Increasing virus numbers have pushed European governments to once again start imposing national measures; the week is starting off on a risk-off note Today may see the official end of stimulus talks; odds for Biden victory are increasing again but is already mostly priced in US manufacturing surveys for October will continue to roll out; Chile’s referendum on a new constitution passed in a landslide Brexit negotiations have been extended; Germany’s October IFO survey came in on the weak side; TRY has depreciated past the psychologically important 8.0 level against the dollar China’s leadership began meeting in Beijing this week to formulate the 14th five-year plan Increasing virus numbers have pushed European governments to once again start imposing national

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Increasing virus numbers have pushed European governments to once again start imposing national measures; the week is starting off on a risk-off note

- Today may see the official end of stimulus talks; odds for Biden victory are increasing again but is already mostly priced in

- US manufacturing surveys for October will continue to roll out; Chile’s referendum on a new constitution passed in a landslide

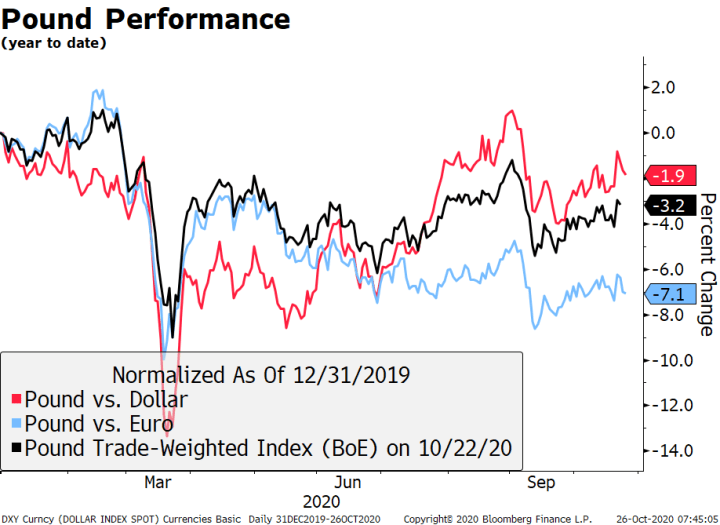

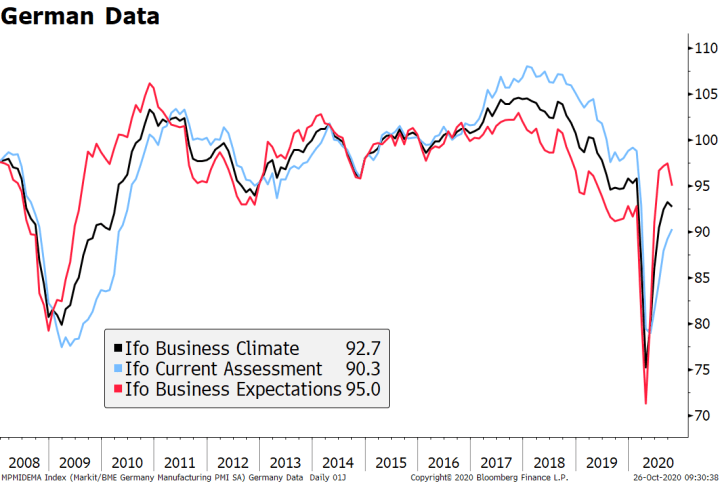

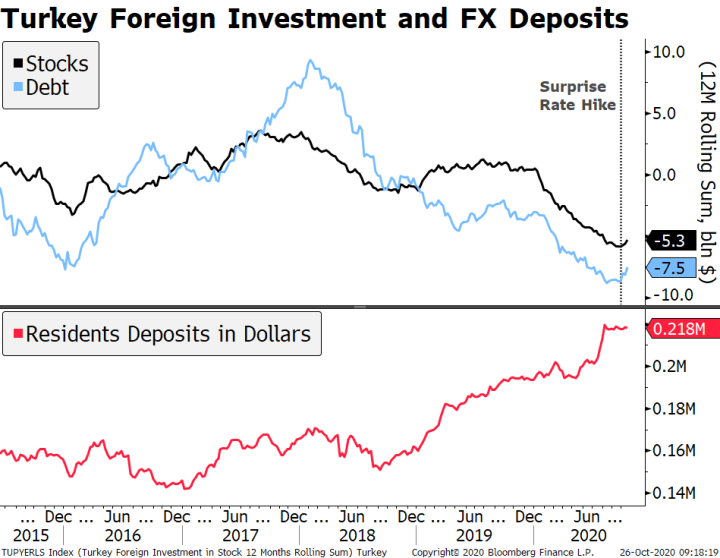

- Brexit negotiations have been extended; Germany’s October IFO survey came in on the weak side; TRY has depreciated past the psychologically important 8.0 level against the dollar

