Policymakers have often said that exchange rates should reflect fundamentals. What does that really mean? Can they do anything but that? It begs the question of which fundamental factors they should reflect. Therein lies the rub. We are still struck by the latest Bank for International Settlements figures. Their survey found that the average daily turnover in the foreign exchange market was $7.5 trillion a day. World trade last year was about $22.5 trillion. The...

Read More »The Latte Index: Using The Impartial Bean To Value Currencies

Like any other market, there are many opinions on what a currency ought to be worth relative to others. With certain currencies, that spectrum of opinions is fairly narrow. As an example, for the world’s most traded currency – the U.S. dollar – the majority of opinions currently fall in a range from the dollar being 2% to 11% overvalued, according to organizations such as the Council of Foreign Relations, the Bank of...

Read More »Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe Show Why Physical Gold Is Ultimate Protection

Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe – Real inflation in Zimbabwe is 313 percent annually and 112 percent on a monthly basis – Venezuela’s new 100,000-bolivar note is worth less oday thehan USD 2.50 – Maduro announces plans to eliminate all physical cash – Gold rises in response to ongoing crises One Hundred Trillion Dollars Zimbabwe - Click to enlarge A military coup-de-grace in Zimbabwe...

Read More »Dollar Surge Continues Ahead Of Jobs Report; Europe Dips As Catalan Fears Return

World stocks eased back from record highs and fell for the first time in eight days, as jitters about Catalonia’s independence push returned while bets on higher U.S. interest rates sent the dollar to its highest since mid August; S&P 500 futures were modestly in the red – as they have been every day this week before levitating to record highs – ahead of hurricane-distorted nonfarm payrolls data (full preview here)....

Read More »Risk Off: Global Stocks Slide As “Fire And Fury” Results In “Selling And Fear”

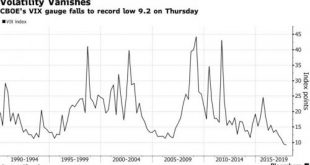

US futures are set for a sharply lower open (at least in recent market terms) following a steep decline in European stocks and a selloff in Asian shares, following yesterday’s sharp escalation in the war of words between the U.S. and North Korea. In a broad risk-off move U.S. Treasuries rose, the VIX surged above 12 overnight, while German bund futures climbed to the highest level in six weeks. The Swiss franc gained...

Read More »Fighting inflation with FX, a real traders market

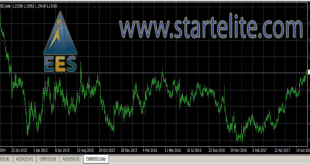

(GLOBALINTELHUB.COM) Dover, DE — 7/18/2017 — Hidden in plain site, as the Trump administration finally released something of substance regarding the so called promised “Trade Negotiation” we see FX take center stage in the global drama unfolding. As noted on a Zero Hedge article: The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the...

Read More »Fighting inflation with FX, a real traders market

(GLOBALINTELHUB.COM) Dover, DE — 7/18/2017 — Hidden in plain site, as the Trump administration finally released something of substance regarding the so called promised “Trade Negotiation” we see FX take center stage in the global drama unfolding. As noted on a Zero Hedge article: The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the Trump administration aimed to reduce the U.S. trade deficit by...

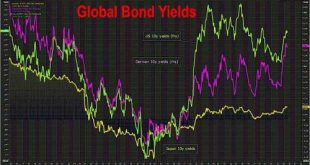

Read More »Bond Selloff Returns As EM Fears Rise; Oil Slides; BOJ Does Not Intervene

U.S. index futures point slightly lower open. Asian shares rose while stocks in Europe fell as energy producers got caught in a downdraft in oil prices and reversed an earlier gain after Goldman unexpectedly warned that WTI could slide below $40 absent "show and awe" from OPEC. The dollar rose, hitting a four-month high against the yen and bonds and top emerging market currencies were back under pressure on Tuesday, following last week’s hawkish rhetoric from central bankers. Nonetheless,...

Read More »New Gold Pool at the BIS Switzerland: A Who’s Who of Central Bankers

This is an extract and summary from “New Gold Pool at the BIS Basle, Switzerland: Part 1” which was first published on the BullionStar.com website in mid-May. Part 2 of the series titled “New Gold Pool at the BIS Basle: Part 2 – Pool vs Gold for Oil” is also posted now on the BullionStar.com website. “In the Governor’s absence I attended the meeting in Zijlstra’s room in the BIS on the afternoon of Monday,...

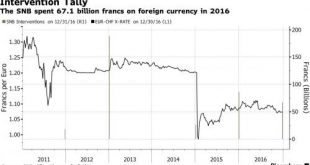

Read More »SNB Spent $68 Billion On Currency Manipulation In 2016

While Donald Trump has repeatedly expressed his displeasure with China for manipulating its currency, he appears to have recently figured out that over the past 2 years Beijing has been spending hundreds of billions in dollar to strengthen, not weaken, the Yuan and to halt the ~$1 trillion in capital flight from China. But while everyone knows that the biggest currency manipulation in the world, and perhaps the Milky...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org