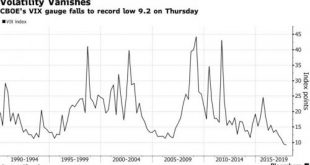

Overview: The capital and commodity markets are becoming less orderly. The scramble for dollars is pressuring the cross-currency basis swaps. Volatility is racing higher in bond and stock markets. The industrial metals and other supplies, and foodstuffs that Russia and Ukraine are important providers have skyrocketed. Large Asia Pacific equity markets, including Japan, Hong Kong, China, and Taiwan fell by 1%-2%, while South Korea, Australia, and India managed...

Read More »SWIFT Isn’t The ‘Nuclear Option’ For Russia, Because Russia can sell the dollars elsewhere and NOT via Swift

As everyone “knows”, the US dollar is the world’s reserve currency which can only leave the US government in control of it. Participation is both required and at the pleasure of American authorities. If you don’t accept their terms, you risk the death penalty: exile from the privilege of the US dollar’s essential business. From what little most people know about that essential business, it seems like it has something to do with that thing called SWIFT. Thus,...

Read More »CBDC and Cross-Border Payments

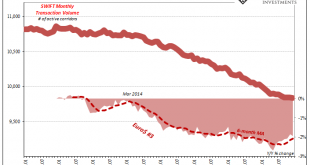

The Economist reports on “The race to redefine cross-border finance:” SWIFT recently launched SWIFT Go for retail payments. FinTech firms often partly bypass SWIFT by aggregating payments first. Ripple evades SWIFT, using a cryptocurrency for international transactions. Credit card companies build infrastructure independent of SWIFT for retail (push) payments initiated by the sender. JPMorgan Chase and a Singaporean bank and Temasek launched Partior for wholesale payments. This...

Read More »De-dollarization By Default Is Not What You Might Think

Last month, a group of central bank governors from across the South Pacific region gathered in Australia to move forward the idea of a KYC utility. If you haven’t heard of KYC, or know your customer, it is a growing legal requirement that is being, and has been, imposed on banks all over the world. Spurred by anti-money laundering efforts undertaken first by the European Union, more and more governments are forcing global banks to take part. KYC is a particularly...

Read More »“Nicht-Wissen kann schützen (Knowing Less Protects),” FuW, 2018

Finanz und Wirtschaft, November 24, 2018. PDF. Ökonomenstimme, November 26, 2018. HTML. European firms dealing with Iran face U.S. “secondary sanctions.” European counter measures (including a blocking statute) prove toothless. Even central banks in the European Union surrender to U.S. pressure, as does SWIFT. Ignorance is bliss: For a sovereign, the best protection against foreign states pressuring to monitor domestic citizens and businesses may be to know as little as possible.

Read More »“Nicht-Wissen kann schützen (Knowing Less Protects),” FuW, 2018

Finanz und Wirtschaft, November 24, 2018. PDF. Ökonomenstimme, November 26, 2018. HTML. European firms dealing with Iran face U.S. “secondary sanctions.” European counter measures (including a blocking statute) prove toothless. Even central banks in the European Union surrender to U.S. pressure, as does SWIFT. Ignorance is bliss: For a sovereign, the best protection against foreign states pressuring to monitor domestic citizens and businesses may be to know as little as possible.

Read More »SWIFT’s Response to the U.S. Iran Sanctions Threat

SWIFT, the international financial messaging system, has responded to the U.S. sanctions threat (see this post)—it has agreed to comply. Michael Peel reports in the FT, that SWIFT suspends certain Iranian banks’ access to its cross border-payment network. According to Peel, SWIFT explains the step as follows: “This step, while regrettable, has been taken in the interest of the stability and integrity of the wider global financial system.” This does not only expose SWIFT to punitive...

Read More »SWIFT’s Response to the U.S. Iran Sanctions Threat

SWIFT, the international financial messaging system, has responded to the U.S. sanctions threat (see this post)—it has agreed to comply. Michael Peel reports in the FT, that SWIFT suspends certain Iranian banks’ access to its cross border-payment network. According to Peel, SWIFT explains the step as follows: “This step, while regrettable, has been taken in the interest of the stability and integrity of the wider global financial system.” This does not only expose SWIFT to punitive...

Read More »Financial Sanctions, the USD, and the EUR

On Moneyness, JP Koning discusses the ability or not of the U.S. treasury to enforce financial sanctions overseas. Focusing on the Iran sanctions that ran from 2010 to 2015 (with strong international support) and are scheduled to be reimposed soon (without such support) Koning compares the U.S. sanctions regime to an exclusivity agreement that a large retailer imposes on a manufacturer. Foreign banks in places like Europe were free to continue providing transactions services to Iran, but...

Read More »Dollar Surge Continues Ahead Of Jobs Report; Europe Dips As Catalan Fears Return

World stocks eased back from record highs and fell for the first time in eight days, as jitters about Catalonia’s independence push returned while bets on higher U.S. interest rates sent the dollar to its highest since mid August; S&P 500 futures were modestly in the red – as they have been every day this week before levitating to record highs – ahead of hurricane-distorted nonfarm payrolls data (full preview here)....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org