Investec Switzerland. Source: UBS Risks to the Swiss property market remained elevated in the second quarter of 2016, with rock-bottom interest rates propping up demand for residential assets to be rented out for investment purposes. Still, UBS Group AG’s index experienced a “slight” decrease in the period, according to economists Matthias Holzhey and Claudio Saputelli. That’s because of a slowdown in the pace of mortgage growth and a 0.6 percent decline in home prices on an inflation-adjusted basis. By Catherine Bosley (Bloomberg) The UBS Swiss Real Estate Bubble Index nudged down in the second quarter of 2016 to 1.32 points remaining in the risk zone. This second consecutive quarterly drop was due to house prices falling in real terms and the declining momentum of mortgage growth. The Swiss regions most exposed to the risk of a price correction are shown on the map below: Source: UBS More on this:UBS report (in English) Facebook and Twitter.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, Property, Property prices Switzerland, Swiss property, Swiss real estate

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

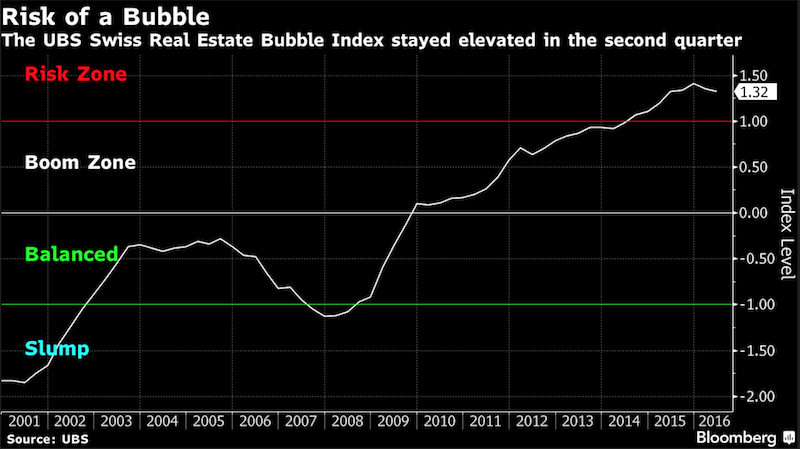

Source: UBS

Risks to the Swiss property market remained elevated in the second quarter of 2016, with rock-bottom interest rates propping up demand for residential assets to be rented out for investment purposes. Still, UBS Group AG’s index experienced a “slight” decrease in the period, according to economists Matthias Holzhey and Claudio Saputelli. That’s because of a slowdown in the pace of mortgage growth and a 0.6 percent decline in home prices on an inflation-adjusted basis.

By Catherine Bosley (Bloomberg)

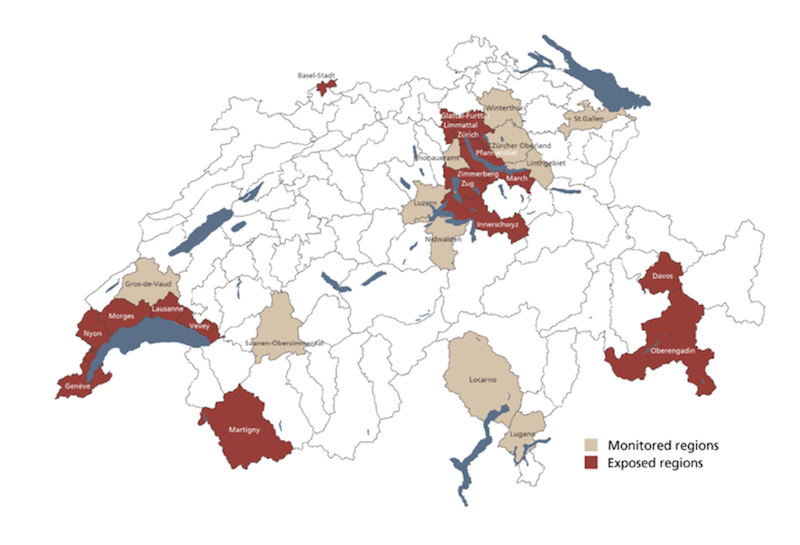

The UBS Swiss Real Estate Bubble Index nudged down in the second quarter of 2016 to 1.32 points remaining in the risk zone. This second consecutive quarterly drop was due to house prices falling in real terms and the declining momentum of mortgage growth. The Swiss regions most exposed to the risk of a price correction are shown on the map below:

Source: UBS

More on this:

UBS report (in English)