World stocks eased back from record highs and fell for the first time in eight days, as jitters about Catalonia’s independence push returned while bets on higher U.S. interest rates sent the dollar to its highest since mid August; S&P 500 futures were modestly in the red – as they have been every day this week before levitating to record highs – ahead of hurricane-distorted nonfarm payrolls data (full preview here). U.S. jobs report will also be released Friday with a speech on monetary policy by the New York Fed chief. On Thursday the S&P 500 reached its latest all-time high after better-than-forecast American factory orders and hawkish comments by SF Fed President John Williams reinforced optimism in the world’s

Topics:

Tyler Durden considers the following as important: ASX 200, Bank Indonesia, Bank of England, Bank of Japan, Bloomberg Dollar Spot, Bond, Business, Catalan parliament, Catalan's Parliament, Catalonian parliament, Central Banks, China, conservative party, Consumer Credit, Continuing Claims, Copper, CPI, Crude, Crude Oil, DAX 30, Deutsche Bank, Donald Trump, Economics, economy, Equity Markets, European Central Bank, European Union, Featured, Fed Speak, Federal Reserve, flash, Foreign exchange market, France, Germany, Global Economy, global macro, Gulf of Mexico, Hang Seng 40, Hang Seng China Enterprises, Harvard University, headlines, Hong Kong, IBEX 35, inflation, Initial Jobless Claims, Interest Rate, International Monetary Fund, Italy, Japan, Jim Reid, John Williams, Macroeconomics, Mexico, Monetary Policy, MSCI Asia Pacific, NASDAQ, New Normal, New York Fed, newsletter, Nikkei, Nikkei 225, nonfarm payrolls, OPEC, Organization of Petroleum-Exporting Countries, Precious Metals, Price Action, Rating Agency, recovery, Reserve Bank of Australia, Reuters, S&P 500, S&P/ASX 200, S&P, S&P 500, S&P/ASX 200, Saudi Arabia, Senate, Spanish Constitutional Court, Spanish government, Stoxx 600, SWIFT, Swiss Franc, Topix, trade deficit, Trump Administration, Unemployment, US Dollar Index, US Federal Reserve, VIX, Volatility, White House, Wholesale Inventories, World Economic Outlook, Yen

This could be interesting, too:

investrends.ch writes Bloomberg: DWS stoppt Private-Credit-Geschäft in Asien

investrends.ch writes Deutsche Bank bleibt auf Rekordkurs

investrends.ch writes DWS mit neuem Vertriebsleiter für Institutionelle

investrends.ch writes Deutsche Bank mit Gewinnsprung – Aktie steigt

| World stocks eased back from record highs and fell for the first time in eight days, as jitters about Catalonia’s independence push returned while bets on higher U.S. interest rates sent the dollar to its highest since mid August; S&P 500 futures were modestly in the red – as they have been every day this week before levitating to record highs – ahead of hurricane-distorted nonfarm payrolls data (full preview here). U.S. jobs report will also be released Friday with a speech on monetary policy by the New York Fed chief.

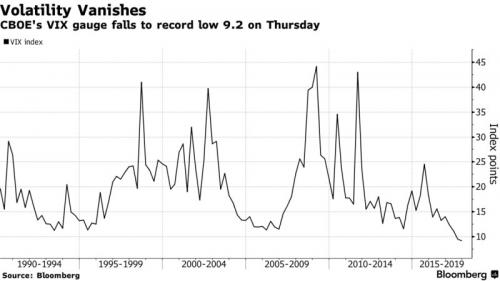

On Thursday the S&P 500 reached its latest all-time high after better-than-forecast American factory orders and hawkish comments by SF Fed President John Williams reinforced optimism in the world’s largest economy, and pushed the dollar higher. Oil fell and the gold price edged higher. The VIX declined to a new record low going back to 1990. |

CBOE VIX Gauge, 1990 - 2019 |

“Uncertainty about whether Catalonian parliament will meet on Monday persists,” Commerzbank strategists said in a note.

