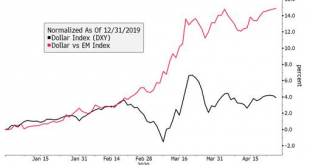

Risk-off sentiment has intensified; as a result, the dollar is getting some more traction Fed Chair Powell pushed back against the notion of negative rates in the US; US Treasury completed its quarterly refunding Weekly jobless claims are expected at 2.5 mln vs. 3.169 mln last week; Mexico is expected to cut rates 50 bp to 5.5%There have been growing discussions about negative rates in the UK; weak UK data, rising Brexit risks, and a more dovish BOE have taken a toll...

Read More »Dollar Mixed as Markets Await Fresh Drivers

The virus news stream is mixed; the dollar continues to consolidate; US-China tensions continue to rise US Treasury wraps up its quarterly refunding; April budget statement is a harbinger of things to come; the next round of stimulus will be contentious We got some dovish BOE comments yesterday; UK continues to play Brexit hardball; UK data was slightly better than expected but awful nonetheless Japan reported March current account data; RBNZ expanded its QE program...

Read More »Different Type of Crisis, Some Old Concerns

Over the past two months we have witnessed historic turmoil followed by unprecedented intervention by policy makers and central banks in supporting the capital markets (and more). In many ways the 2020 COVID-19 pandemic is very different from the 2008 global financial crisis, but for some, certain old concerns still linger. In the face of short selling bans and worries about market liquidity, we discuss below how best to navigate some of the common objections and...

Read More »Restricted Market Trading Comments

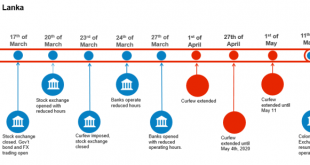

Restricted Market Trading Comments By Dara O’Sullivan, Derrick Leonard, and Ilan Solot Covid-19 related measures for restricted markets remain largely unchanged from last week. Sri Lanka and India have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity. Please see trading comments below Sri Lanka: The Colombo Stock Exchange (CSE) resumed operations today following an extended period of closure. Foreign exchange trading is...

Read More »Dollar Mixed as Doves Fly

Measures of cross-market implied volatility have been stable for a few weeks now Weekly jobless claims are expected at 3 mln; reports suggest House Democrats are pushing ahead with a possible vote next week on another relief package Canada reports April Ivey PMI; Peru is expected to keep rates steady; Brazil COPOM delivered a dovish surprise last night The Bank of England delivered a dovish hold; The Norges Bank surprised markets with a 25 bp cut to 0%; Czech...

Read More »Negative News from Europe Helps Dollar Build on Gains

UK has been confirmed to have the highest death toll in Europe the dollar is getting more traction Reports suggest Congress is resisting President Trump’s call for a payroll tax cut; ADP private sector jobs data is expected to come in at -21 mln Brazil is expected to cut rates 50 bp; Fitch cut its outlook on Brazil to negative; Chile is expected to keep rates steady Sterling remains under pressure as Brexit talks sour; the EC warned that the future of the eurozone is...

Read More »Restricted Market Trading Comments

By Dara O’Sullivan, Derrick Leonard, and Ilan Solot Covid-19 related measures for restricted markets remain largely unchanged from last week. Sri Lanka and India have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity. Please see trading comments below Sri Lanka: The government announced on May 1 that the current lockdown will remain in place until May 11, when it will be reviewed. The Colombo Stock Exchange (CSE) remains...

Read More »Dollar Remains Under Pressure as Europe Unveils Some Plans to Reopen

Global equity markets continue to trend higher; the dollar remains under pressure The two-day FOMC meeting ends today; the first look at Q1 US GDP comes out France and Spain laid out plans to reopen; the UK will rely on a contact tracing plan to limit the viral spread Ahead of the ECB meeting Thursday, European policymakers are showing a similar willingness to act as needed Fitch cut Italy by a notch to BBB- with stable outlook; Germany reports April CPI Reports...

Read More »Some Thoughts on Recent Foreign Exchange Intervention

Dollar softness this week will take some pressure off of the foreign currencies but it’s too early to sound the all clear. This piece focuses on how central banks around the world may be intervening to influence their currencies. Most of the world, particularly EM, is grappling with supporting weak currencies but a select few are dealing with stronger currencies. This is a very opaque process and so we are simply making our best guesses. As April reserves data...

Read More »Restricted Market Trading Comments

By Dara O’Sullivan, Derrick Leonard, and Ilan Solot As the week commences, a few markets such as Sri Lanka and Philippines are extending their lockdown periods while others such as Nigeria and Kenya continue to experience USD liquidity issues. Please see comments below. Sri Lanka: The Colombo Stock Exchange (CSE) was expected to resume operations on April 27 but, due to an uptick in Covid-19 cases, the exchange remains closed until May 4. Foreign exchange trading is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org