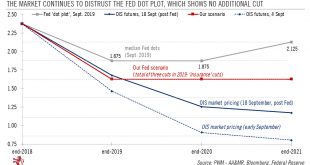

In spite of internal divisions, the Fed may go for a third rate cut in October and step in to alleviate pressure in repo market. The Federal Reserve (Fed) cut rates by 0.25% on Wednesday, as widely anticipated. The new fed funds target range is 1.75%-2.00%. The interest rate on banks’ excess reserves was cut by 0.30% to 1.80%. Fed Chairman Jerome Powell again justified this second rate cut since July as “insurance” against risks to the US outlook – mostly the weak...

Read More »Powell plays the ‘insurance’ card again

In spite of internal divisions, the Fed may go for a third rate cut in October and step in to alleviate pressure in repo market.The Federal Reserve (Fed) cut rates by 0.25% on Wednesday, as widely anticipated. The new fed funds target range is 1.75%-2.00%. The interest rate on banks’ excess reserves was cut by 0.30% to 1.80%. Fed Chairman Jerome Powell again justified this second rate cut since July as “insurance” against risks to the US outlook – mostly the weak global growth picture and...

Read More »Outsized rise in rates charged on US credit cards

The increase in interest rates paid for credit card debt far exceeds the rise in the Fed funds rate, pointing to sizeable divergence in the impact Fed tightening is having on the US economy.The Fed’s interest-rate tightening since Q4 2015 has had divergent repercussions on interest rates paid by ‘end users’ across the US economy.Interest rates on credit card debt have risen particularly sharply since the start of Fed tightening.How monetary policy is transmitted to the ‘real economy’,...

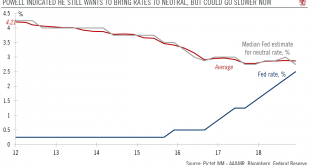

Read More »December’s Federal Reserve meeting review

Fed chair Jerome Powell still wants to “normalize” monetary policy in 2019.The Federal Reserve (Fed) raised the Fed funds target range (FFTR) by another 25 basis points (bps) on 19 December, as widely anticipated. The new FFTR range is 2.25-2.50%. This marked the fourth rate increase of 2018.There was no formal guidance about the next hike and clues were rather hazy. It seems like the Fed still wants to bring rates towards ‘neutral’ in 2019 (currently 2.75% based on the median Fed dot –...

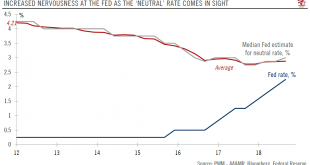

Read More »US Federal Reserve hints it might turn off the auto pilot

While a December rate hike is on the cards, comments from the central bank are raising questions about when the Fed will pause its rate-hiking cycle.The Federal Reserve (Fed) has been sending dovish signals in recent days: The previous exuberantly optimistic tone about the US growth has been pared down, as some pockets of data have softened, notably housing.Meanwhile, there is renewed debate about the landing zone of the current monetary tightening. Some Fed members want to change the...

Read More »A Gold Guy’s View Of Crypto, Bitcoin, And Blockchain

Bitcoin was on my radar far back as 2011, but for years, I didn’t think much of it. It was a curiosity. Nothing more. Sort of like the virtual money you use in World of Warcraft or something. In 2015, looking deeper, I slowly (not the sharpest tool in the shed) arrived at that “aha” inflection point that most advocates of honest money arrive at. I realized that a distributed public ledger has the power to change, well,...

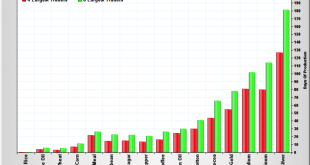

Read More »Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts

Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts – Gold and silver COT suggests bottoming and price rally coming– Speculators cut way back on long positions and added to short bets– Commercials/banks significantly reduced short positions– Commercial net short position saw biggest one-week decline in COMEX history– ‘Big 4’ commercial traders decreased their short positions by 28,800...

Read More »Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels...

Read More »Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels...

Read More »Year-end Rate Hike Once Again Proves To Be Launchpad For Gold Price

Year-end rate hike once again proves to be launchpad for gold price – FOMC follows through on much anticipated rate-hike of 0.25%– Spot gold responds by heading for biggest gain in three weeks, rising by over 1%– Final meeting for Federal Reserve Chair Janet Yellen– Yellen does not expect Trump’s tax-cut package to result in significant, strong growth for US economy– No concern for bitcoin which ‘plays a very small...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org