Friday’s other focus for markets will be U.S. jobs data due out at 830am ET. Wall Street consensus is for a 90,000 print down from 156,000 new jobs in August. The number however will be largely distorted by hurricanes, resulting in a drop in jobs offset by a rise in wages. The number will be largely meaningless, because as Bloomberg’s David Finnery writes, “any weakness will be attributed to hurricanes, while a beat on payrolls or wages would be seen as supporting a Federal Reserve interest rate increase in December.”

As Deutsche Bank writes overnight, it’s fair to say that inflation is a more important variable than employment at the moment for central banks. An in-line ADP print (135k) earlier in the week and decent employment component readings out of the ISM’s makes it feel like the whisper number is slightly above the market consensus for today of 80k (vs. 156k in August). DB economists expect a 50k reading, noting that the initially reported September 2005 employment report, which followed Hurricane Katrina, showed a -35k decline in nonfarm payrolls after averaging 174k over the three months ending in August 2005. It’s worth noting that the highest and lowest economist forecasts on Bloomberg for today are 260k and -45k – so the street collectively appears pretty confused. In these high intensity wage/inflation watching times, the average hourly earnings will be key.

Since U.S. data this week has been solid on the whole, it has been one of the reasons for the dollar’s strength by also feeding bets that the Federal Reserve will raise U.S. interest rates for a third time this year in December. According to Reuters, interest rate futures traders are now pricing in an 86 percent likelihood of a December rate hike, up from 78 percent a week ago, according to the CME Group’s FedWatch Tool. Aberdeen Standard Investments Senior Investment Manager James Athey said the question now was what happens next year. Not only is inflation still subdued but the Fed could well get a new head.

“Investors need a lot of convincing about how far this Fed will hike without some decent wage growth and inflation,” he said. “In any case, the Fed’s thinking is going to be extremely hard to predict over the coming months as so many members change.”

Ahead of the payrolls report, Asian stocks rose, set to cap their best week since July, after U.S. economic reports and Fed speaker comments bolstered optimism on the global economy. The MSCI Asia Pacific Index climbed 0.2% to 163.17, its highest close in two weeks. With China’s holiday week coming to an end, and maindland market still closed, the Hang Seng Index posted its biggest weekly increase since mid-July and closed at its highest since December 2007 as Geely Automobile Holdings – the year’s top performer – helped offset loses by Macau casino operators. The Hang Seng Index rose 0.3% to 28,458.04 after earlier advancing as much as 0.9%; the index rose 3.3% on the week. Hang Seng China Enterprises Index adds 0.5% for weekly gain of 5%. Japan’s Topix index rose, completing its fourth weekly gain, as banks and insurance shares climbed. Australian shares advanced, halting a three-day slide, as BHP Billiton Ltd. and Rio Tinto Ltd. led a rally of metals producers.

European equities traded marginally flat, with underperformance evident in the IBEX: Spanish stocks and bond prices, which surged on Thursday, were sent tumbling back again as a Catalonian official said the region’s parliament would meet on Monday in defiance of a ruling by Spain’s constitutional court. Spain’s defiance also sent the euro scuttling back below $1.17 again and gave the dollar another leg up as it headed for a fourth consecutive week of gains a move that is also starting to apply pressure to currency-sensitive emerging markets. The higher than expected German Industry Orders paved no immediate bearish pressure in German Bunds, despite opening marginally weaker, led by the US following hawkish Fed commentary yesterday.

The Bloomberg Dollar Spot Index extended its gains, rising to an 11 week high as it moved above yearly trendline resistance before U.S. payrolls, while Treasuries were pressured after London stepped in. The Yen is set to post its fourth straight weekly loss against the dollar, which will make the longest streak since early July. The loonie hit a five-week low ahead of Canadian labor data, while the pound headed for its biggest weekly decline versus the dollar since last October’s ‘flash crash’ as doubts on Theresa May’s future as U.K. Prime Minister grew, with many of her own party members demanding she quit. Sterling was set for its steepest weekly drop against the euro since July. It could slip even further given the chaos within the Conservative party and less-than-encouraging U.K. economic data, analysts said. This is a swift turn in fortunes for the pound.

