Summary:

Interview with Robert Hartmann, Co-Owner ProAurum Over the last couple of months, we’ve witnessed unprecedented changes in the global economy, in the markets and in our societies. The corona crisis and the governmental measures that were introduced had a dramatic and direct effect on all of us, as investors and as citizens. That is especially true of precious metals investors. A new gold rush is now underway, with impressive price gains and elevated demand levels that are expected to persist. However, this skyrocketing demand, triggered by the panic in stock markets, coincided with a historic supply shock back in March, creating serious and widespread disruptions in the physical precious metals market. To discuss exactly what happened, what the experience

Topics:

Claudio Grass considers the following as important: 6a) Gold & Bitcoin, 6b.) Claudio Grass, Corona, Crisis, Economics, Featured, Finance, Gold, Monetary, newsletter, ROBERT HARTMANN, Thoughts, Uncategorized

This could be interesting, too:

Interview with Robert Hartmann, Co-Owner ProAurum

Over the last couple of months, we’ve witnessed unprecedented changes in the global economy, in the markets and in our societies. The corona crisis and the governmental measures that were introduced had a dramatic and direct effect on all of us, as investors and as citizens.

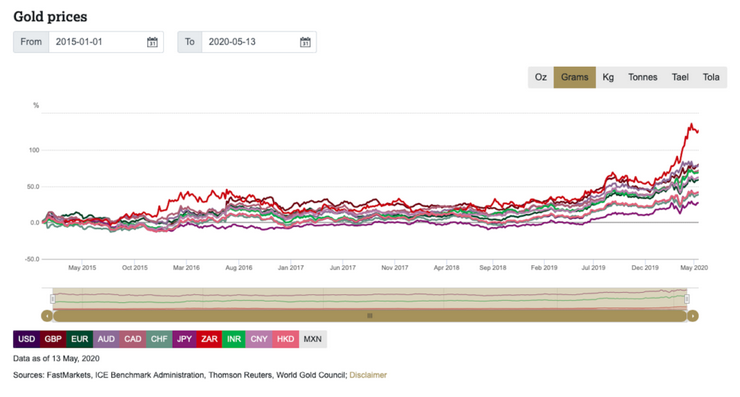

That is especially true of precious metals investors. A new gold rush is now underway, with impressive price gains and elevated demand levels that are expected to persist. However, this skyrocketing demand, triggered by the panic in stock markets, coincided with a historic supply shock back in March, creating serious and widespread disruptions in the physical precious metals market. To discuss exactly what happened, what the experience was like in the “frontline” and what to expect going forward, I turned to Robert Hartmann, one of the founders of pro aurum, whose experience in the investment world and in precious metals spans decades.

—–

Claudio Grass (CG): The corona crisis has introduced unprecedented risks and heightened levels of uncertainty, both among investors and among the general public. What is your own reaction to this extraordinary shift and your overall outlook of the global economy going forward?

Robert Hartmann (RH): I think it is important to understand that the risks in our financial system were already considerable before the corona crisis. I’m not an economist, but common sense clearly tells me that the gigantic orgy of debt on the part of governments and companies, coupled with ever lower interest rates, is not sustainable in the long run. The interest-bearing asset classes with negative real interest rates simply no longer make sense, due to the intervention of the central banks. Debtor risks have long ceased to be reflected in valuations.

The corona crisis is exacerbating and accelerating this mispricing even further. It is no longer billions of euros that are being created out of thin air, as in previous crises; this time it’s trillions. Also, in contrast to the last rescue operation in 2008-2009, this time a large part of the money is being injected directly into the real economy. This means that more money is now chasing a decreasing amount of goods. I learned at school that this will have an inflationary effect.

It looks to me as if the central banks are using more and more resources in their effort to resuscitate and reactivate the global financial system with their respective bailouts at more or less regular intervals of around 10 years. In the process, more and more anomalies are being created, which certainly would not have occurred without this interference. When I look at some key metrics and indicators, such as the gold/oil ratio, the gold/silver ratio, the gold/platinum ratio or the valuations of major stock markets in comparison to the GDP of their respective countries, the extreme deviations from the historical averages can be seen very clearly. Decisions on where to invest your capital in the medium to long term are becoming increasingly difficult for investors.

