US-China relations appear to be thawing Trading was volatile after the ECB decision; we are still dollar bulls EM has benefitted from the shift in the global backdrop this week The US data highlight is August retail sales Vietnam cut rates 25 bp to 6.0%; Turkey reported July current account and IP The dollar is mostly softer against the majors ahead of the US retail sales data. Sterling and Swissie are outperforming, while Kiwi and Loonie are underperforming. EM...

Read More »Turkey Monetary Policy Planting Seeds of Future Crisis

Turkey central bank meets September 12 and is expected to cut rates 275 bp. With Erdogan talking about single digit rates and inflation, it’s clear that rates are headed significantly lower. At some point soon, we think the risk/reward for investing in Turkey will send investors fleeing for the exits.POLITICAL OUTLOOK President Erdogan sacked central bank Governor Murat Cetinkaya on July 6, ostensibly for not cutting rates quickly enough. In early August, several...

Read More »EM Preview for the Week Ahead

Despite some positive developments last week, we think the three key issues for risk assets have not been resolved yet. Hong Kong protests continue, while reports suggest the US and China remain far apart. Even Brexit has likely been given only a three month reprieve. We remain negative on EM until these key issues have been ultimately resolved. China reports August money and loan data this week but no data has been set. With the recently announced cuts in...

Read More »DM Equity Allocation Model For Q3 2019

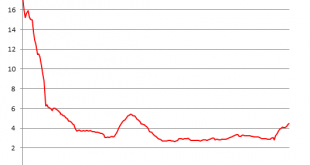

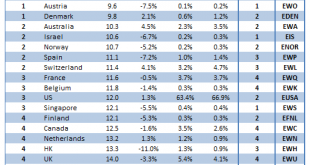

We recently introduced our Developed Markets (DM) Equity Allocation model. Building on the success of our EM model, this new framework extends our analysis to cover 24 DM equity markets. Our analysis is meant to assist global equity investors in assessing relative sovereign risk and optimal asset allocation across countries within the DM universe. DM EQUITY OUTLOOK Global equity markets have come under pressure in recent weeks as the US-China trade war intensified....

Read More »Dollar Firm Ahead of Jackson Hole

FOMC minutes were not as dovish as many had hoped; bond and equity markets are set up for a big reset Today sees the start of the annual Fed symposium in Jackson Hole; the US reports a slew of data Markit flash eurozone August PMI readings were reported; ECB publishes the account of its July 25 meeting Japan-Korea relations continue to deteriorate Indonesia delivered a dovish surprise; Mexico and Brazil report mid-August inflation data The dollar is broadly firmer...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org