In rates, the yield on 10-year Treasuries advanced two basis points to 2.36 percent, the highest in more than 12 weeks. Germany’s 10-year yield rose three basis points. Britain’s 10-year yield was unchanged at 1.387 percent, the highest in eight month.

In commodities Brent crude was down 0.1 percent at $56.94 a barrel. The futures contract had jumped 2.1 percent overnight on signs Saudi Arabia and Russia would limit production through next year, although caution towards a tropical storm heading for the Gulf of Mexico cut short the advance. Gold gained 0.1 percent to $1,269.48 an ounce. Copper advanced 0.1 percent to $3.05 a pound, the highest in more than three weeks.

Aside from US nonfarm payrolls, looking ahead highlights include the Canadian jobs reports, BoE’s Haldane, Fed’s Bostic, Dudley and Kaplan.

Market Snapshot

- S&P 500 futures down 0.06% to 2,548.50

- VIX Index up 0.8%

- STOXX Europe 600 down 0.2% to 390.31

- MSCI Asia up 0.2% to 163.17

- MSCI Asia ex Japan up 0.4% to 538.72

- Nikkei up 0.3% to 20,690.71

- Topix up 0.3% to 1,687.16

- Hang Seng Index up 0.3% to 28,458.04

- Shanghai Composite up 0.3% to 3,348.94

- Sensex up 0.6% to 31,773.78

- Australia S&P/ASX 200 up 1% to 5,710.68

- Kospi up 0.9% to 2,394.47

- German 10Y yield rose 2.8 bps to 0.484%

- Euro down 0.1% to $1.1699

- Italian 10Y yield fell 4.4 bps to 1.857%

- Spanish 10Y yield rose 5.9 bps to 1.758%

- WTI crude down 0.5% to $50.53

- Brent drops 0.5% to $50.55

- Gold spot up 0.07% to $1,269.16

- U.S. Dollar Index up 0.1% to 94.06

Top Headline News

- U.S. President Donald Trump said a military gathering Thursday night might represent “the calm before the storm,” without clarifying his comments

- Crisis in Spain: Spanish Prime Minister Mariano Rajoy convenes his cabinet on Friday as Catalan lawmakers plan to hold a meeting on Monday defying a suspension by Spain’s Constitutional Court

- The Trump administration is set to release its blueprint for overhauling regulation of U.S. markets, an expansive list of priorities that touches on the stock, bond and derivatives trading that fuels Walls Street profits

- German manufacturing orders rose 7.8% y/y in August, the fastest expansion since 2016, in a sign that Europe’s largest economy is set to sustain its robust pace of growth

- With U.K. PM Theresa May’s leadership in doubt, four scenarios are that (1) May clings on, with lawmakers calculating a leadership battle would lead to another election that they may lose to Labour (perceived by markets as the least bad option), (2) that May is ousted, triggering a leadership race, (3) that May resigns and a consensus leader emerges, or (4) a general election where Labour’s Corbyn wins

- The national working group on Swiss franc reference rates recommended SARON as alternative to the Swiss franc Libor

- Japan Credit Rating Agency says it may consider downgrading Japan’s AAA sovereign rating if the government “completely’’ or “effectively’’ gives up its balanced-budget target

- Tokyo Governor Yuriko Koike’s opposition party released an election manifesto ahead of the Oct. 22 vote that distances it from the Bank of Japan’s controversial stimulus program while indicating that any change will be so gradual that it’s unlikely to roil markets

- HSBC Currency Unit Used Code to Trigger Front- Running, U.S. Says

- Costco Fourth Quarter EPS Beats Estimates

- U.S. Delays Announcement on Bombardier Jet Duties

Asian stocks took the impetus from another record day on Wall St where all major indices hit new all-time highs, with the S&P 500 posting its longest win streak in around 4 years and Nasdaq outperformed on tech strength. This underpinned sentiment in the region with ASX 200 (+1.04%) led higher by commodity names after gains in copper and crude oil. Nikkei 225 (+0.30%) printed its highest in 2 years but with gains somewhat capped as participants were tentative ahead of today’s Non-Farm Payrolls report and the extended weekend, while Hang Seng (+0.3%) also conformed to the global upbeat sentiment as Hong Kong participants picked up from where they left off on return from yesterday’s market closure. 10yr JGBs were subdued with a lack of demand seen amid gains in riskier assets and as the BoJ’s presence in the market for JPY 710bln of 5yr to super-long JGBs failed to support. RBA’s Harper says not ruling out a rate cut and a rate response could be warranted should a wider stalling of consumption happen.