- China’s leadership began meeting in Beijing this week to formulate the 14th five-year plan

Increasing virus numbers have pushed European governments to once again start imposing national measures. While the measures are for now more limited than during the first wave, violent protests broke out in Rome in reaction to the new restrictions. Spain is imposing a national curfew (11 PM-6 AM), while Italy plans to shut down several services and limit operating hours for bars and restaurants. Bulgaria’s Prime Minister Borissov and Polish President Duda have tested positive for Covid-19. So have senior staff members of US Vice President Pence. On the positive side, the AstraZenica-University of Oxford vaccine has reportedly shown promising results in treatment for the elderly, but we need to wait for the phase 3 trials to get a more conclusive picture about its safety metrics. Separately, J&J’s vaccine could be available for emergency use by January, assuming no surprise in the results from its latest trial, expected later this year.

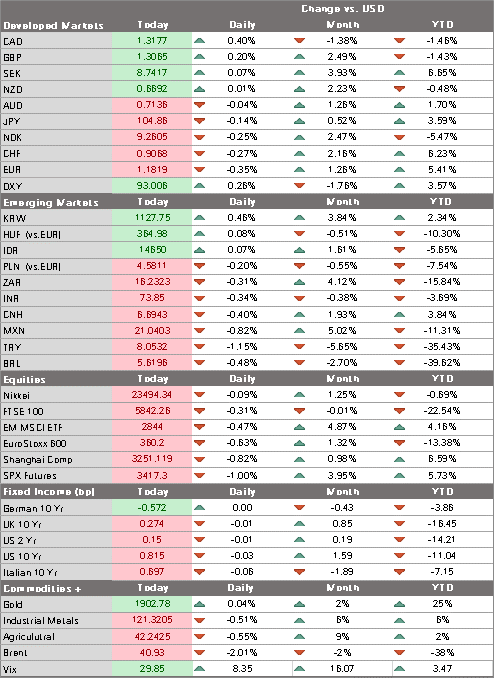

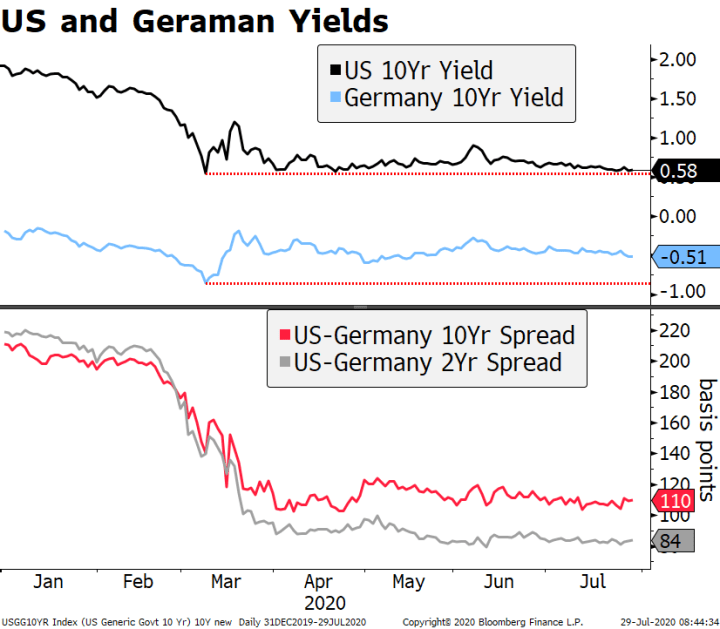

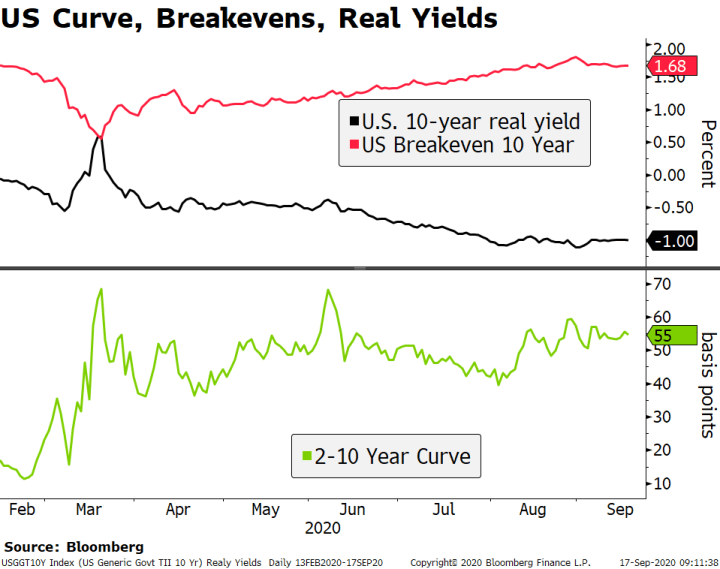

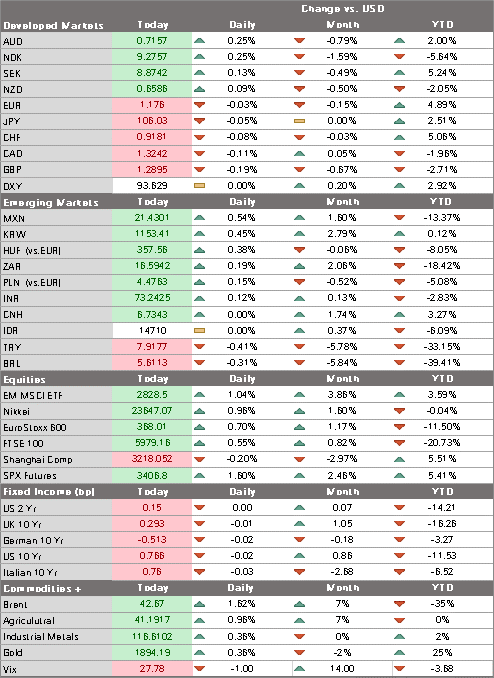

The week is starting off on a risk-off note. The dollar is bid today but selling pressure is likely to resume once again. DXY is poking back into the 93-94 range that held for most of October but gains have been limited and we still