CG: The physical gold market was especially affected by the supply chain and production disruptions that governmental measures introduced. We saw very unusual premiums and widespread shortages in March, while the price for “paper” gold diverged from the physical. Can you explain what happened and why?

RH: We experienced the perfect storm in the precious metals markets in general and gold and silver in particular. Practically without warning, all major gold producers in Switzerland, that account for around 70% of global bullion production, were shut down by official channels. At the same time, there were dramatic restrictions on air travel, so the import of the most important bullion coins, such as the Krugerrand (South Africa), the Maple Leaf (Canada) or the American Eagle (USA), was simply no longer possible. As for the silver coins from Australia and Canada, we had to wait about four weeks for deliveries from the producers, for coins we had already paid for.

Amid this supply shock, demand from German and European investors rose to an all-time high. Many traders were only able to obtain goods on the secondary market (i.e. not from the producers), refinancing rates for precious metal loans multiplied, freight rates exploded by a factor of 10-20 and the bid-ask spread for an ounce of paper gold rose to a peak of almost USD100. These are all hard costs that precious metal traders had to pass on to their customers.

CG: How about now? Is the situation in physical gold normalized or do you expect there might be further disruptions and risks down the road?

RH: After the bar producers in Switzerland partially resumed their production and the volatility has abated, the premiums for physical bars and coins have already decreased.

The pressure has eased somewhat over the past 8 days and we are receiving around 30-35% fewer orders from customers than we did at the end of March. Now that the stock markets have recovered, many investors are probably relatively more optimistic about what the economy will look like after the end of the shutdown. That gives us some breathing space. We are, however, expecting a new wave and we’re prepared for it. Regardless of the rosy picture that stock markets might paint at the moment, the corona crisis is far from over. When its impact becomes even more apparent, we expect another gold rush and the higher the prices rise, the more demand there will be.

At the end of the day, gold and silver in their physical form cannot be created at will like paper money or bonds. I have repeatedly highlighted this simple fact at every opportunity over the past 20 years. So many people still seem to be oblivious to the nature of fiat money and its inherent risks. Only 10-15% of Germans are invested in physical precious metals.

CG: How is pro aurum positioned for the challenging months that follow? How have you prepared for possible risks ahead?

RH: We have done very well compared to other retailers over the last 3 months. To a large extent, we owe this to our dealers, who already ramped up our inventories to the limit in the run-up to the crisis. This enabled us to supply not only our private customers, but also our banking partners and even other precious metal traders. We also took important proactive steps internally, as we deployed our staff flexibly, so that our customers could always reach us. In our newsroom, we published an update almost daily on the situation at pro aurum.

Currently, we are in the process of replenishing our stocks as much as possible, while we are also processing all orders that are still open from the time after Easter. Overall, the corona crisis was a valuable experience that we will undoubtedly benefit from in the future, like we did from the lessons learned during the stormy times of the 2008 crisis and from the buying spree in December 2019, shortly before the lowering of the cash limit for anonymous precious metal purchases in Germany.

Newsroom of pro aurum, the leading precious metals company in Europe with an independent subsidiary in Switzerland.

This work is licensed under a Creative Commons Attribution 4.0 International License.

Interview with Robert Hartmann, Co-Owner ProAurum Over the last couple of months, we’ve witnessed unprecedented changes in the global economy, in the markets and in our societies. The corona crisis and the governmental measures that were introduced had a dramatic and direct effect on all of us, as investors and as citizens. That is especially true of precious metals investors. A new gold rush is now underway, with impressive price gains and elevated demand levels that are expected to persist. However, this skyrocketing demand, triggered by the panic in stock markets, coincided with a historic supply shock back in March, creating serious and widespread disruptions in the physical precious metals market. To discuss exactly what happened, what the experience

Topics:

Claudio Grass considers the following as important: 6a) Gold & Bitcoin, 6b.) Claudio Grass, Corona, Crisis, Economics, Featured, Finance, Gold, Monetary, newsletter, ROBERT HARTMANN, Thoughts, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Tags: Corona,Crisis,Economics,Featured,Finance,Gold,Monetary,newsletter,ROBERT HARTMANN,Thoughts,Uncategorized