[This article is part of the Understanding Money Mechanics series, by Robert P. Murphy. The series will be published as a book in late 2020.] Starting with Carl Menger’s undisputed role in the “marginal revolution,” which ushered in subjective value theory, the Austrian school has made important contributions that have been absorbed into standard economic theory. However, the Austrian theory of the business cycle is still something unique to the school, differing not only from the Keynesian (see Chapter 14) but also the market monetarist (see chapter 15) explanations. Indeed, if someone asks, “Why study Austrian economics?,” the present author answers that only the Austrian approach—with its emphasis on the economy’s intricate capital structure and an appreciation

Topics:

Robert P. Murphy considers the following as important: 6b) Mises.org, Carl Menger, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

[This article is part of the Understanding Money Mechanics series, by Robert P. Murphy. The series will be published as a book in late 2020.]

Starting with Carl Menger’s undisputed role in the “marginal revolution,” which ushered in subjective value theory, the Austrian school has made important contributions that have been absorbed into standard economic theory. However, the Austrian theory of the business cycle is still something unique to the school, differing not only from the Keynesian (see Chapter 14) but also the market monetarist (see chapter 15) explanations.

Indeed, if someone asks, “Why study Austrian economics?,” the present author answers that only the Austrian approach—with its emphasis on the economy’s intricate capital structure and an appreciation for the guidance that market prices offer to entrepreneurs—can explain modern business cycles. Given the unprecedented actions of central banks following the 2008 financial crisis and now the 2020 coronavirus panic, it is more important than ever for investors and citizens to familiarize themselves with the Austrian perspective.

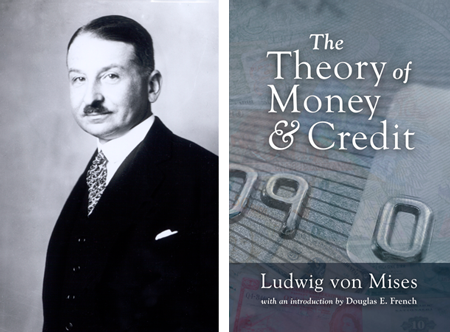

The present chapter summarizes the theory of the business cycle originally published in 1912 by Ludwig von Mises and elaborated by Friedrich Hayek (who would win a Nobel Memorial Prize in 1974 partly for this work1). This summary will be intuitive; the endnotes provide a list of further reading, both for newcomers and for advanced students of economics.2

Mises’s Framework for Money and Banking

Although Carl Menger founded the Austrian school in 1871 with his book Principles of Economics, in the twentieth century the acknowledged leader of the Austrians was Ludwig von Mises. Most modern fans associate him with his magnum opus, Human Action (first published in 1949), but Mises’s pathbreaking work on money, banking, and the business cycle was contained in his 1912 German book, translated as The Theory of Money and Credit.3

In this early book, before presenting his explanation of the business cycle (or what he called the “trade cycle”), Mises first offered a threefold classification of types of money: commodity money, fiat money, and credit money. What is fascinating to a modern reader is that Mises, writing in 1912, says of the second category:

It can hardly be contested that fiat money in the strict sense of the word is theoretically conceivable. The theory of value proves the possibility of its existence. Whether fiat money has ever actually existed is, of course, another question, and one that cannot off-hand be answered affirmatively. It can hardly be doubted that most of those kinds of money that are not commodity money must be classified as credit money. But only detailed historical investigation could clear this matter up. [Mises 1912, p. 61, bold added.]

Besides reminding modern readers of the charming times when all major currencies were backed by the precious metals—such that Mises could not even be sure whether fiat money had ever existed—this passage is crucial to establish that the Austrian theory of the business cycle isn’t based on fiat money. Indeed, Ludwig von Mises developed his explanation of the boom-bust cycle at a time when he didn’t even think fiat money had ever been in use. So clearly, the Misesian theory of recessions isn’t directly tied to the abandonment of the gold standard, and it’s therefore not a problem for Austrians to explain depressions (or “panics”) that occurred during the days of the classical gold standard.

