Some are holding out hope but we think the stimulus package remains dead; Fed releases its Beige Book report Wednesday; there is a full slate of Fed speakers this week Fed manufacturing surveys for October will continue to roll out; weekly jobless claims will be reported Thursday; BOC releases results of its Q3 Business Outlook Survey Monday Renewed virus restrictions are weighing on the economic outlook for the eurozone; no wonder ECB officials are sounding very...

Read More »EM Preview for the Week Ahead

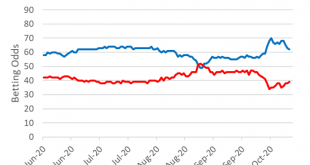

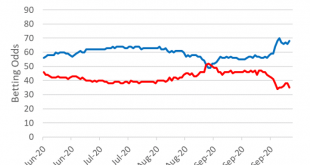

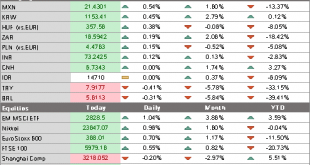

Risk assets are coming off a tough week. The dollar was bid across the board except for the yen, which outperformed slightly. The only EM currencies to gain against the dollar were KRW and CLP. The major US equity indices somehow managed to eke out very modest gains but stock markets across Europe sank as the viral spread threatens to slam economic activity again. Yet we have seen time and time again that the safe haven bid for the dollar eventually gives way to...

Read More »Dollar Gains as Market Sentiment Goes South

Virus restrictions across Europe continue to sour sentiment; the dollar is benefiting from the risk-off backdrop The stimulus package is deader than Elvis; Fed manufacturing surveys for October will start to roll out; weekly jobless claims will be reported; Chile is expected to keep rates steady at 0.5% The unofficial deadline for Brexit has likely been extended; the two-day EU summit in Brussels starts today; Israel reports September CPI Australia reported September...

Read More »Dollar Bounce Remains Modest as Headwinds Build

The dollar is making a modest comeback; stimulus talks have hit a dead end; we get more US inflation readings for September Brexit talks continue ahead of the EU summit Thursday and Friday; a new bill by the UK government could change the investment landscape in the country The EU recovery fund has hit some speed bumps; the Netherlands is the latest country to impose stricter measures; eurozone IP came in slightly lower than expected China reported strong money and...

Read More »Dollar Bleeding Stanched as Markets Search for Direction

Markets have a bit of a risk-off feel today; the dollar bleeding has been stanched for now; IMF releases its updated World Economic Outlook A stimulus package before the election appears doomed; Fed’s Barkin and Daly speak; a big data week for the US kicks off with September CPI today UK jobs data came in decidedly downbeat even though the furlough scheme has not yet ended; BOE Governor Bailey said that the bank is not yet ready to implement negative rates Japan will...

Read More »Drivers for the Week Ahead

Dollar losses are accelerating; the virtual IMF/World Bank meetings begin Monday A big stimulus package before the election still seems unlikely; there are a fair amount of Fed speakers during this holiday-shortened week The main data event this week is September retail sales Friday; ahead of that, we get inflation readings for September; Fed manufacturing surveys for October will start to roll out The account of the ECB’s September meeting added a layer of...

Read More »Dollar Slide Continues as US Fiscal Stimulus Remains Questionable

The dollar remains heavy; stimulus talks may or may not be dead; the White House is still sending mixed signals This is another quiet day in terms of US data; Canada reports September jobs data We got some more eurozone IP readings for August; following Greece yesterday, it’s Italy’s turn today to register another record low for its 10-year bond yield UK data came in significantly weaker than expected; Japan reported weak August real cash earnings and household...

Read More »Dollar Remains Heavy as Markets Await Fresh Drivers

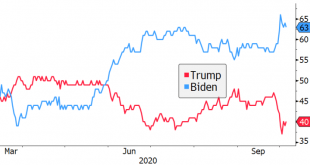

The US Vice Presidential debate was a comparatively cordial affair, though the impact on the election is likely to be limited; polls continue to move in favor of Biden, including in swing states The weak dollar narrative under a Democratic sweep continues to play out; the outlook for fiscal stimulus is as cloudy as ever; FOMC minutes contained no big surprises Weekly jobless claims will be reported; like last week, there will be a quirk to this week’s initial claims;...

Read More »Dollar Softens and US Curve Steepens as Odds of Democratic Sweep Rise

The dollar remains under pressure; the US curve continues to steepen; a compromise on fiscal stimulus before the election still seems unlikely; this is another quiet day in terms of US data President Lagarde said the ECB is prepared to inject fresh monetary stimulus to support the recovery; we expect the ECB to increase its PEPP in Q4 German factory orders came in much stronger than expected; Russia reports September CPI RBA delivered a dovish hold; the Australian...

Read More »Drivers for the Week Ahead

The US political outlook has been upended by recent developments; lack of a significant safe haven bid for the dollar so far is telling This is a very quiet week in terms of US data; FOMC minutes will be released Wednesday; there is a full slate of Fed speakers The eurozone has a fairly heavy data week; Brexit talks continue in London; UK has a heavy data week Japan has a fairly heavy data week; RBA meets Tuesday and is expected to keep policy unchanged; that same...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org