 11. Last week, Empire survey came in at 14.0 vs. 17.0 in September while the Philly Fed came in at 14.8 vs. 15.0 in September. Tomorrow’s preliminary October Markit PMI should give a better read of the national manufacturing outlook, with a slight improvement to 53.5 expected. Elsewhere, September existing home sales and leading index will be reported and expected to rise 5.0% m/m and 0.6% m/m, respectively. Weekly jobless claims will be reported. Initial claims are expected at 870k vs. 898k the previous week, which was the highest reading since August. We don’t want to make too much of last week’s claims data, as we know California is still working out its distortions for another week or two. That said, the lack of another stimulus deal pretty much guarantees that the claims data will move higher and the labor market will get worse. This week’s initial claims data will be for the BLS survey week containing the 12th of the month, but even a bad number shouldn’t be over-processed. Continuing claims are expected at 9.625 mln vs. 10.018 mln the previous week. While there’s no consensus yet for the October jobs report November 6, we do expect downside risks. Mexico reports mid-October CPI. Headline inflation is expected at 4.0% y/y vs. 4.1% in mid-September. If so, inflation would move back within the 2-4% target range for the first time since mid-August. This would give Banco de Mexico the opportunity to extend its easing cycle. Next policy meeting is November 12 and another 25 bp cut to 4.0% is expected. Most expect the cycle to end then but we see scope for extension into 2021 if disinflation continues and the peso remains relatively firm. |

Cross-Market Implied Vol, 2020 |

| EUROPE/MIDDLE EAST/AFRICA

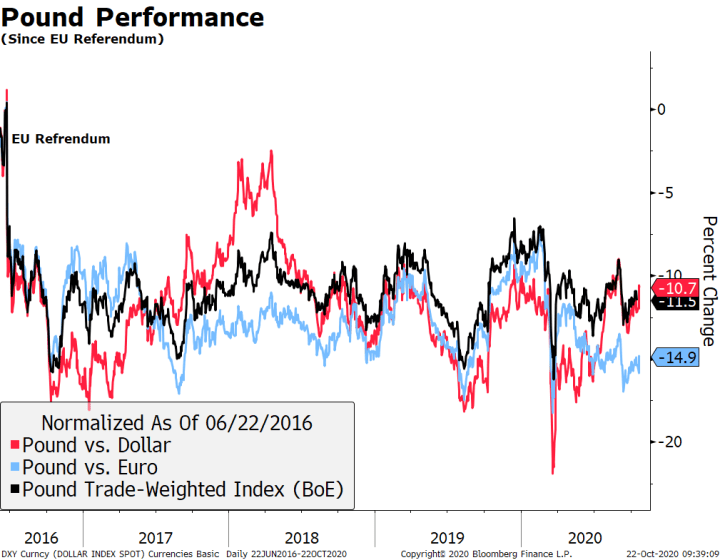

The UK has agreed to come back to the Brexit negotiating table, as widely expected. Reports suggest both sides are ready to intensify talks with the aim of striking a deal by mid-November. However, the brinkmanship theatre is likely to continue for a little while longer, as the stakes are not yet at their maximum. We are guessing that early to mid-November is when something substantial will happen. Once again, we think the skew favors being long sterling right now. That is, any negative headlines until early November will be brushed off as brinkmanship, but there is a risk (even if small) that a deal is reached ahead of that. A short euro-sterling position probably gives us a cleaner expression of this view by partially neutralizing the broad dollar moves. Sterling is about 7% weaker against the euro and 1% weaker against the dollar year to date. UK CBI industrial trends survey for October was released. Total orders component came in at -34 vs. -50 expected and -48 in September and business optimism component came in at 0 vs. -17 expected and -1 in September. CBI releases results of its distributive trade survey next Tuesday, while September retail sales data out tomorrow will likely set the tone ahead of that. Bank of Israel is expected to keep rates at 0.10%. However, a handful of analysts look for a 10 bp cut to zero. We think there is a risk that the bank expands its asset purchases in response to rising bond yields and a steepening yield curve. Also, recent shekel gains are likely to trigger a stronger response by the bank to prevent excessive appreciation. Of note, deflation eased slightly to -0.7% y/y in September but remains well below the 1-3% target range. Turkey central bank is expected to hike rates 175 bp. If so, this would take the benchmark 1-week repo rate to 12.0% and the Late Liquidity Window (LLW) rate to 15.0%. The market is split, however. Of the 27 analysts polled by Bloomberg, 2 see no change, 1 sees a 100 bp hike, 10 see a 150 bp hike, 3 see a 175 bp hike, 10 see a 200 bp hike, and 1 sees a 300 bp hike. After the surprise 200 bp hike last month, the central bank has continued to do backdoor tightening and has boosted the average cost of funds to 12.47%, moving close to the current LLW ceiling of 13.25%. Since the September 24 hike, USD/TRY has gone on to make a new record high October 14 before this latest EM rally threw a temporary lifeline to the lira. Recent gains in the currency makes a hawkish surprise today less likely. |

Pound Performance, 2016-2020 |

| ASIA

Japan reported weak September department store sales. Nationwide sales fell -33.6% y/y vs. -22.0% in August, while Tokyo sales fell -35.0% y/y vs. -29.1% in August. The deterioration is to be expected was due in large part to high base effects. Yesterday, supermarket sales fell -4.6% y/y vs. +3.3% in August. Consumers were front-running the planned consumption tax hike that came into effect last October and brought forward a lot of purchases into September. Retail sales data next week should show a similar dynamic. Japan LDP tax chief Amari said the government will put together a third supplementary budget this year. This has been widely expected and reports had suggested preparation was under way, but this is the first official confirmation. Amari said that its likely to come around December 14 or 15. Japan’s recovery remains weak and uneven compared to its DM peers and policymakers know this. They cannot be happy with recent yen strength but the BOJ is unlikely to do anything but jawbone at next week’s policy meeting. Reports suggest China is preparing a possible administrative measure to allow greater capital outflows. As we mentioned in yesterday’s daily, China has several levers to pull and lean against what had started to look like a one-way market in CNY. This time, local news sources claim that SAFE will increase the Qualified Domestic Institutional Investor (QDII) quota by $10 bln from its current level of just over $100 bln. This is more of a signal (if anything) than a substantive measure to weaken the currency. According to Bloomberg estimates, bond market inflows from foreign investors is over $100 bln so far this year, so opening the spigot by $10 bln shouldn’t do much. Again, expect more of these measures to come as USD/CNY continues trending lower. |

Tags: Articles,Daily News,Featured,newsletter