For me, the defining characteristic of the late nineties wasn’t the dot-coms. Most people were exposed to the NASDAQ because, frankly, at the time there was no getting away from it. It had seeped into everything, transforming from a financial niche bleeding eventually into the entire worldwide culture. We all remember the grocery clerks who became day traders. Behind all that was some darker evolutions. It was a period...

Read More »If Bitcoin Is A Bubble…

Our earlier articles on bitcoin discuss the crypto asset as a currency and a commodity. Both papers focused on the consequences of bitcoin’s defining feature: the asymptotic supply limit of 21 million coins. This gives it an unusual juxtaposition of demand uncertainty and supply certainty (as well as inelasticity). As a currency, it gives rise to a tension between its use as a store of value and as medium of exchange....

Read More »Each Bitcoin Transaction Uses As Much Energy As Your House In A Week

While Bitcoin bulls will probably never have it so good as they have in 2017, we wonder whether many of them have stopped to think about the environmental downside of this roaring bull market. After all, back in the dot.com boom, people had ideas about potential internet businesses, issued pieces of paper representing ownership and watched their prices go parabolic parabolic. All it took was a Powerpoint presentation,...

Read More »Each Bitcoin Transaction Uses As Much Energy As Your House In A Week

While Bitcoin bulls will probably never have it so good as they have in 2017, we wonder whether many of them have stopped to think about the environmental downside of this roaring bull market. After all, back in the dot.com boom, people had ideas about potential internet businesses, issued pieces of paper representing ownership and watched their prices go parabolic parabolic. All it took was a Powerpoint presentation, some computer programming expertise and a “research” report,...

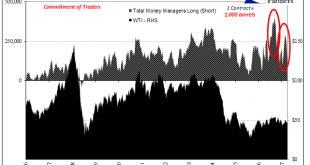

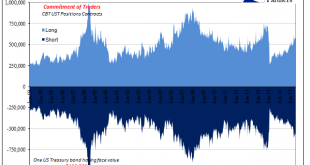

Read More »COT Report: Black (Crude) and Blue (UST’s)

Over the past month, crude prices have been pinned in a range $50 to the high side and ~$46 at the low. In the futures market, the price of crude is usually set by the money managers (how net long they shift). As discussed before, there have been notable exceptions to this paradigm including some big ones this year. It was earlier in February when money managers piled in to WTI longs, apparently expecting better things...

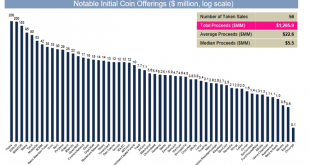

Read More »Bitcoin Fork, Hyped ICOs – Immutable Gold and Silver

Bitcoin Fork, Hyped ICOs – Immutable Gold and Silver Latest developments show risks in crypto currencies Confusion as bitcoin may split tomorrow SEC stepped into express concern over ICOs ICOs have so far raised $1.2 billion in 2017 ICOs preying on lack of understanding from investors Physical gold not vulnerable to technological risk Beauty and safety in simplicity of gold and silver Forks and ICOs solves bitcoin v...

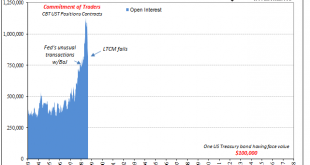

Read More »U.S. Treasuries: Not Really Wrong On Bonds

It is often said that the market for US Treasuries is the deepest and most liquid in the world. While that’s true, we have to be careful about what it is we are talking about. There is no single US Treasury market, and often differences can be striking. The most prominent example was, of course, October 15, 2014. In truth, the liquidity side of cash market UST’s has been diminished since around 2013. Largely as a...

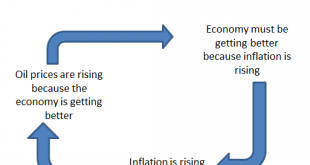

Read More »Why Aren’t Oil Prices $50 Ahead?

Right now there are two conventional propositions behind the “reflation” trade, and in many ways both are highly related if not fully intertwined. The first is that interest rates have nowhere to go but up. The Fed is raising rates again and seems more confident in doing more this year than it wanted to last year. With nominal rates already rising in the last half of 2016, and with more (surveyed) optimism than even...

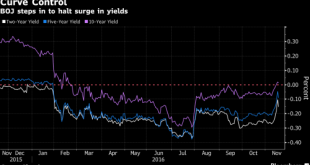

Read More »BOJ “Fires Warning At Bond Market” Sending Global Yields, Dollar Lower; All Eyes On Yellen

Yesterday morning we noted why, in light of the ongoing global bond rout, all eyes would be on the BOJ, and specifically whether Kuroda would engage his "Yield control" operation to stabilize the steepness of the JGB yield curve and implicitly support global bond yields in what DB said would be "full blown helicopter money" where the "BoJ is flying the copter over the US and may be about to become the new US government’s best friend." And sure enough that is precisely what Kuroda did last...

Read More »US Futures Rebound, European Stocks Higher As Oil Rises

The summer doldrums continue with another listless overnight session, not helpd by Japan markets which are closed for holiday, as Asian stocks fell fractionally, while European stocks rebounded as oil trimmed losses after the the IEA said pent-up demand would absorb record crude output (something they have said every single month). S&P futures have wiped out almost all of yesterday's losses and were up over 0.2% in early trading. Europe's Stoxx 600 rose 0.4% with miners and energy...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org