Top Asian News

- Bank Indonesia Sees Narrowing Window for Policy Rate Easing

- StanChart Is Said to Be Probed on $1.4 Billion Client Transfers

- Ivory Coast Starts Alstom Rail Talks After Hyundai Edged Out

European bourses have traded subdued, with Spain and Italy the noticeable under-performers, down around 0.50%; the former’s IBEX trades around session lows, following a Catalan official stating parliament will meet on Monday, not helped by the weakness specifically in peripheral banks. The higher than expected German Industry Orders paved no immediate bearish pressure in German Bunds, despite opening marginally weaker, led by the US following hawkish Fed commentary yesterday. The US will stay in focus later in the session, with focus on NFP, possibly touted to be an anomaly figure, following the catastrophic hurricanes seen in the States. Elsewhere, Spanish yields continue to trade higher, alongside other European bonds. The German 10y breaking through the 161.00 handle, likely a result of 25000 contracts pushing the asset class down from 161.08.

Top European News

- German Factory Orders Surge as Economy Sustains Strong Momentum

- With May’s Leadership in Doubt, Four Scenarios for Brexit

- U.K. Home-Price Inflation Accelerates to Fastest in Seven Months

- Swiss Working Group Recommends Saron as CHF-Libor Alternative

- EU Steelmakers Win Hot-Rolled-Coil Tariffs on Four More Nations

- Catalan Separatists Squeezed Further as Spain Tightens Grip

In currencies, the NFP trade has been evident across FX markets, with the majority of major pairs seeing range bound trade. The week’s strong US data has kept the greenback set for its fourth week of gains, as the DXY broke 94.00 in Asian hours. GBP has ground slowly lower through early European trade, as the currency continues to be hampered by concerns over PM May, with reports staying that around 30 rebels are calling for her immediate departure. The EUR dipped below 1.17 amid the strength in the USD-index, although 1.1690 holding firm for now, while cross related buying in EUR/GBP has stemmed the downside in EUR. Political woes escalating in the UK could likely see EUR/GBP back at 0.90. Huge expiries in EUR/USD likely to guide price action with 6.3bln worth of vanilla options from 1.1640-1.1750.

In commodities, WTI has consolidated above 50.00/bbl, but looks indecisive as non-farm Friday is the theme of the day. Commentary has been muted today, with Saudi Arabia making no firm pledge yesterday to extend a deal between OPEC, Russia and other producers on cutting supplies but said it was ‘flexible’. Copper was the metal highlight overnight, buoyed by news that the re-opening of one of the world’s biggest mines has run into trouble. Copper managed to break through the 3.00 handle on the news and has consolidated above 3.02. Precious metals have been in rangebound trade, with many likely set to await today’s payroll report.

Looking at the day ahead, the change in nonfarm and manufacturing payrolls, September unemployment rate, hourly earnings, wholesale inventories, and consumer credit are all due. Onto other events, BOE’s Chief economist Haldane speaks at the “Great Trust Shift” debate. In the US, we have three more Fed speakers, including: Bostic, Kaplan and Dudley, with the latter speaking on “The Monetary Policy Outlook and the Importance of Higher Education for Economic Mobility”.

US Event Calendar

- 8:30am: Change in Nonfarm Payrolls, est. 80,000, prior 156,000

- Change in Private Payrolls, est. 74,000, prior 165,000

- Change in Manufact. Payrolls, est. 10,000, prior 36,000

- Unemployment Rate, est. 4.4%, prior 4.4%

- Average Hourly Earnings MoM, est. 0.3%, prior 0.1%

- Average Hourly Earnings YoY, est. 2.5%, prior 2.5%

- Average Weekly Hours All Employees, est. 34.4, prior 34.4

- Labor Force Participation Rate, prior 62.9%

- Underemployment Rate, prior 8.6%

- 10am: Wholesale Trade Sales MoM, est. 0.0%, prior -0.1%; Wholesale Inventories MoM, est. 1.0%, prior 1.0%

