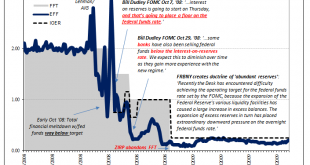

I’ve said it all along; focusing in on bank reserves would leave you dazed and confused. It’s just not how the system works. After all, as I pointed out again not long ago, “our” glorious central bank had the audacity to claim that there were “abundant” reserves during the worst financial panic in four generations. “Somehow” despite that, it was a Global Financial Crisis that lived up to its name – global. Straight away you have to ask, what good are reserves if...

Read More »Dollar Surge Continues Ahead Of Jobs Report; Europe Dips As Catalan Fears Return

World stocks eased back from record highs and fell for the first time in eight days, as jitters about Catalonia’s independence push returned while bets on higher U.S. interest rates sent the dollar to its highest since mid August; S&P 500 futures were modestly in the red – as they have been every day this week before levitating to record highs – ahead of hurricane-distorted nonfarm payrolls data (full preview here)....

Read More »Key Events In The Coming Week: All Eyes On Fed Balance Sheet Announcement

This week attention will fall on US FOMC rate decision, BoJ policy rate announcement, German and NZ elections. Economic data releases include PMI in the Euro area, retail sales in the UK and existing home sales in US. In Emerging Markets, there are monetary policy meetings in South Africa, Indonesia, Hungary, Taiwan and Philippines. BofA highlights the week's key global events: Central bank meetings: US FOMC and BoJ The Fed will make policy announcement on Wednesday. Balance sheet...

Read More »The Internet Helped Kill Inflation In America, Says Credit Suisse

Whether or not San Francisco Fed President John Williams is right about US inflation and employment being about as close to the central bank’s targets as investors have seen – as he told CNBC two days ago – is irrelevant: The central bank is going to raise interest rates two more times this year no matter what happens to consumer prices, says Credit Suisse Chief Investment Officer for Switzerland Burkhard Varnholt....

Read More »Gold Wins In Three Out Of Four Scenarios, Macquarie Warns “None Of Them Are Good For The Economy”

Submitted by Valentin Schmid via The Epoch Times, Warren Buffett claims that gold is worthless because it doesn’t produce anything. Fair point, but what if the other sectors of the economy also stop producing? “If you think of gold, the only way gold loses is if normal business and private sector cycles come back. If that is the case, gold goes back 100 dollars per ounce. The other outcomes, deflation, stagflation, hyperinflation are good for gold,” said Viktor Shvets,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org