target the low for the cycle near 91.746 from September 1. The euro is testing support near $1.18 while sterling is outperforming on Brexit optimism (see below) and is holding up well above $1.30. USD/JPY is testing the 105 level but still feels heavy.

AMERICAS

Today may see the official end of stimulus talks. House Speaker Pelosi said she is awaiting a counteroffer today from Treasury Secretary Mnuchin. Both have accused the other of moving the goalposts. We think markets have come to realize that chances of a pre-election deal are nearly nil. However, we are not sure markets have priced in what we see as zero chance of a deal in 2020. Unless President Trump wins reelection, there is simply no political incentive for Congressional Republicans to pass any stimulus bill. We think it will be up to the next Congress, which means actual stimulus won’t reach households and businesses until February at the earliest.

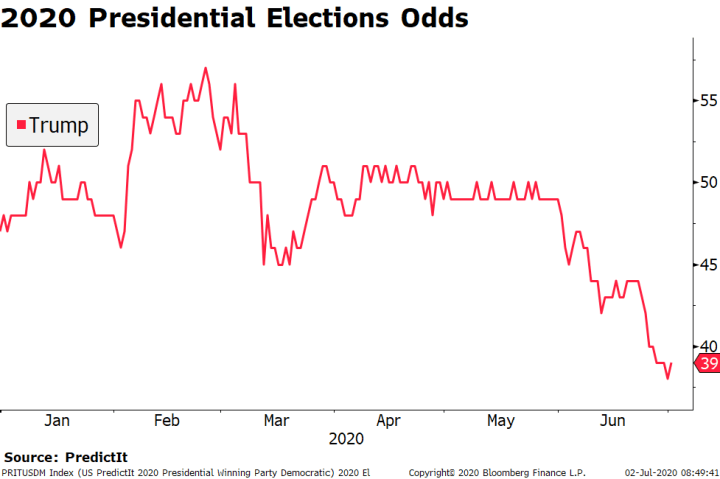

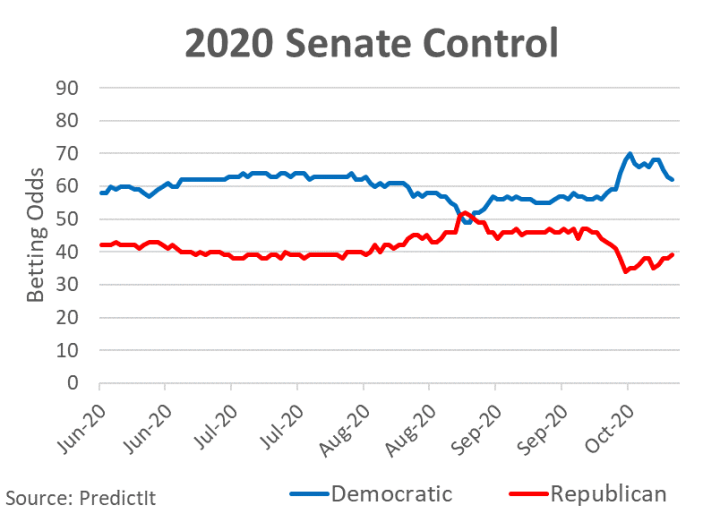

On the election front, the odds for Biden victory are increasing again but is already mostly priced in. His chance of winning is back up over 65%, according to data compiled by Real Clear Politics. This is probably due mostly to polls remaining little changed (a gap of 8-10 percentage points nationally), which means time is running out for Trump to revert the trend. The odds for a Democratic takeover of the Senate are around 60%.