- 3pm: Consumer Credit, est. $15.5b, prior $18.5b

DB’s Jim Reid concludes the overnight wrap

I got home last night from my US trip to find my wife on the floor changing one twin’s nappy whilst bottle feeding the other with her foot. I have never seen anything like it. After rushing to her aid we then eventually watched the final Narcos of season 3 – a season we have watched whilst feeding the twins on our laps of an evening. Given the shocking violence I’m wondering what impact this will have on them (Kray twins??) but needs must! Age appropriate programs are a bit of a barbell really as up to a certain age it surely doesn’t matter (I hope). However at what age should you stop a baby watching say a violent 18 movie, only to allow them again a decade and a half or so later? Answers welcome. Narcos comes highly recommended by the way. I can believe it’s actually a true story!

The Colombian politics in Narcos actually make current global political meanderings seem a bit dull, but the headlines continue to fly. However one could argue that the last 24 hours is a nice microcosm for markets in 2017. We’ve had plenty of headlines (mainly political) but volatility continues to remain historically low with the VIX below 10 for the 7th session in a row yesterday and in fact hitting the lowest closing level on record last night (9.19) beating the 9.31 in December 1993, but still higher than the intra-day low of 8.84 in July this year.

Equity markets continued to grind higher with a late bounce in Europe helping stocks to just about finish onside. The S&P 500 meanwhile rose +0.56% to finish higher for the 8th session in a row (longest run since July 2013) and also notch up yet another record high. It’s worth noting that the late recovery in Europe appeared to be driven by Spain, following the news that Catalan separatists are on the verge of putting off a definitive declaration of independence. This supposedly follows some on the Catalan side as pushing for a negotiated settlement. Prior to this, the Spanish Constitutional Court had announced that it was suspending a session of the Catalan Parliament on Monday although rebels say they are still planning to convene. The Spanish Press also reported that CaixaBank was considering a temporary move of its legal domicile to the Balearic Islands which might have helped temper the separatists push. In the evening, Banco Sabadell announced plans to move out of the region and into Alicante. It seems the Spanish Government are going to make this easier for companies to relocate in order to put pressure on the rebels. A strong 2 year auction was also a help to sentiment earlier in the session. 10yrs Bonds rallied 7.8bp (the best day since late July) and the IBEX rebounded +2.51%. Bunds on the other hand were broaldy flat on the day but 2.9bp off the intra-day lows at the close. Overall it feels like there are quite a few more ebb and flows to this Spanish story to come though. Will the Catalan’s Parliament meet on Monday and will they declare independence in the new few days? Or will the business community exodus create an incentive to negotiate.

Moving onto today, the payrolls report will be the next main market hurdle although the hurricane impacts will mean the information contained within it will have less value than normal. It’s also fair to say that inflation is a more important variable than employment at the moment for central banks. An in-line ADP print (135k) earlier in the week and decent employment component readings out of the ISM’s makes it feel like the whisper number is slightly above the market consensus for today of 80k (vs. 156k in August). Our US economists expect a 50k reading though. They’ve noted that the initially reported September 2005 employment report, which followed Hurricane Katrina, showed a -35k decline in nonfarm payrolls after averaging 174k over the three months ending in August 2005. It’s worth noting that the highest and lowest economist forecasts on Bloomberg for today are 260k and -45k – so the street collectively appears pretty confused. In these high intensity wage/inflation watching times, the average hourly earnings will be key. Our guys expect a solid 0.3% m/m partly for technical reasons.

Leading into the report Treasuries were flattish for much of the European session yesterday before yields spiked 3.8bp on the back of comments from the Fed’s Harker and Williams, before closing 2.5bp higher for the day. The former said that he had “pencilled in” a third rate hike this year for December, while Williams (a voter next year) sounded generally upbeat on the inflationary environment, noting that “as these (temporary) effects wane and the strong economy pushes inflation higher for prices….I am optimistic that inflation will move up to our 2% goal over the next couple of years”. Further, the “favourable employment numbers, combined with findings on inflation and steady pace of growth, are all behind my confidence that rates will need to rise to their new normal levels”. The odds of a December rate hike rose c3ppt overnight to 73.3% (per Bloomberg).

