World stocks eased back from record highs and fell for the first time in eight days, as jitters about Catalonia’s independence push returned while bets on higher U.S. interest rates sent the dollar to its highest since mid August; S&P 500 futures were modestly in the red – as they have been every day this week before levitating to record highs – ahead of hurricane-distorted nonfarm payrolls data (full preview here)....

Read More »Risk Off: Global Stocks Slide As “Fire And Fury” Results In “Selling And Fear”

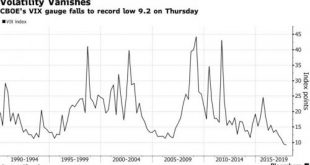

US futures are set for a sharply lower open (at least in recent market terms) following a steep decline in European stocks and a selloff in Asian shares, following yesterday’s sharp escalation in the war of words between the U.S. and North Korea. In a broad risk-off move U.S. Treasuries rose, the VIX surged above 12 overnight, while German bund futures climbed to the highest level in six weeks. The Swiss franc gained...

Read More »Bond Selloff Returns As EM Fears Rise; Oil Slides; BOJ Does Not Intervene

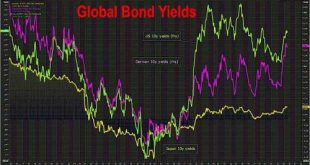

U.S. index futures point slightly lower open. Asian shares rose while stocks in Europe fell as energy producers got caught in a downdraft in oil prices and reversed an earlier gain after Goldman unexpectedly warned that WTI could slide below $40 absent "show and awe" from OPEC. The dollar rose, hitting a four-month high against the yen and bonds and top emerging market currencies were back under pressure on Tuesday, following last week’s hawkish rhetoric from central bankers. Nonetheless,...

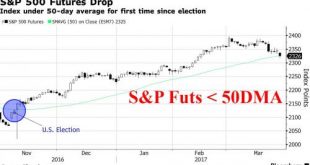

Read More »Global Stocks Slide, S&P Futures Tumble Below 50DMA As “Trump Trade” Collapses

Global stocks are lower across the board to start the week, as concerns about Trump's administration to pull off a material tax reform plan finally emerge, pressuring S&P futures some 20 points lower this morning, following European and Asian shares lower, while crude oil prices fall unable to find support in this weekend's OPEC meeting in Kuwait where a committee recommended to extend oil production cuts by another 6 months. Safe havens including the yen and bonds climbed as did gold,...

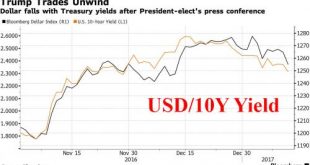

Read More »Dollar, Futures Slump; Gold Spikes Over $1,200 After Trump Disappoints Markets

Risk assets declined across the globe, with European, Asian shares and S&P 500 futures all falling, while the dollar slumped against most currencies after a news conference by President-elect Donald Trump disappointed investors with limited details of his economic-stimulus plans, and the Trumpflation/reflation trade was said to be unwinding. "The risk was always that a president like Trump would end up upsetting that consensus (of faster U.S. growth, stronger dollar) view by introducing...

Read More »European Stocks Greet The New Year By Rising To One Year Highs; Euro Slides

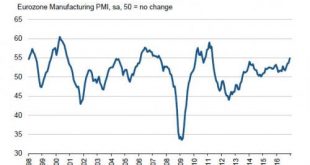

While most of the world is enjoying it last day off from the 2017 holiday transition, with Asia’s major markets closed for the New Year holiday, along with Britain and Switzerland in Europe and the US and Canada across the Atlantic, European stocks climbed to their highest levels in over a year on Monday after the Markit PMI survey showed manufacturing production in the Eurozone rose to the highest level since April...

Read More »S&P Futures Rise Propelled By Stronger Dollar; Europe At 1 Year High As Yen, Bonds Drop

It appears nothing can stop the upward moment of equities heading into the year end, and as has been the case for the past few weeks, US traders walk in with futures higher, propelled by European stocks which climbed to their highest in almost a year, while the dollar rose and bonds and gold fell, failing again to respond to a series of geopolitical shocks following terrorist attacks in Ankara, Berlin and Zurich. The yen tumbled after the Bank of Japan maintained its stimulus plan even as the...

Read More »Trumpflation Takes A Breather As Global Stocks Rise, Oil Jumps On Renewed OPEC “Deal Optimism”

With the Trumpflation euphoria easing back slightly overnight, leading to a modest paring in the USD index and US Treasury yields, Asian and European stocks rose, while US equity futures rebounded to just shy of new all time highs, as crude jumped on renewed optimism that OPEC will agree to cut output; Italian equities underperformed ahead of the Italian referendum; metals rebounded from last week’s losses as yields dropped and the dollar halted its longest winning streak versus the euro....

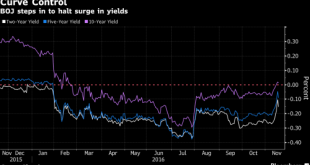

Read More »BOJ “Fires Warning At Bond Market” Sending Global Yields, Dollar Lower; All Eyes On Yellen

Yesterday morning we noted why, in light of the ongoing global bond rout, all eyes would be on the BOJ, and specifically whether Kuroda would engage his "Yield control" operation to stabilize the steepness of the JGB yield curve and implicitly support global bond yields in what DB said would be "full blown helicopter money" where the "BoJ is flying the copter over the US and may be about to become the new US government’s best friend." And sure enough that is precisely what Kuroda did last...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org