Likewise, when it came to banking operations, in his 1912 book Mises distinguished between two types of credit transactions, namely commodity credit and circulation credit:

Credit transactions fall into two groups…On the one hand are those credit transactions which are characterized by the fact that they impose a sacrifice on that party who performs his part of the bargain before the other does—the foregoing of immediate power of disposal over the exchanged good…This sacrifice is balanced by a corresponding gain on the part of the other party to the contract—the advantage of obtaining earlier disposal over the good acquired in exchange…

The second group of credit transactions is characterized by the fact that in them the gain of the party who receives before he pays is balanced by no sacrifice on the part of the other party….In the credit transactions of the second group, the granter of the credit renounces for the time being the ownership of a sum of money, but this renunciation (given certain assumptions that in this case are justifiable) results for him in no reduction of satisfaction. If a creditor is able to confer a loan by issuing claims which are payable on demand, then the granting of the credit is bound up with no economic sacrifice for him.…

It seems desirable to choose special names for the two groups of credit transactions in order to avoid any possible confusion of the concepts. For the first group the name Commodity Credit…is suggested, for the second the name Circulation Credit. [Mises 1912, pp. 264–65, bold added.]

In a loan involving commodity credit, someone lends (say) 100 barrels of oil today in exchange for a promise of 110 barrels of oil delivered in a year’s time. This credit transaction involves the renunciation of the oil for twelve months by the lender; he can’t simultaneously lend it out and still have the oil. Likewise, it would also be an example of commodity credit if someone lent $100 in currency to a borrower who promised to pay back $110 in a year. Because the lender would no longer physically possess the currency, this would be a genuine deprivation, a sacrifice of present goods for the hope of obtaining a greater number of future goods, and hence would be considered commodity credit.

However, under the practice of “fractional reserve banking” (which we explained in detail in chapters 5 and 7), there is a sense in which a lender can lend out his funds while still enjoying the benefits of holding the money. For example, when a man deposits $100 in his checking account, upon which he earns interest because the bank then lends out $90 to a new borrower, even though this is a credit transaction, the original depositor still thinks that he has $100 in the bank. This is what Mises has in mind when he says that there are credit transactions in which the renunciation of the lender “results for him in no reduction of satisfaction.” Thus, to the extent that bank loans involve unbacked claims to money, where the total customer deposits exceed the total reserves of actual money in the vaults, the loans constitute circulation credit in the Misesian framework.

It’s significant that Mises himself didn’t call his explanation “the Austrian theory of the business cycle,” which is today’s popular (yet somewhat generic) term. Rather, he used the more specific description “the monetary or circulation credit theory of the trade cycle.”4 We have explained Mises’s terminology to show that his theory was based on the fact that commercial banks could “create money” (in the broad sense of the term) by lending out deposits even though the depositors still thought they had the ability to immediately redeem “their” money.

To be sure, to this day one of the biggest controversies within Austrian circles concerns the validity (or lack thereof) of fractional reserve banking and the related question of whether Mises himself endorsed or opposed the practice.5 But there is no doubt that Mises’s theory of the business cycle is based on the ability of the private commercial banks to create money through the issuance of new loans using deposits that the depositors still think are in their checking accounts.6

It is true that central banks can influence these commercial bank practices in a harmful way, but the Misesian theory isn’t about central banks (or fiat money) per se. It is thus no embarrassment for the Austrian theory that the United States suffered depressions and panics even before the formation of the Federal Reserve in 1913. Furthermore, when modern fans of Mises discuss the business cycle, they should be careful to avoid claiming that it necessarily starts with a central bank injecting new fiat money into the economy.

How Banks Cause the Business Cycle

In Mises’s view, the economy relies on a sophisticated interlocking structure of capital goods that must reflect the preferences of the consumers over the timing of the flow of goods and services. For example, if most people in the community are very future oriented—economists would say they have low time preference—then they will save a large fraction of their income and interest rates (other things equal) will tend to be low, fostering long-term investment projects. In contrast, if most people in the community are present oriented—meaning they have high time preference—then they won’t save much, and the corresponding high interest rates will be a signal to entrepreneurs “penalizing” long-term projects.