Staying with all things rates focused, the ECB meeting minutes weren’t a huge event but confirmed that there exists a trade-offs between the various taper announcements that could be made at the October meeting: We discovered that “the benefits from a longer intended purchase horizon, combined with a greater reduction in pace, were compared with those from a shorter period of purchases and larger monthly volumes”. This follows various ECB comments of late suggesting that the momentum is moving towards a taper to EUR30bn/month but with a 9 month commitment over EUR40bn for 6 months. It could be that this is a compromise between the hawks and doves in that there is less QE but the program is reduced more steadily with the added benefit that it would also get us past the Italian election and all the noise that could come with a fresh taper decision just as they have to vote. DB have changed their call for the October meeting from 40bln x 6mths to 30bln x 9mths, and dropped the call for a oneoff depo hike in mid-2018 but still sees the first refi rate hike in mid-2019.

This morning in Asia, markets have followed the positive lead from the US and are trading modestly higher. As we type, the Hang Seng (+0.44%), Nikkei (+0.25%) and ASX 200 (+0.80%) are all up modestly. The Chinese bourses and Kospi remain closed for holidays.

Turning to the UK, Conservative lawmaker Ed Vaizey publicly noted his concerns about PM May continuing as leader and then Grant Shapps (who served as Conservative Party Chaiman) said he has a list of colleagues who want to choose a new leader of the party. DB’s Oliver Harvey has published a timely note “Brexit update: leadership options” looking at potential implications and scenarios if there was a leadership change. His base case is PM May will stay on, at least until the current stage of Brexit negotiations and autumn Budget are concluded. This is in part given the lack of obvious replacements. Other less likely scenarios considered include a full leadership contest and an orderly transition to a new leader. Overall, he believes that developments continue to point to an EEA-based transitional deal as the realistic medium term direction of travel. Please refer to his note for more details.

Quickly recapping other market performance yesterday. Increased signs of stability at Spain boosted European markets, with Italian 10y bond yields down 4bp and equities broadly higher, with the Stoxx 600 (+0.16%), FTSE (+0.54%) and Italy’s FTSE MIB (+0.49%) all modestly higher, but the DAX dipping 0.02%. Over in the S&P, the rally was broad based with only two sectors marginally in the red (telco & utilities, both -0.1%), while gains were led by tech stocks (+1.06%) and financials.

Turning to currencies, the US dollar index gained 0.54% to a 2 months high, following stronger than expected macro data and hawkish Fed speak. Elsewhere, Sterling weakened 0.97%, partly due to increased concerns on a potential leadership change, but the Euro/USD (-0.41%) didn’t seem to be impacted by the ECB minutes which reaffirmed that the stronger Euro “represented a source of concern, which required monitoring”. Moving onto commodities, WTI oil snapped a three day losing streak to be up 1.62% overnight asSaudi Arabiais reportedly interested in acquiring Russian oil assets and both countries would continue cooperation on mitigating the excess global crude supply. We shall learn more as Saudi’s King is scheduled to visit Russia later in the week.

Elsewhere, precious metals were little changed (Gold -0.52%; Silver +0.07%). Away from the markets, BOE’s McCafferty has reaffirmed his hawkish bias. He said the little slack left in the economy “is likely to disappear quite quickly, while inflation is projected to persistently overshoot the target”. Further, he said rates could rise several times before BOE starts to unwind the bond purchase program. Elsewhere, he noted that “until recently, financial markets appear to believe….Brexit uncertainties effectively tied our hands…this, we felt was a misreading of our reaction function”. The odds of a rate hike in December is currently at 79.4% (per Bloomberg).

