Vincent Held continue à présenter des extraits dans cette 3ème et dernière vidéo. Les 3 vidéos se trouvent sur le site de Planètes 360. [embedded content] Cette vidéo fait suite à celle sur le marché REPO: [embedded content] Related posts: US-China Trade War Escalates As Further Measures Are Taken Our emerging market currencies scorecard gives good...

Read More »Our emerging market currencies scorecard gives good marks to real and rouble

The scope of this note is to present a score card for Emerging Market (EM)currencies, designed to assess the attractiveness of a given currency over the coming 12 months. The scorecard (see chart), constructed using a rules – based methodology, suggests that the Russian rubble and the Brazilian real are currently among the most attractive EM currencies. EM FX scorecard - Click to enlarge Construction of the EM FX...

Read More »The BoJ is sticking to monetary easing

The BoJ remains the last major central bank still firmly committed to large-scale monetary easing. After its Monetary Policy Meeting of December 21, the Bank of Japan (BoJ) announced its intention to keep its current monetary easing programme intact. The BOJ will continue with its “Quantitative and Qualitative Monetary Easing with Yield Curve Control ”, aiming to achieve and overshoot the core inflation target of 2%....

Read More »Global macro: 10 surprises for 2018

Having laid down our expectations for the World economy in 2018, in this note we describe a number of potential surprises to the outlook. The usual suspects, or ‘known unknowns’, include a larger-than-expected fiscal boost from US tax cuts, (geo-)political risks, economic policy mistakes, inflation surprises, a financial bubble burst, or a Minsky moment in China, to name a few. We chose to include some of the...

Read More »Global macro: 10 surprises for 2018

Having set out our expectations for the global economy in 2018, we add here a number of potential surprises. None of them are included in our baseline projections.In the US, we include first a ‘Texas boom’ due to rising oil prices. US oil investment could see a major uptick and Texas could accelerate, in turn lifting US growth.Secondly, we include a hawkish shift at the Fed. While Trump has preferred continuity in the Fed’s leadership with his nominee as Fed Chair, Jerome Powell, he could...

Read More »Less Retail Jobs, More Amazon Robots: Get Used To It

When it comes to job creation in the United States, President Trump will be displeased to hear the latest findings from Quartz: 170,000 fewer retail jobs in 2017 – and 75,000 more Amazon robots. In November, we explained that while everyone likes to point the finger at Amazon, America’s retail apocalypse can’t be tied to just one catalyst (see: A Look At America’s Retail Apocalypse In Charts), however, fierce...

Read More »Emerging Markets: What Changed

Summary China eased curbs on coal use for heating in the northern provinces to cope with colder weather. Poland announced a cabinet shuffle. Poland’s lower house approved the controversial judicial reform bill. President Trump announced that the US recognizes Jerusalem as Israel’s capital. Brazil COPOM was more dovish than expected after cutting rates 50 bp to 7.0%. Chile central bank cut its 2017 and 2018 inflation...

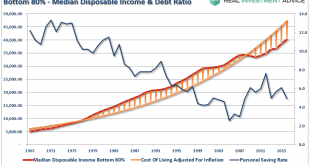

Read More »The Savings Rate Conundrum

The economy is booming. Employment is at decade lows. Unemployment claims are at the lowest levels in 40-years. The stock market is at record highs and climbing. Consumers are more confident than they have been in a decade. Wages are finally showing signs of growth. What’s not to love? I just have one question. If things are so good, then why is America’s saving rate posting such a sharp decline? The answer is not...

Read More »The World’s Largest ICO Is Imploding After Just 3 Months

Earlier this summer, Tezos smashed existing sales records in the white-hot IPO market after the company’s pitch to build a better blockchain for cryptocurrencies made it one of the buzziest ICOs in the world. As we noted at the time, the company capitalized on that buzz by courting VC firms and other institutional investors with a $50 million token pre-sale. After the company opened up selling to the broader public,...

Read More »Le Liban découvre la politique monétaire non conventionnelle

S’il y a une chose que les Libanais savent faire, c’est compter! S’il y a une deuxième chose qu’ils savent faire, c’est oser s’exprimer. C’est exactement ce que le député Georges Adwan a fait: Calculer le manque à gagner généré par la Banque du Liban à travers sa politique monétaire, et en faire part. Il semblerait qu’en lieu et place d’un bénéfice de 1 milliard de dollars, seuls 40,5 millions de dollars soient arrivés...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org