Now, because commercial banks enjoy the legal ability to create money by issuing loans in excess of their reserves in the vault—again, see chapters 5 and 7 for the details of this process—Mises argued that they could temporarily push the actual, market rate of interest below the “natural” rate corresponding to genuine consumer time preference and saving.7 In effect, the banks can create new money and lend it out to borrowers even though there are no corresponding savers on the other end of the transaction.

The influx of new credit and lower interest rates causes a boom. Entrepreneurs make calculations based on the “cheap credit” and start long-term projects, hiring workers and bidding up the prices of raw materials. So long as the cheap credit policy continues, people feel prosperous.

However, the boom can’t last. Just because the commercial banks decide to lend out money—even though households haven’t engaged in more saving—and cut interest rates, doesn’t actually create more barrels of crude oil, factory capacity, or inventory in warehouses. If the economy had originally been in a long-run equilibrium at the higher interest rate, it is now embarked on an unsustainable trajectory at the artificially lower interest rate.

In a typical boom, the banks eventually become skittish, perhaps because of rising prices or other indicators, and they abandon their cheap credit policy. That is, the banks stop injecting new amounts of unbacked money into the loan market, and the interest rate rises toward a more appropriate level. At this point, many entrepreneurs realize that they had been too ambitious, and they either scale back operations or shut down altogether. The workers who had been drawn into the unsustainable projects during the boom years must be laid off in order for their labor to (eventually) be reallocated to more sustainable outlets that are consistent with genuine consumer preferences and saving behavior.

Mises’s Analogy of the Master Builder

In the preceding section we laid out the essence of Mises’s theory of the business cycle. Yet in order to understand its implications, one of the most useful analogies was created by Mises himself. When responding to the claim that his was an “overinvestment” theory, Mises explained in Human Action:

The whole entrepreneurial class is, as it were, in the position of a master-builder whose task it is to erect a building out of a limited supply of building materials. If this man overestimates the quantity of the available supply, he drafts a plan for the execution of which the means at his disposal are not sufficient. He oversizes the groundwork and the foundations and only discovers later in the progress of the construction that he lacks the material needed for the completion of the structure. It is obvious that our master-builder’s fault was not overinvestment, but an inappropriate employment of the means at his disposal. [Mises [1949] 1998, p. 557, bold added.]

And thus we see that Mises doesn’t say that the banks’ injection of new money into the loan market causes overinvestment. Rather, he says that their policies cause malinvestment.

| Imagine a master builder working on a house. Thinking he has a certain quantity of materials—bricks, wood, glass, shingles, etc.—at his disposal, he draws up blueprints and assigns various skilled and unskilled workers to their tasks. | |

| But suppose that the builder had overestimated how many bricks he originally had. In that case, the house depicted in his blueprints would be physically unattainable. The moment the builder realized his error—in other words, when he realized that his actual supply of remaining bricks was smaller than what his plans required—his immediate response would be to tell everyone on the work site to halt! Our master builder needs to revise the blueprints in light of the new information, and he doesn’t want workers squandering scarce bricks or other materials until he knows the new plan. |

This is a good metaphor for the market economy in the throes of a credit-induced boom-bust cycle. During the boom period, driven by the influx of unbacked money and artificially cheap credit, entrepreneurs begin various projects that are physically unsustainable: there is simply not enough “real” savings to carry all of the projects to completion.

The sooner the entrepreneurs realize their error, the better. That is, the sooner the banks end their cheap credit policy, the quicker they can nip the festering malinvestments in the bud.

In any event, whenever the boom ends and the entrepreneurs face reality, the immediate response is a slowdown in production. Factors of production, including workers’ labor hours, must be rearranged. If everyone kept going to work and doing the same activities as during the boom years, there would eventually be an even bigger crisis.

In the Austrian view, paradoxically, the boom period is actually harmful, while the bust period, though unpleasant, is a healthy return to reality. According to Mises, the only way to permanently cure recessions is to stop letting banks foster the preceding artificial booms.

- 1. See Friedrich Hayek’s Nobel award notification here: “Friedrich August von Hayek – Facts,” NobelPrize.org, May 11, 2020, https://www.nobelprize.org/prizes/economic-sciences/1974/hayek/facts/.