Turning back to Puerto Rico’s municipal debt ordeal, where President Trump had earlier suggested that the government’s debt should be wiped clean to help the island to recover from Hurricane Maria. Overnight, we got the official confirmation from White House Press Secretary Sarah Sanders, who said “there’s a (bankruptcy) process for how to deal with the Puerto Rico’s debt….the President wants it to go through that process and that’s the stage we’re at on that”. Puerto Rico’s benchmark 2035 bond was broadly unchanged at 38c/$. The day before, the price tumbled down from 44c/$ to as low as 30c/$ intraday, before recovering to 38c/$ after Trump’s Budget director Mick Mulvaney said we should not take Mr Trump’s comments too literally.

Staying in the US, the senate has voted (65-32) to confirm Randal Quarles as a new Fed governor, becoming the first of several new Fed nominees President Trump will choose over the coming weeks and months.

Finally, IMF’s Managing Director Largarde has provided a glimpse of what to expect in next week’s IMF World Economic outlook report. Speaking at Harvard University, she noted that a cyclical pickup in investment and trade in advance economies (particularly Europe) is creating better than expected growth. Elsewhere, US growth will be above trend this year and next.

Before we take a look at today’s calendar, we wrap up with other data releases from yesterday. In the US, the macro data was broadly better than market expectations. August factory orders was stronger than expected at 1.2% mom (vs. 1%) and is now up 5.7% yoy. The final readings on August core durable goods orders was revised up to 0.5% mom (vs. 0.2% expected) and capital goods were also higher at 1.1% mom (vs. 0.9% expected). Elsewhere, the weekly initial jobless claims (260k vs. 265k expected) and continuing claims (1,938k vs. 1,950k expected) were also marginally better than expected. Finally, the August trade deficit was slightly narrower at -$42.4bln (vs. -$42.7bln expected), which is the smallest deficit in 11 months.

In Europe, Switzerland’s September CPI was higher than expected at 0.8% yoy (vs. 0.5% yoy previous, 0.2% mom) and the highest since 2011. Elsewhere, the Eurozone’s retail PMI was stronger than expected at 52.3 (vs. 50.8 previous), led by gains from France (53.3 vs. 50.4 previous) and Italy (50.2 vs. 48 previous), but partly offset by Germany (52.8 vs. 53.0 previous).

Looking at the day ahead, Germany’s August factory orders (0.7% mom expected) will be due early. Then we have France’s August trade and budget balance along with Italy’s retail sales and UK’s Halifax house price index. Over in the US, the change in nonfarm and manufacturing payrolls, September unemployment rate, hourly earnings, wholesale inventories, and consumer credit are all due. Onto other events, BOE’s Chief economist Haldane speaks at the “Great Trust Shift” debate. In the US, we have three more Fed speakers, including: Bostic, Kaplan and Dudley, with the latter speaking on “The Monetary Policy Outlook and the Importance of Higher Education for Economic Mobility”.

Tags: ASX 200,Bank Indonesia,Bank of England,Bank of Japan,Bloomberg Dollar Spot,Bond,Business,Catalan parliament,Catalan's Parliament,Catalonian parliament,central banks,China,conservative party,Consumer Credit,Continuing Claims,Copper,CPI,Crude,Crude Oil,DAX 30,Deutsche Bank,Donald Trump,Economics,economy,Equity Markets,European central bank,European Union,Featured,Fed Speak,Federal Reserve,flash,Foreign exchange market,France,Germany,Global Economy,Gulf of Mexico,Hang Seng 40,Hang Seng China Enterprises,Harvard University,headlines,Hong Kong,IBEX 35,inflation,Initial Jobless Claims,Interest Rate,International Monetary Fund,Italy,Japan,Jim Reid,John Williams,Macroeconomics,Mexico,Monetary Policy,MSCI Asia Pacific,NASDAQ,New Normal,New York Fed,newsletter,Nikkei,Nikkei 225,Nonfarm payrolls,OPEC,Organization of Petroleum-Exporting Countries,Precious Metals,Price Action,Rating Agency,recovery,Reserve Bank of Australia,Reuters,S&P 500,S&P/ASX 200,Saudi-Arabia,Senate,SP,Spanish Constitutional Court,Spanish government,Stoxx 600,SWIFT,Swiss Franc,Topix,trade deficit,Trump Administration,Unemployment,US Dollar Index,US Federal Reserve,VIX,Volatility,White House,Wholesale Inventories,World Economic Outlook,Yen