Risk-off sentiment has intensified; as a result, the dollar is getting some more traction Fed Chair Powell pushed back against the notion of negative rates in the US; US Treasury completed its quarterly refunding Weekly jobless claims are expected at 2.5 mln vs. 3.169 mln last week; Mexico is expected to cut rates 50 bp to 5.5%There have been growing discussions about negative rates in the UK; weak UK data, rising Brexit risks, and a more dovish BOE have taken a toll on sterling ECB Vice President de Guindos said the region’s economy has “hit the bottom”; the EC is getting ready to roll out a new economic plan to help the most affected countries Japan machine tool orders plunged -48.3% y/y in April; Australia reported weak April jobs data The dollar is mostly

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Risk-off sentiment has intensified; as a result, the dollar is getting some more traction

- Fed Chair Powell pushed back against the notion of negative rates in the US; US Treasury completed its quarterly refunding

- Weekly jobless claims are expected at 2.5 mln vs. 3.169 mln last week; Mexico is expected to cut rates 50 bp to 5.5%

There have been growing discussions about negative rates in the UK; weak UK data, rising Brexit risks, and a more dovish BOE have taken a toll on sterling - ECB Vice President de Guindos said the region’s economy has “hit the bottom”; the EC is getting ready to roll out a new economic plan to help the most affected countries

- Japan machine tool orders plunged -48.3% y/y in April; Australia reported weak April jobs data

The dollar is mostly firmer against the majors as risk-off sentiment picks up. Yen and Loonie are outperforming, while the growth-sensitive Scandies and Antipodeans are underperforming. EM currencies are broadly weaker. TRY and RUB are outperforming, while HUF and CZK are underperforming. MSCI Asia Pacific was down 1.5% on the day, with the Nikkei falling 1.7%. MSCI EM is down 1.0% so far today, with the Shanghai Composite falling 1.0%. Euro Stoxx 600 is down 1.9% near midday, while US futures are pointing to a lower open. 10-year UST yield is down 3 bp at 0.62%, while the 3-month to 10-year spread is down 3 bp at +51 bp. Commodity prices are mixed, with Brent oil up 4.3%, WTI oil up 5.1%, copper down 0.5%, and gold flat.

The dollar is mostly firmer against the majors as risk-off sentiment picks up. Yen and Loonie are outperforming, while the growth-sensitive Scandies and Antipodeans are underperforming. EM currencies are broadly weaker. TRY and RUB are outperforming, while HUF and CZK are underperforming. MSCI Asia Pacific was down 1.5% on the day, with the Nikkei falling 1.7%. MSCI EM is down 1.0% so far today, with the Shanghai Composite falling 1.0%. Euro Stoxx 600 is down 1.9% near midday, while US futures are pointing to a lower open. 10-year UST yield is down 3 bp at 0.62%, while the 3-month to 10-year spread is down 3 bp at +51 bp. Commodity prices are mixed, with Brent oil up 4.3%, WTI oil up 5.1%, copper down 0.5%, and gold flat.

Risk-off sentiment has intensified. Fed Chair Powell warned of a deeper than expected downturn yesterday, while several investment heavyweights came out with some bearish equity calls. These calls come out even as the economic data continue to worse, underscoring the risks ahead. Equity markets are in the red worldwide, while US equity futures are pointing to a lower open.

As a result, the dollar is getting some more traction. DXY is trading near 100.40, near the highs of this month. If those highs are taken out, the April 24 high near 100.867 comes into focus. The euro is trading back below $1.08 and remains heavy, while sterling is trading below $1.22 at the lowest level since April 7. Given the still-high Brexit and EU risks, we suspect both currencies will continue to move lower.

AMERICAS

Fed Chair Powell pushed back against the notion of negative rates in the US. His forceful pushback helped the dollar get some traction. However, he also painted a pretty negative outlook for the economy, which added to the risk-off vibe that typically favors the dollar. Yet Fed Funds futures are still implying negative rates by Q2 2021. Kashkari and Kaplan speak today. We suspect the negative rates issue will continue to come up and we expect the Fed to keep pushing back against the notion.

The negative rate debate is not just for the US. WIRP suggests a small chance of BOE going negative in early 2021 (see below), as well as rising chances of the ECB and BOJ going more negative in late 2020. On the other hand, WIRP suggests BOC, RBA, and RBNZ are not expected to go negative, at least for now.

The US Treasury completed its quarterly refunding. The $22 bln of 30-year bonds sale was solid but not as strong as the two previous legs. The bid to cover ratio was 2.30 vs. 2.35 previously and the yield 1.342% vs. 1.325% previously. Contrast this with the US 10-year auction Tuesday, where the ratio was 2.69 vs. 2.43 previously, and the 3-year sale Monday, where the ratio was 2.54 vs. 2.27 previously. Yields fell from the previous auction for the two shorter legs. The total of $96 bln on offer compares to $84 bln last quarter and all in all, the markets were able to absorb the steadily growing issuance.

US inflation readings were worse than expected but largely irrelevant for the markets. PPI headline reading came in yesterday at -1.2% y/y vs. -0.4% expected and +0.7% in March, while core PPI came in at 0.6% y/y vs. 0.8% expected and 1.4% in March. CPI was reported Tuesday, with headline inflation plunging to 0.3% y/y vs. 0.4% expected and 1.5% in March and core falling to 1.4% y/y vs. 1.7% expected and 2.1% in March. Deflationary forces are at work here but there are no immediate policy implications beyond the obvious that US rates will stay low for a long, long time.