- 2. For beginners, here is a list of treatments of Austrian business cycle theory that are accessible yet comprehensive: Murray Rothbard’s “Austrian Business Cycle Theory, Explained” (excerpted from his America’s Great Depression), Mises Wire, July 9, 2019, available at: https://mises.org/wire/austrian-business-cycle-theory-explained; Mark Thornton’s book The Skyscraper Curse: And How Austrian Economists Predicted Every Major Economic Crisis of the Last Century (Auburn, AL: Ludwig von Mises Institute, 2018), available at: https://mises.org/library/skyscraper-curse; Robert P. Murphy, Choice: Cooperation, Enterprise, and Human Action (Oakland, CA: Independent Institute, 2015), chap. 14; and Shawn Ritenour, Foundations of Economics: A Christian View (Eugene, OR: Wipf and Stock, 2010), chap. 13. For advanced readers, here are more technical expositions of the Austrian approach: The collection of essays The Austrian Theory of the Trade Cycle, ed. Richard M. Eberling (Auburn, AL: Ludwig von Mises Institute, 1996), available at: https://mises.org/library/austrian-theory-trade-cycle-and-other-essays; Ludwig von Mises’ collection of essays The Causes of the Economic Crisis, and Other Essays before and after the Great Depression, ed. Percy L. Greaves Jr. (Auburn, AL: Ludwig von Mises Institute, 2006), available at: https://mises.org/library/causes-economic-crisis-and-other-essays-and-after-great-depression; and Mises, Human Action: A Treatise on Economics, scholar’s ed., (1949; Auburn, AL: Ludwig von Mises Institute, 1998), chap. 20, available at: https://mises.org/library/human-action-0. For the very technical work by Hayek, see his Prices and Production, second ed. (1935; repr., New York: Augustus M. Kelly Publishers, 1967), available at: https://mises.org/library/prices-and-production. Finally, to see the Hayekian vision expressed with the toolbox of mainstream economic theory, see Roger W. Garrison’s Time and Money: The Macroeconomics of Capital Structure (New York: Routledge, 2001), as well as his excellent PowerPoint shows available at http://webhome.auburn.edu/~garriro/tam.htm.

- 3. The 2009 edition of The Theory of Money and Credit is available free from the Mises Institute at https://mises.org/library/theory-money-and-credit. See also the free study guide for the book written by the current author at: Study Guide to The Theory of Money and Credit (Auburn, AL: Ludwig von Mises Institute, 2011), https://mises.org/library/study-guide-theory-money-and-credit.

- 4. In footnote 1 (p. 423) of the most recent edition of The Theory of Money and Credit, Mises writes: “Part III of the present book (pp. 261–366) is entirely devoted to the exposition of the trade-cycle theory, the doctrine that is called the monetary or circulation credit theory, sometimes also the Austrian theory.” In his 1949 English-language work Human Action, Mises titles the crucial section in chapter 20 as “8. The Monetary or Circulation Credit Theory of the Trade Cycle.”

- 5. For a discussion and links to further reading on the intra-Austrian debates on fractional reserve banking, see Robert P. Murphy, “More Than Quibbles: Problems with the Theory and History of Fractional Reserve Free Banking,” Quarterly Journal of Austrian Economics 22, no. 1 (Spring 2019): 3–25, available at https://mises.org/library/more-quibbles-problems-theory-and-history-fractional-reserve-free-banking.

- 6. For example, after laying out his framework Mises says, “Our theory of banking, like that of the Currency Principle, leads ultimately to a theory of business cycles.” The Theory of Money and Credit, trans. J.E. Baton (1912, 1953; repr., Auburn, AL: Ludwig von Mises Institute, 2009), p. 365.

- 7. In The Theory of Money and Credit Mises writes, “The issuers of the fiduciary media are able to induce an extension of the demand for them by reducing the interest demanded to a rate below the natural rate of interest, that is below that rate of interest that would be established by supply and demand if the real capital were lent in natura without the mediation of money” (pp. 306–07). However, in his exposition in Human Action Mises no longer uses this term, but instead contrasts the bank-distorted gross market rate of interest with the rate of “originary interest,” which he defines as “the difference between the valuation of present and future goods” (p. 536).

Tags: Carl Menger,Featured,newsletter