Manufacturing surveys for October will continue to roll out. Dallas Fed reports today and is expected at 13.3 vs. 13.6 in September. Richmond Fed reports Tuesday and is expected at 18 vs. 21 in September. So far, the regional Fed surveys have come in relatively firm. Kansas City came in at 13 vs. 11 in September, Empire survey came in at 14.0 vs. 17.0 in September, and the Philly Fed came in at 14.8 vs. 15.0 in September. Last week, Markit preliminary October PMI readings were reported, with manufacturing at 53.3, services at 56.0, and composite at 55.5. September Chicago Fed National Activity Index (0.60 expected) and new homes sales (1.3% m/m expected) will also be reported today.

Chile’s referendum on a new constitution passed in a landslide. Nearly 80% favored replacing the Pinochet-era constitution as well as the formation of a new constitutional convention with representatives that will be elected in April. The vote triggers several years of talks and uncertainty before a new charter is promulgated. The obvious concern is that Chile will lurch too far to the left. However, it was agreed that all clauses in the new constitution must be approved by a two thirds majority.

| EUROPE/MIDDLE EAST/AFRICA

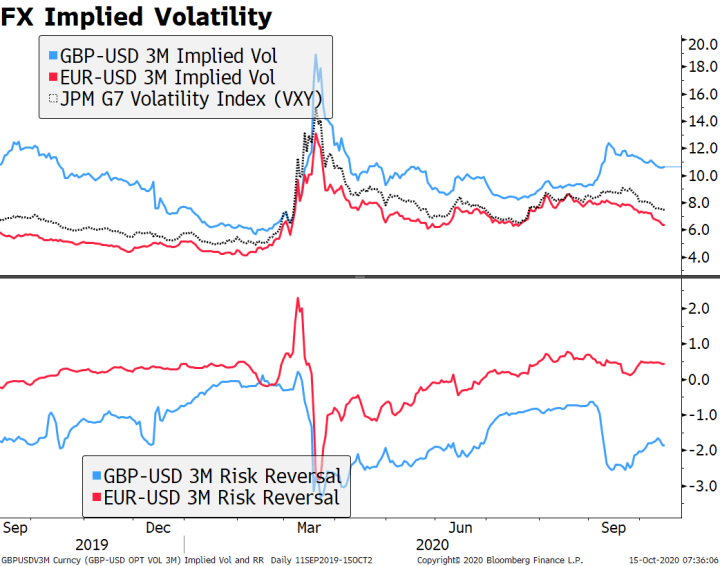

Brexit negotiations have been extended. Tope EU negotiator Barnier will reportedly remain in London until Wednesday to continue talks. Talks will then move to Brussels starting Thursday. We still think the skew favors being long sterling because negative headlines until then will be brushed off as brinkmanship, but there is a risk (even if small) that a deal is reached ahead of that. A short euro-sterling position probably gives us a cleaner expression of this view by partially neutralizing the broad dollar moves. |

Pound Performance, 2020 |

| Germany’s October IFO survey came in on the weak side. The business climate reading fell to 92.7 vs. 93.0 expected and a revised 93.2 (was 93.4) in September, while the forward-looking expectations component fell to 95.0 vs. 96.5 expected and a revised 97.4 (was 97.7) in September. With Europe moving back into restrictive mode, we don’t think near-term data points will be very useful. The direction for activity is clearly downwards, but it will take some time until we can gauge the magnitude of the decline, or how wide the gap between the services and industry will be this time around. We are hopeful that most countries will avoid national lockdowns in favor of more targeted ones. |

German Data, 2008-2020 |

| The Turkish lira has depreciated past the psychologically important 8.0 level against the dollar. Nothing much has changed in the toxic cocktail of drivers, including: lack of policy credibility, poor fundamental picture, dangerously low FX reserves, and an extremely complicated geopolitical backdrop. Foreign investor inflows have picked up ever so slightly after the September hawkish surprise, but we expect that to be short-lived. Similarly, the secular trend towards residents building up foreign currency deposits took a pause in the last few months but is likely to continue indefinitely. |

Turkey Foreign Investment and FX Deposits, 2015-2020 |

| ASIA

China’s leadership began meeting in Beijing this week to formulate the 14th five-year plan that runs from 2021 through 2025. The final plan won’t be made public before being formally approved by the National People’s Congress in March. However, some details are likely to emerge in official state media after the meetings end Thursday. Observers expect President Xi to stress rebalancing of the economy away from exports and towards domestic consumption. However, this should not be mistaken for any huge turn inwards. China will still need foreign investment, technology, and hardware and it will need to make concessions to the West. The prospects of a Biden presidency is unlikely to lead to any softening, as the US-China relationship has been changed forever. |

Tags: Articles,Daily News,Featured,newsletter