Weekly jobless claims are expected at 2.5 mln vs. 3.169 mln last week. If so, this would mean that around 36 mln will have become jobless over the last eight weeks, which is nearly 25% of the labor force. The BLS said that the 14.7% unemployment rate reported last week for April would have been five percentage points higher if not for misclassification of workers impacted by the pandemic. Even that is likely underreporting the truly awful state of the US labor market. US also reports April import/export prices. Canada reports March manufacturing sales, which are expected to fall -4.5% m/m.

Banco de Mexico is expected to cut rates 50 bp to 5.5%. A couple of outliers see cuts of 75 and 100 bp. April inflation came in at 2.15%, the lowest since December 2015 and near the bottom of the 2-4% target range. There has been no inflation pass-through from the weak peso and so the bank has ample room to cut rates further this year.

| EUROPE/MIDDLE EAST/AFRICA

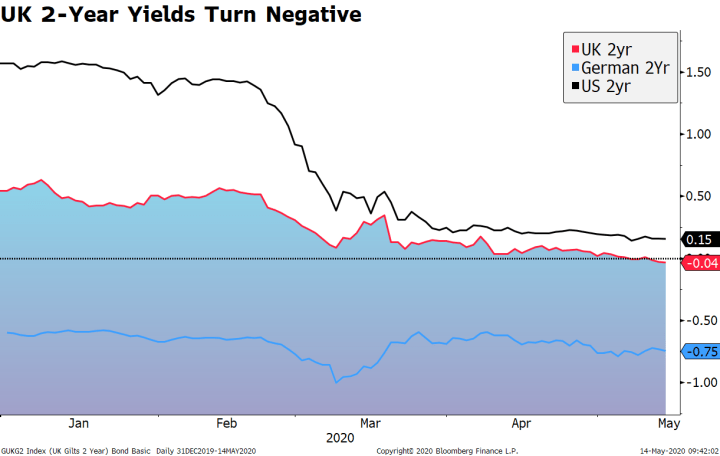

Like the US, there has been growing discussions about the possibility of negative rates in the UK. Futures contracts are near zero out towards mid-2021 as 2-year gilt yields turned negative earlier in the week, while WIRP suggests a very small chance of negative rates by early 2021. We just don’t think this is likely. Like the case of the US, officials have already started pushing back. BOE Governor Broadbent, for example, said that going sub-zero could do more harm than good. That said, officials including Governor Bailey have also signaled that more QE could be in the cards, which is in line with our view. |

UK 2-Year Yields Turn Negative |

| The combination of weak data, rising Brexit risks, and a more dovish BOE have taken a toll on sterling. Cable is trading just below $1.22 at the lowest level since April 7. Break of that day’s low near $1.2165 would set up a deeper move to the $1.2030 area.

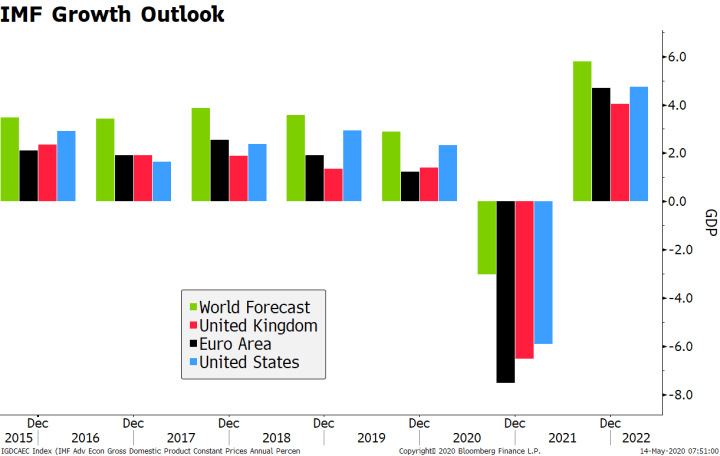

ECB Vice President de Guindos said the region’s economy has “hit the bottom in terms of the contraction.” We don’t doubt it, given that re-opening is starting in many countries. The problem is how long it will take for the economy, and especially consumption, to start picking up. Another concern is that we could settle into a multi-year new normal for demand and consumer behavior. In short, the fog of uncertainty is still too thick. |

IMF Growth Outlook, 2015-2022 |

On the positive side, it looks as if the European Commission is getting ready to roll out a new economic plan to help the most affected countries. The details are not out yet, but it will be a recovery instrument that will co-exist with the bloc’s budget and directed towards public investments and reforms in the most affected countries. Meanwhile, Italy approved it’s €55 bln stimulus package. The money will go to income measures (unemployed, furloughed workers, and self-employed), tax cuts, and funding for struggling companies.

ASIA

Japan machine tool orders plunged -48.3% y/y in April. This compares to -40.7% in March and confirms that Q2 will be even worse than Q1 in terms of economic contraction. With all the market talk about negative rates in other countries, BOJ Kuroda appears to be putting rate cuts as a low probability response, instead favoring further QE in terms of adding more stimulus. USD/JPY is stuck near 107, right in the middle of the 106-108 range seen since mid-April.

Australia reported weak April jobs data. The headline reading came in at -594.3k vs. -575k expected, while the unemployment rate rose to 6.2% vs. 8.2% expected and 5.2% in March. The breakdown saw -220.5k full-time jobs and -373.8k part-time jobs. For now, it seems the RBA is on hold so that it can better gauge the impact of its unconventional policies before tweaking them. It is worth noting that WIRP suggests 50% odds that the RBA cuts rates to zero, though negative rates are not seen currently. Next policy meeting is June 2.

Tags: Articles,Daily News,Featured,newsletter