Why would anyone sell when further gains are guaranteed? Because the gains are unreal but the losses are real. When markets are soaring and your portfolio is rocketing higher, the gains seem unreal. Did I really make that much in one day, week, month? Wow! With the gains higher every time you look, it would be foolish to sell because look at the flood of media reports on “the Roaring 20s” that are predicted with such certitude that it’s essentially guaranteed, the reflation that’s lifting all boats globally, the Federal Reserve printing trillions to further inflate the market, and the millions of new traders scooping fantastic gains. Why would anyone be idiotic enough to sell when the Bull Market is just getting started? Indeed. Sure, you sold to book those crazy

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

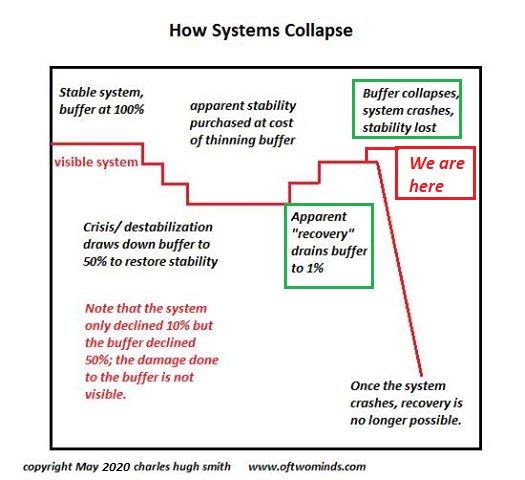

Why would anyone sell when further gains are guaranteed? Because the gains are unreal but the losses are real. When markets are soaring and your portfolio is rocketing higher, the gains seem unreal. Did I really make that much in one day, week, month? Wow! With the gains higher every time you look, it would be foolish to sell because look at the flood of media reports on “the Roaring 20s” that are predicted with such certitude that it’s essentially guaranteed, the reflation that’s lifting all boats globally, the Federal Reserve printing trillions to further inflate the market, and the millions of new traders scooping fantastic gains.

Why would anyone be idiotic enough to sell when the Bull Market is just getting started? Indeed. Sure, you sold to book those crazy gains in a couple of speculative frenzies, but you bought right back in to grab the next booster rocket higher.

There is only one thing more painful than watching the market continue higher after you sold: and that is holding on for the inevitable bounce and losing your entire profit.

There is only one thing more painful than watching the market continue higher after you sold: and that is holding on for the inevitable bounce and losing your entire profit.

There is only one thing more painful than holding on for the inevitable bounce and losing your entire profit: and that is continuing to hold because you’re so sure the market will bounce big-time that you lose much or most of your capital.

There is only one thing more painful than being so sure the market will bounce big-time that you lose much or most of your capital: and that’s refusing to accept your losses and hanging on until you’ve lost all your capital.

There is only one thing more painful than refusing to accept your losses and hanging on until you’ve lost all your capital: and that is realizing you still owe the government an enormous sum for the capital gains you reaped on the way up but no longer have the money to pay.

Why would anyone sell when further gains are guaranteed? Because the gains are unreal but the losses are real. Put another way: the gains aren’t really yours until you sell and pocket them in cash. (Best to pay your estimated taxes the day after you book the gains, as a third of those gains aren’t really yours, they belong to the government.)

Gains are unreal, losses are real.

Tags: Featured,newsletter