Optimism on a stimulus deal remains high; the FOMC decision will be key; the dollar tends to weaken on recent FOMC decision days November retail sales will be the US data highlight; Markit reports preliminary December PMI readings; Canada reports November CPI The latest Brexit headlines are sounding optimistic; UK November CPI came in weaker than expected; eurozone December preliminary PMI provided an upside surprise; EU regulators lifted their curb on bank...

Read More »Some Thoughts on the Latest Treasury FX Report

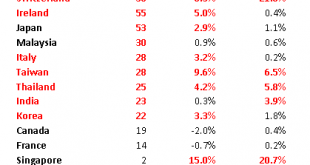

The US Treasury’s latest “Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States” report named Switzerland and Vietnam as currency manipulators. Both countries came under scrutiny in the last report and so this week’s announcement was only surprising in that it was made by a lame duck administration that will be gone in a month. RECENT DEVELOPMENTS This is the first Treasury FX report since January. In previous administrations, the...

Read More »FOMC Preview

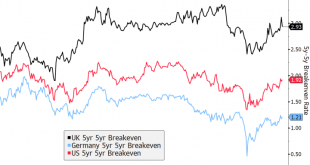

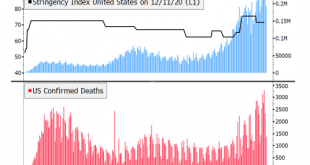

The two-day FOMC meeting starts tomorrow and wraps up Wednesday afternoon. While no policy changes are expected, we highlight what the Fed may or may not do. We expect a dovish hold, with Powell underscoring the growing downside risks facing the US economy in the coming months. RECENT DEVELOPMENTS The US outlook has worsened since the November FOMC meeting. Infection numbers are making new highs with no sign of abating. There is no national strategy to contain the...

Read More »Drivers for the Week Ahead

The Senate passed a stopgap bill late Friday that will keep the government funded until midnight this Friday; optimism on a stimulus deal appears to be picking up; the two-day FOMC meeting ending with a decision Wednesday will be important November retail sales Wednesday will be the US data highlight for the week; Fed manufacturing surveys for December will start to roll out; weekly jobless claims Thursday will be important; Canada has a busy data week Brexit talks...

Read More »Dollar Rally Running Out of Steam Ahead of ECB Decision

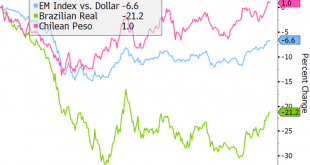

Stimulus talks drag on; US November CPI will be today’s data highlight; US Treasury wraps up a big week of auctions today with $24 bln of 30-year bonds on offer The November budget statement will hold some interest; weekly jobless claims will be closely watched; Brazil left rates unchanged at 2.0% but made some important hawkish changes to its forward guidance; Peru is expected to keep rates steady at 0.5% Brexit negotiations have been extended again; two-day EU...

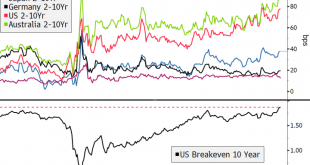

Read More »Jittery Markets Keep the Dollar Afloat (For Now)

US fiscal negotiations are taking longer than expected; US Treasury auctions $56 bln of 3-year notes; we believe the Fed is watching the yield curve closely; Brazil reports November IPCA inflation; Chile kept rates on hold at 0.50% and tweaked its asset purchase program UK Prime Minister Johnson is going to Brussels for high-level Brexit negotiations with EC President von der Leyen; there are no signs of progress in the EU budget and recovery fund negotiations;...

Read More »Some Thoughts on a Potential US Government Shutdown

The US Congress has returned from recess with a lot on its plate. Priority must be given to passing an omnibus spending bill that prevents a government shutdown after December 11. The next round of fiscal stimulus has taken on greater urgency and may be attached to the wider spending bill. RECENT DEVELOPMENTS The Senate returned from recess Monday and the House returns today. Much of the work ahead will be done behind the scenes as lawmakers negotiate passage of an...

Read More »Dollar Stabilizes but Weakness to Resume

There are new efforts to pass another round of stimulus sooner rather than later; we warn against getting too optimistic; US bond yields rose in anticipation of stimulus; Fed Chair Powell and Treasury Secretary Mnuchin gave somewhat conflicting outlooks for the US The Fed releases its Beige Book report for the December FOMC meeting; ADP releases its private sector jobs estimate, with consensus at 430k; Brazil outperformed yesterday on positive fiscal comments from...

Read More »Dollar Plumbs New Depths With No Relief In Sight

Stimulus talks continue but the goalposts have indeed been moved; the good news is that a package before year-end is looking more likely; optimism regarding stimulus continues to buoy US yields ISM services PMI is expected at 55.8 vs. 56.6 in October; weekly jobless claims data will be reported; Fed Beige Book report was suitably downbeat The noise level around Brexit continues to rise are we approach the finish line; eurozone and UK data came in firmer than...

Read More »Dollar Weakness Resumes as Short-Covering Fades

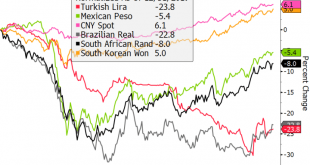

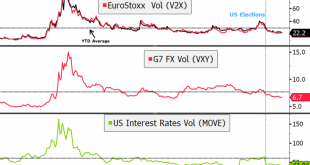

Sentiment is being buoyed by two incrementally positive stories; cross-markets implied volatility measures continue to trend lower; dollar weakness has resumed President-elect Biden will reportedly officially name his first cabinet picks today; Fed manufacturing surveys for November will continue to roll out; Brazil and Mexico both reports mid-November inflation readings German IFO Business Climate survey for November was mixed; UK national lockdown will end next...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org